PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797884

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797884

North America Smart Grid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

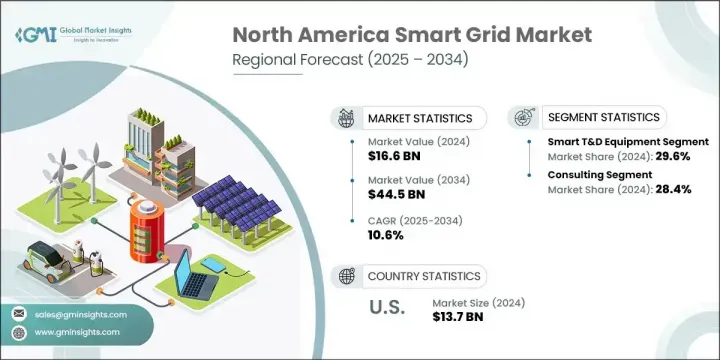

North America Smart Grid Market was valued at USD 16.6 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 44.5 billion by 2034. The market growth trajectory reflects a broader shift toward smarter, more efficient power systems driven by increasing electricity consumption across urban and industrial sectors. Ongoing efforts to upgrade outdated grid infrastructure are propelling demand for intelligent grid technologies. Collaborations between utility firms and technology developers are playing a vital role in scaling up modern grid systems.

These partnerships are improving system integration, enhancing grid interoperability, and fostering innovation to ensure energy reliability and sustainability in a fast-evolving power landscape. The adoption of smart grid solutions is also fueled by robust policy backing at both the federal and state levels, with financial incentives supporting infrastructure upgrades and clean energy alignment. As energy consumption patterns become more complex, utilities are embracing automation, data-driven forecasting, and resilient technologies to enhance overall grid stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $44.5 Billion |

| CAGR | 10.6% |

The introduction of IoT into smart grid ecosystems is changing how real-time operations are managed, offering deeper visibility and faster diagnostics. Alongside this, edge computing is making it possible to process data locally, minimizing latency and enabling instant decision-making. These tools are critical for maintaining service continuity in both densely populated and remote areas. Technological innovation in advanced metering infrastructure, automated distribution systems, and optimization tools continues to improve overall energy efficiency. As environmental regulations tighten and carbon targets become more aggressive, smart grid adoption is expected to accelerate further. The evolution of digital substations is also making a considerable impact, enabling automated fault identification and seamless energy distribution while laying the groundwork for a responsive and future-ready grid architecture.

The distribution and network automation segment is expected to grow at a robust CAGR of 11.2% through 2034. As the frequency and intensity of extreme weather conditions continue to rise, the demand for more resilient, responsive, and intelligent grid systems is gaining urgency. Advanced automation solutions play a critical role in transforming grid infrastructure by enabling real-time monitoring, self-healing capabilities, and remote fault isolation. These systems enhance the grid's ability to adapt to unforeseen disruptions, helping utilities maintain continuous power delivery even in the face of natural disasters or equipment failures.

The deployment and integration services segment held a 43.5% share in 2024 and is projected to grow at a CAGR of 10% through 2034. These services are essential to ensuring the reliable installation, scalability, and functionality of smart grid components. Growing focus on regulatory compliance, optimized asset deployment, and smooth operations is driving demand for advanced service capabilities. By enabling interoperability across complex infrastructure systems, these services allow utilities to achieve better performance outcomes, minimize downtime, and maximize returns on smart grid investments.

United States Smart Grid Market held an 82.5% share in 2024, generating USD 13.7 billion. Legacy grid systems across the country are proving insufficient to meet surging power demands, especially with the rise in distributed renewable energy sources. This imbalance is prompting utilities to accelerate the deployment of smart grid frameworks. Predictive analytics is being increasingly utilized to enhance power generation forecasting from variable sources, ensuring grid consistency. At the same time, supportive government policies are reinforcing energy efficiency efforts and driving significant momentum toward large-scale digital grid adoption, further solidifying the U.S. market's leadership.

Leading players shaping the competitive landscape of the North America Smart Grid Market include Schneider Electric, Itron, GE Vernova, ABB, and Siemens. These companies are actively driving innovation, expanding grid connectivity, and helping utilities transition toward more intelligent and adaptive energy systems. Key strategies adopted by companies in the North America Smart Grid Market include aggressive R&D to enhance automation capabilities, digital transformation of grid infrastructure, and expansion into underserved utility regions. Companies like Itron and Siemens are focusing on end-to-end solutions that integrate smart meters, communication platforms, and software analytics to optimize grid performance. Others are investing in predictive maintenance tools and cybersecurity frameworks to boost reliability and protect assets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Service trends

- 2.1.4 Deployment trends

- 2.1.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supply chain dynamics

- 3.1.2 Raw material dependencies

- 3.1.3 Manufacturing ecosystem

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.4.1 Bargaining power of suppliers

- 3.4.2 Bargaining power of buyers

- 3.4.3 Threat of new entrants

- 3.4.4 Threat of substitutes

- 3.5 PESTEL analysis

- 3.5.1 Political factors

- 3.5.2 Economic factors

- 3.5.3 Social factors

- 3.5.4 Technological factors

- 3.5.5 Environmental factors

- 3.5.6 Legal factors

- 3.6 Emerging technologies in smart grid

- 3.6.1 Artificial intelligence and machine learning applications

- 3.6.2 Internet of things (IoT) integration

- 3.6.3 5g communication networks

- 3.6.4 Edge computing solutions

- 3.6.5 Digital twin technology

- 3.6.6 Blockchain applications

- 3.6.7 Quantum computing potential

- 3.7 Cybersecurity innovation

- 3.7.1 Zero trust architecture

- 3.7.2 Ai-powered threat detection

- 3.7.3 Quantum-safe cryptography

- 3.7.4 Industrial control system security

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Smart T&D equipment

- 5.3 Distribution & network automation

- 5.4 Advanced metering infrastructure

- 5.5 Consumer interface

- 5.6 Communication & wireless infrastructure

Chapter 6 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Consulting

- 6.3 Deployment & integration

- 6.4 Support & maintenance

Chapter 7 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Generation

- 7.3 Transmission

- 7.4 Distribution

- 7.5 End use

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

- 8.4 Mexico

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Belden Inc.

- 9.3 Cisco Systems, Inc.

- 9.4 Eaton

- 9.5 Emerson Electric

- 9.6 Enel

- 9.7 Fujitsu

- 9.8 GE Vernova

- 9.9 Honeywell International Inc.

- 9.10 Hubbell

- 9.11 IBM

- 9.12 Itron Inc.

- 9.13 Landis+Gyr

- 9.14 Oracle

- 9.15 S&C Electric Company

- 9.16 Schneider Electric

- 9.17 Siemens

- 9.18 Sunverge Energy Inc.

- 9.19 Uplight, Inc.

- 9.20 Wipro