PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913387

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913387

Data Center Construction Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

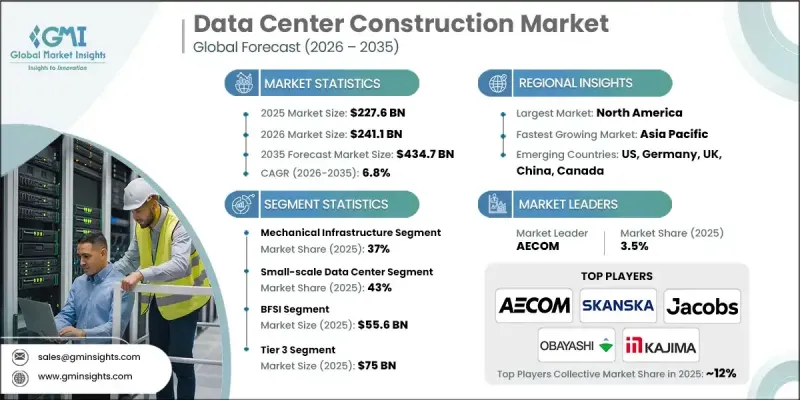

The Global Data Center Construction Market was valued at USD 227.6 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 434.7 billion by 2035.

Market growth is driven by the accelerating adoption of cloud-based delivery models across enterprises worldwide. Organizations are steadily shifting workloads away from in-house infrastructure, prompting cloud service providers to invest heavily in new capacity through large campuses and regional facilities. This sustained demand is encouraging the continuous development of scalable, standardized construction models that support rapid deployment and long-term resilience. At the same time, the rising influence of advanced computing workloads is reshaping facility requirements, increasing the need for higher power density, sophisticated cooling solutions, and reinforced electrical systems. Growth in global data creation from digital platforms and enterprise transformation is further elevating the requirement for reliable processing and storage capacity. Construction activity is also supported by increasing reliance on shared infrastructure models, as businesses favor flexible leasing arrangements to reduce capital intensity and operational burden. Together, these trends are driving steady investment in modern, efficient, and future-ready data center facilities across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $227.6 Billion |

| Forecast Value | $434.7 Billion |

| CAGR | 6.8% |

The small-scale data center segment accounted for 43% share in 2025 and is expected to grow at a CAGR of 5% between 2026 and 2035. These facilities typically operate within lower power capacity ranges and are designed to support regional operations, distributed computing needs, and localized processing. Their role within decentralized digital infrastructure continues to grow as organizations prioritize responsiveness and data proximity.

The BFSI segment generated USD 55.6 billion in 2025. Financial institutions require highly secure, compliant, and resilient infrastructure, driving sustained construction of facilities that meet stringent operational standards. Regulatory requirements and data sovereignty considerations support the adoption of geographically distributed development strategies within this segment.

U.S. Data Center Construction Market reached USD 59.5 billion in 2025. Strong investment activity is supported by the concentration of large technology providers, advanced research ecosystems, and ongoing infrastructure modernization. The country represents a significant share of global operational capacity, with continued expansion expected through 2030.

Key companies active in the Global Data Center Construction Market include Skanska, Turner & Townsend, AECOM, Jacobs Engineering, DPR Construction, NTT Facilities, Obayashi, Kaijima, Mace, and DSCO. Companies operating in the Global Data Center Construction Market are reinforcing their market position through strategic specialization, technological integration, and global expansion. Many firms are investing in expertise related to high-density and energy-efficient facility design to meet evolving workload requirements. Strategic partnerships with cloud providers and colocation operators help secure long-term project pipelines. Companies are also focusing on modular construction techniques to reduce build timelines and improve scalability. Geographic diversification allows firms to capture demand across emerging and established markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Data center

- 2.2.3 Infrastructure

- 2.2.4 End use

- 2.2.5 Tier

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 System & platform providers

- 3.1.1.2 Hardware suppliers

- 3.1.1.3 Payment partners

- 3.1.1.4 Niche specialists

- 3.1.1.5 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth in cloud computing

- 3.2.1.2 Proliferation of AI, machine learning, and high-performance computing

- 3.2.1.3 Explosion in data generation and digital services

- 3.2.1.4 Shift toward colocation and outsourced data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power availability and grid constraints

- 3.2.2.2 Rising construction and equipment costs

- 3.2.2.3 Long lead times for critical equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of ai-ready and high-density data center infrastructure

- 3.2.3.2 Adoption of modular and prefabricated construction models

- 3.2.3.3 Integration of on-site power generation and energy storage solutions

- 3.2.3.4 Development of data centers in power-rich secondary and emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory Landscape

- 3.4.1 North America

- 3.4.1.1 CCPA / CPRA (California Consumer Privacy Act / California Privacy Rights Act)

- 3.4.1.2 NERC CIP (North American Electric Reliability Corporation - Critical Infrastructure Protection)

