PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721593

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721593

Medium Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

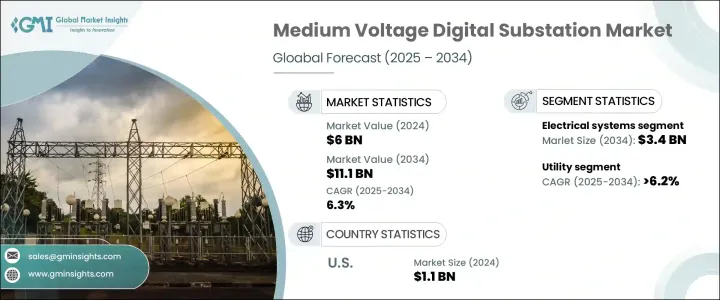

The Global Medium Voltage Digital Substation Market reached USD 6 billion in 2024 and is projected to grow at a CAGR of 6.3% to reach USD 11.1 billion by 2034. This growth is driven by the increasing demand for grid modernization, the rise of automation and digital technologies, and the integration of renewable energy sources. The transition from traditional substations to digital systems is enhancing the efficiency of operations, lowering maintenance costs, and improving the reliability and resilience of the power grid. These digital substations offer more advanced capabilities in managing real-time data, optimizing performance, and improving grid stability.

The rise of digital substations uses innovative technologies such as IoT sensors, cloud computing, and AI-driven analytics. These substations can capture and analyze massive amounts of data from various components, including transformers, circuit breakers, and switchgear. This data is transmitted securely to the cloud, where machine learning and advanced analytics are applied to assess performance and predict failures, allowing for proactive maintenance and enhanced operational performance. This data-driven approach is transforming grid management and significantly improving decision-making during emergencies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 6.3% |

The market is further segmented by components, with electrical systems comprising circuit breakers, transformers, switchgear, and protection devices leading the market. The electrical systems segment is expected to generate USD 3.4 billion by 2034, supported by ongoing advancements in grid automation and the increased integration of renewable energy sources. These components are critical for maintaining the uninterrupted operation of digital substations essential for efficient and reliable power distribution systems. As industries push for smarter and more sustainable energy solutions, the demand for these components is set to rise.

In addition to electrical systems, the industrial segment is projected to generate USD 5.8 billion by 2034. The sector's growth is driven by investments in energy automation, the adoption of eco-friendly technologies, and the ongoing development of industrial facilities globally. The need for efficient power distribution and the integration of IoT-based monitoring and smart technologies are also contributing factors to the market's expansion.

U.S. Medium Voltage Digital Substation Market, valued at USD 0.9 billion in 2022, is poised to experience steady growth in the upcoming years. This growth is primarily driven by the country's escalating demand for energy and the rapid pace of industrialization. As industries expand, the need for reliable, efficient, and modernized power distribution systems becomes more pronounced. Medium voltage digital substations, which integrate digital technologies to improve performance, monitoring, and automation, are increasingly being adopted as part of the broader shift towards smart grid systems.

Some of the Global Medium Voltage Digital Substation Market prominent players in the market include ABB, Schneider Electric, Siemens, General Electric, Belden, Hitachi Energy, Cisco Systems, Toshiba, Larsen & Toubro Limited, and Eaton. To strengthen their positions in the medium voltage digital substation market, companies focus on enhancing their product offerings through technological advancements. Key strategies include investing in research and development to innovate and improve digital substation solutions. Many players expand their global footprint by entering new regional markets and forming strategic partnerships with other technology providers. Additionally, mergers and acquisitions are becoming a common strategy to combine expertise, streamline operations, and meet the growing demands of the evolving power industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Belden

- 10.3 Cisco Systems

- 10.4 Eaton

- 10.5 Efacec

- 10.6 General Electric

- 10.7 Grid to Great

- 10.8 Hitachi Energy

- 10.9 Larsen & Toubro Limited

- 10.10 Netcontrol Group

- 10.11 Schneider Electric

- 10.12 Siemens

- 10.13 SIFANG

- 10.14 Tesco Automation

- 10.15 Texas Instruments Incorporated

- 10.16 Toshiba