PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716518

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716518

Grinding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

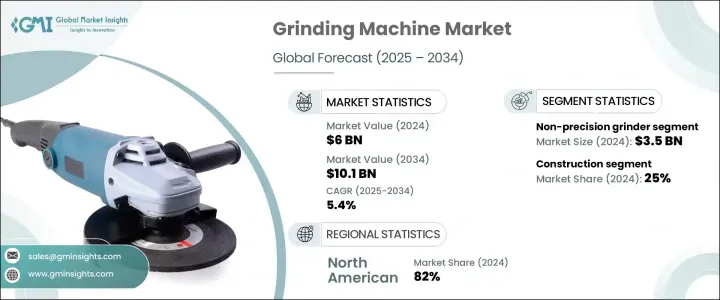

The Global Grinding Machine Market was valued at USD 6 billion in 2024 and is projected to expand at a CAGR of 5.4% between 2025 and 2034, driven by rapid advancements in precision manufacturing, the surging automotive sector, growing industrial automation, and steady growth in metalworking industries. Grinding machines are becoming an indispensable part of modern manufacturing, offering unmatched efficiency and precision in producing components that require high accuracy. As industries across the globe focus on achieving superior quality, tighter tolerances, and faster production times, the demand for technologically advanced grinding machines continues to grow. These machines play a critical role in delivering consistent, high-quality finishes on complex components, making them essential for industries such as automotive, aerospace, construction, and medical device manufacturing.

The growing trend toward automation, coupled with rising labor costs, is also pushing manufacturers to invest in sophisticated grinding technologies that can ensure speed, consistency, and minimal manual intervention. Moreover, as global supply chains become more complex and industries face mounting pressure to reduce waste and improve productivity, grinding machines offer the versatility and precision needed to meet modern manufacturing challenges. From sharpening cutting tools to fine-tuning intricate parts used in heavy machinery, grinding machines are proving their value in a wide range of industrial applications, enhancing production capabilities and ensuring component durability and performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 5.4% |

The grinding machine market is broadly segmented into precision grinders and non-precision grinders, each catering to different industrial requirements. In 2024, the non-precision grinder segment accounted for USD 3.5 billion, with expectations to grow at a CAGR of 5.1% between 2025 and 2034. These machines are crucial in mass production environments where high throughput and basic finishing are essential. On the other hand, precision grinders are gaining traction in sectors that require extreme accuracy and superior surface finish. The demand for both types is witnessing a surge due to continuous advancements in control systems, high-performance sensors, and next-generation abrasive materials, which have dramatically improved grinding efficiency, precision, and reliability. Enhanced grinding wheels, better automation, and improved machine control contribute to delivering smoother surface finishes and greater reproducibility - essential factors for industries focused on high-quality manufacturing and intricate component design.

Grinding machines find widespread application across industries such as automotive, aerospace, medical, construction, and industrial manufacturing, with each sector relying on them for their ability to create high-precision components. In 2024, the construction industry alone captured nearly 25% of the market share, fueled by the need for robust, precision-engineered parts for heavy machinery and tools. With construction activities intensifying globally, particularly in emerging markets, grinding machines are vital for sharpening equipment like drills, blades, and grinders, ensuring flawless finishes and optimal operational performance.

North America grinding machine market held an impressive 82% share in 2024, underpinned by rapid advancements in automation, smart manufacturing technologies, and significant investments in industrial upgrades. The robust growth of the US construction industry - bolstered by infrastructure expansion, data center developments, and energy sector investments - further amplifies the regional demand. Government initiatives aimed at modernizing infrastructure and promoting industrial growth are also contributing to the widespread adoption of advanced grinding solutions across North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Demand for precision manufacturing

- 3.5.1.2 Advancement in industrial automation and smart manufacturing

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Technological complexity and integration challenges

- 3.5.2.2 High initial investment costs

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Non-precision grinder

- 5.2.1 Bench grinder

- 5.2.2 Portable grinder

- 5.2.3 Pedestal grinder

- 5.2.4 Flexible grinder

- 5.3 Precision grinder

- 5.3.1 Cylindrical grinding machines

- 5.3.2 Surface grinding machines

- 5.3.3 Centre-less grinding machines

- 5.3.4 Tool and cutter grinding machines

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace

- 6.4 Medical

- 6.5 Construction

- 6.6 Industrial manufacturing

- 6.7 Electrical and electronics

- 6.8 Marine Industry

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 UAE

- 7.6.2 Saudi Arabia

- 7.6.3 South Africa

Chapter 8 Company Profiles

- 8.1 Amada Machine Tools

- 8.2 Danobat

- 8.3 Doimak

- 8.4 EMAG

- 8.5 Gleason

- 8.6 Haas Automation

- 8.7 JTEKT Machinery Americas

- 8.8 Junker

- 8.9 Kellenberger

- 8.10 Makino Milling Machine

- 8.11 Okamoto

- 8.12 Schaudt Mikrosa

- 8.13 Studer

- 8.14 Toyoda Machinery USA Corporation

- 8.15 United Grinding North America