PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750569

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750569

Utility Scale Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

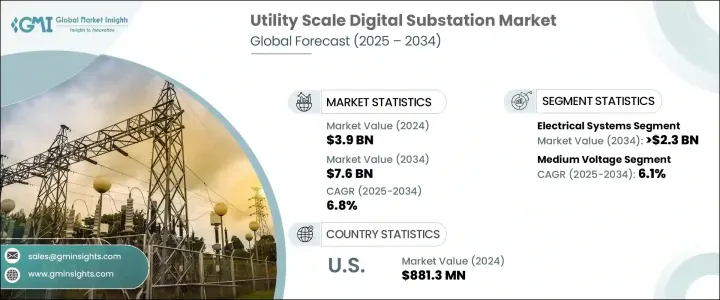

The Global Utility Scale Digital Substation Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.6 billion by 2034, fueled by the rising demand for more efficient and reliable power distribution systems, especially with the shift toward renewable energy sources. Aging infrastructure is being upgraded to incorporate digital substations, which include smart meters, automated systems, and advanced monitoring capabilities. This modernization enhances the ability of utilities to monitor real-time data and better manage electricity distribution. By deploying Advanced Metering Infrastructure (AMI) and Supervisory Control and Data Acquisition (SCADA) systems, utilities can not only reduce energy loss but also boost grid responsiveness and reliability. These digital solutions enable real-time monitoring, load balancing, and faster fault detection, which are vital for the efficient operation of modern power networks.

As energy consumption patterns evolve and the complexity of power grids continues to grow, digital technologies are no longer optional-they're essential. Utilities are under increasing pressure to ensure reliability, minimize outages, and balance supply with fluctuating demand, all while integrating a diverse mix of renewable energy sources. This dynamic landscape demands real-time data visibility, rapid decision-making, and intelligent automation, which digital solutions are uniquely equipped to deliver. Digital substations help transform conventional grid infrastructure into more flexible and adaptive networks. These systems enable predictive maintenance, fault detection, and automated response mechanisms that reduce downtime and operational inefficiencies. They also allow operators to remotely monitor assets and optimize energy flows across increasingly decentralized power networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 6.8% |

The electrical systems component of the utility-scale digital substations market will reach USD 2.3 billion by 2034. This is due to consistent investments in upgrading high-voltage transmission lines and increasing efforts to integrate renewable energy into national grids. As more solar, wind, and hydro sources come online, robust electrical systems are necessary to manage fluctuations and ensure smooth transmission over long distances. The growing need to modernize aging transmission networks is pushing utilities to invest in next-gen substation components equipped with intelligent automation and fault-tolerant technology.

Meanwhile, the medium voltage segment is expected to maintain strong momentum, growing at a CAGR of 6.1% through 2034. This growth is tied to the rise of decentralized energy systems, where localized power generation and smart microgrids are gaining traction. Medium voltage networks are the backbone for distributing electricity from substations to end users, particularly in industrial parks, residential developments, and commercial zones. Governments and private energy providers are increasingly channeling funds into digital medium voltage solutions that support load forecasting, peak demand control, and asset optimization-all critical functions for a resilient and flexible energy grid.

United States Utility Scale Digital Substation Market was valued at USD 881.3 million in 2024. The country is making major strides in modernizing its power infrastructure to meet the evolving energy landscape. Utilities are actively phasing out legacy systems in favor of fully automated digital substations, which offer improved system diagnostics, predictive maintenance capabilities, and streamlined operations. This transition is heavily supported by federal initiatives and funding programs aimed at enhancing grid reliability and accelerating the adoption of smart energy technologies.

Key players in the market include ABB, Belden, Cisco Systems, Eaton, Efacec, General Electric, Hitachi Energy, Larsen & Toubro Limited, Netcontrol Group, Schneider Electric, Siemens, SIFANG, Tesco Automation, Texas Instruments Incorporated, and Toshiba. To strengthen their market position, companies in the utility-scale digital substation market are employing a range of strategies. They focus on developing and refining innovative technologies, enhancing their product offerings to meet the evolving needs of energy distribution, and forming partnerships with utilities and energy providers to expand their market reach. Strategic investments in digital infrastructure and automation are also helping these companies stay competitive. Furthermore, they focus on global expansion, ensuring they can support large-scale infrastructure projects worldwide while meeting the increasing demand for smart grid solutions. These strategies help companies improve their market standing and position themselves for growth in this expanding sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Belden

- 10.3 Cisco Systems

- 10.4 Eaton

- 10.5 Efacec

- 10.6 General Electric

- 10.7 Grid to Great

- 10.8 Hitachi Energy

- 10.9 Larsen & Toubro Limited

- 10.10 Netcontrol Group

- 10.11 Schneider Electric

- 10.12 Siemens

- 10.13 SIFANG

- 10.14 Tesco Automation

- 10.15 Texas Instruments Incorporated

- 10.16 Toshiba