PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871314

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871314

Biodegradable Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

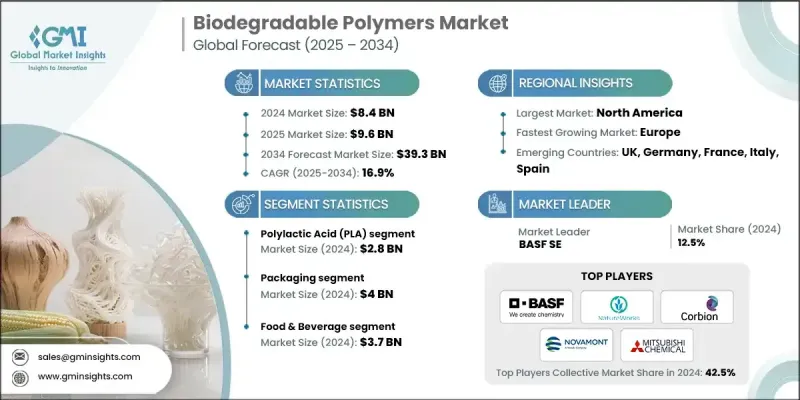

The Global Biodegradable Polymers Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 39.3 billion by 2034.

Biodegradable polymers are materials capable of breaking down naturally through exposure to microorganisms, heat, moisture, and aerobic conditions into water, carbon dioxide, and biomass. Unlike conventional plastics that persist in the environment for centuries, these polymers offer sustainable alternatives derived from renewable sources or produced synthetically. Growing environmental awareness and stricter regulations on plastic pollution are driving their adoption across industries. Governments worldwide are imposing restrictions on single-use plastics, encouraging companies to switch to eco-friendly options. Rising consumer demand for sustainable packaging, agricultural films, and disposable products further accelerates growth. Technological advancements are enhancing the performance, processability, and durability of biodegradable polymers. Current research focuses on optimizing chemical structures to improve strength, flexibility, and thermal stability while ensuring they remain naturally degradable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $39.3 Billion |

| CAGR | 16.9% |

The polylactic Acid (PLA) accounted for USD 2.8 billion in 2024, driven by its application in packaging, disposable products, and biomedical uses. Its ability to compost industrially and integrate with existing manufacturing setups makes it highly favored by companies pursuing sustainable solutions. Polyhydroxyalkanoates (PHAs) are gaining traction in medical devices and specialty plastics markets due to their excellent biodegradability and versatility.

The packaging segment generated USD 4 billion in 2024, driven by the growing application of biodegradable polymers. Companies in the food, beverage, and retail sectors are increasingly replacing conventional plastics with PLA, starch-based films, and cellulose products to meet regulatory requirements and consumer expectations. This segment combines high-volume usage with visible sustainability benefits, making it the most commercially advanced area for biodegradable polymer adoption.

U.S. Biodegradable Polymers Market generated USD 2.1 billion in 2024. North America continues to lead as companies and consumers prioritize eco-friendly solutions. Federal and state policies, along with growing awareness of plastic pollution, have encouraged the integration of biodegradable materials in packaging, agriculture, and consumer products. Advances in polymer science have enhanced cost-efficiency and performance, making biodegradable polymers an attractive option for industries aiming to lower their environmental impact. This positions North America as a hub for innovation and widespread adoption of sustainable polymer solutions.

Key players operating in the Global Biodegradable Polymers Market include BASF SE, NatureWorks LLC, Novamont S.p.A., Corbion N.V., Mitsubishi Chemical Group, Kaneka Corporation, Biome Bioplastics Limited, FKuR Kunststoff GmbH, Braskem S.A., Kingfa Sci. & Tech. Co., Ltd., Bio On S.p.A., Plantic Technologies Limited, Genomatica Inc., Mango Materials Inc., Full Cycle Bioplastics Inc., RWDC Industries Pte Ltd., Bioplastics Feedstock Alliance, and CJ CheilJedang Corporation. Companies in the Biodegradable Polymers Market are strengthening their presence through multiple strategic approaches. They are investing heavily in research and development to innovate new polymer formulations with improved strength, thermal stability, and biodegradability. Strategic partnerships and collaborations with packaging, consumer goods, and agricultural firms allow them to expand market reach and develop tailored solutions. Mergers and acquisitions are being pursued to consolidate technological capabilities and scale production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Polymer type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in production technology

- 3.2.1.2 Rising demand in packaging industry

- 3.2.1.3 Increasing use in medical and agricultural applications

- 3.2.1.4 Consumer preference for eco-friendly products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Performance limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in medical and agriculture sectors

- 3.2.3.2 Technological innovations

- 3.2.3.3 Development of circular economy models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polylactic acid (PLA)

- 5.3 Polyhydroxyalkanoates (PHA)

- 5.4 Polybutylene succinate (PBS)

- 5.5 Polycaprolactone (PCL)

- 5.6 Starch-based polymers

- 5.7 Cellulose derivatives

- 5.8 Emerging types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Packaging

- 6.3 Agricultural

- 6.4 Medical & healthcare

- 6.5 Textile & fiber

- 6.6 Consumer goods

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Agriculture & horticulture

- 7.4 Healthcare & medical

- 7.5 Automotive

- 7.6 Electronics & consumer

- 7.7 Textile & apparel

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 NatureWorks LLC

- 9.3 Novamont S.p.A

- 9.4 Corbion N.V.

- 9.5 Mitsubishi Chemical Group

- 9.6 Kaneka Corporation

- 9.7 Biome Bioplastics Limited

- 9.8 FKuR Kunststoff GmbH

- 9.9 Braskem S.A.

- 9.10 Kingfa Sci. & Tech.Co.,Ltd.

- 9.11 Bio On S.p.A.

- 9.12 Plantic Technologies Limited

- 9.13 Genomatica Inc.

- 9.14 Mango Materials Inc.

- 9.15 Full Cycle Bioplastics Inc.

- 9.16 RWDC Industries Pte Ltd.

- 9.17 Bioplastics Feedstock Alliance

- 9.18 CJ CheilJedang Corporation