- 3.4.2 Europe

- 3.4.2.1 GDPR (General Data Protection Regulation)

- 3.4.2.2 Data Protection Act 2018 (UK)

- 3.4.2.3 EU Energy Efficiency Directive

- 3.4.2.4 Climate Neutral Data Centre Pact

- 3.4.2.5 National Cybersecurity Agency Directives

- 3.4.3 Asia Pacific

- 3.4.3.1 Digital Personal Data Protection Act 2023 (India)

- 3.4.3.2 PIPA (Personal Information Protection Act, South Korea)

- 3.4.3.3 Telecommunications (Interception and Access) Act 1979 (Australia)

- 3.4.3.4 National Data Localization and Cybersecurity Laws

- 3.4.4 Latin America

- 3.4.4.1 LGPD (Lei Geral de Protecao de Dados - Brazil)

- 3.4.4.2 National Directorate for Personal Data Protection Regulations (Argentina)

- 3.4.4.3 Federal Law on the Protection of Personal Data Held by Private Parties (Mexico)

- 3.4.5 Middle East & Africa

- 3.4.5.1 PDPL (Personal Data Protection Law - UAE, Saudi Arabia)

- 3.4.5.2 Anti-Cyber Crime Laws

- 3.4.5.3 Electronic Communications and Transactions Act (South Africa)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.9.1 Vendor cost structure

- 3.9.2 Implementation of cost components

- 3.9.3 Ongoing operational costs

- 3.9.4 Indirect customer costs

- 3.10 Patent analysis

- 3.11 Business model analysis

- 3.11.1 Capex sale vs managed services models

- 3.11.2 Revenue streams

- 3.11.3 Hybrid commercial structures

- 3.12 Case studies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Future outlook and opportunities

- 3.15 Power Availability, Grid Constraints & Energy Strategy Impact

- 3.16 AI-Ready & High-Density Infrastructure Design Requirements

- 3.17 Modular, Prefabricated & Scalable Deployment Models

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Data Center, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Small-scale data center

- 5.3 Medium data center

- 5.4 Large data center

Chapter 6 Market Estimates & Forecast, By Infrastructure, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Electrical infrastructure

- 6.2.1 UPS

- 6.2.2 Power distribution units (PDUs)

- 6.2.3 Backup generators

- 6.2.4 Others

- 6.3 Mechanical infrastructure

- 6.3.1 Cooling systems

- 6.3.2 Hvac

- 6.3.2.1 Computer room air conditioning (CRAC) units

- 6.3.2.1.1 Fan arrays

- 6.3.2.1.2 Air flow measurement damper

- 6.3.2.1.3 DOAS

- 6.3.2.2 Precision air conditioning (PAC) units

- 6.3.2.2.1 Face mounted plenum fan with EC motor

- 6.3.2.2.2 MAU

- 6.3.2.2.3 ERV

- 6.3.2.3 Chilled water systems

- 6.3.2.3.1 Dampers

- 6.3.2.3.2 Condenser fans

- 6.3.2.4 Ventilation systems

- 6.3.2.5 Direct expansion (DX) systems

- 6.3.2.6 Others

- 6.3.2.1 Computer room air conditioning (CRAC) units

- 6.3.3 Racks

- 6.3.4 Ductwork

- 6.3.5 Raised flooring

- 6.3.6 Others

- 6.4 Networking infrastructure

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Energy

- 7.4 Government

- 7.5 Healthcare

- 7.6 Manufacturing

- 7.7 IT & telecom

- 7.8 Media & entertainment

- 7.9 Retail

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Tier, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Tier 1

- 8.3 Tier 2

- 8.4 Tier 3

- 8.5 Tier 4

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Chile

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global leaders

- 10.1.1 AECOM

- 10.1.2 Jacobs

- 10.1.3 Fluor

- 10.1.4 Bechtel

- 10.1.5 Skanska

- 10.1.6 Samsung C&T

- 10.1.7 Larsen & Toubro (L&T)

- 10.1.8 Kajima

- 10.1.9 Obayashi

- 10.1.10 Balfour Beatty

- 10.1.11 Turner Construction Company

- 10.1.12 Mace

- 10.1.13 NTT Facilities

- 10.1.14 DSCO

- 10.2 Regional players

- 10.2.1 Holder Construction

- 10.2.2 Mortenson

- 10.2.3 JE Dunn Construction

- 10.2.4 Whiting-Turner Contracting Company

- 10.2.5 HITT Contracting

- 10.2.6 Clayco

- 10.2.7 Hensel Phelps

- 10.2.8 DPR Construction

- 10.2.9 ISG plc

- 10.3 Emerging players

- 10.3.1 AirTrunk

- 10.3.2 Vantage Data Centers

- 10.3.3 ODATA (Ascenty / ODATA)

- 10.3.4 GreenSquareDC

- 10.3.5 STO Building