PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928918

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928918

Satellite Modem Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

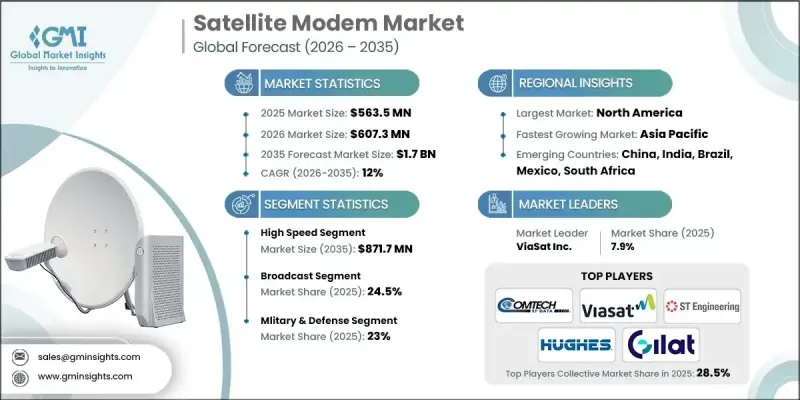

The Global Satellite Modem Market was valued at USD 563.5 million in 2025 and is estimated to grow at a CAGR of 12% to reach USD 1.7 billion by 2035.

Market growth is strongly influenced by the increasing reliance on satellite communication systems within defense and security operations worldwide. As military organizations place greater emphasis on secure, uninterrupted data exchange, demand is rising for sophisticated satellite modems capable of meeting strict performance and security standards. These solutions are widely recognized for supporting protected communications, real-time operational visibility, and command coordination, which has driven the development of highly specialized modem technologies. Beyond defense, expanding demand for reliable broadband connectivity in underserved and geographically isolated regions is accelerating market adoption. Satellite modem technology enables consistent internet access where conventional infrastructure cannot be deployed, supporting connectivity needs across commercial, institutional, and residential users. In satellite communication systems, these modems function by converting digital information into radio signals for uplink transmission and reconverting incoming signals back into usable digital data. Continuous investments in satellite network expansion are reinforcing the long-term growth outlook for the market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $563.5 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 12% |

The high-speed segment is projected to reach USD 871.7 million by 2035. This segment is gaining traction as demand rises for faster data transmission, reduced latency, and seamless performance across data-intensive applications. Advancements in modem design, along with improvements in data modulation and coding techniques, are enabling higher throughput rates and enhanced service quality, supporting a broad range of bandwidth-heavy use cases.

The broadcast segment accounted for a 24.5% share in 2025. Shifting consumption patterns in digital media distribution are reshaping this segment, with satellite modems increasingly optimized to handle large-scale video delivery, improved signal quality, and efficient bandwidth utilization. These enhancements are allowing content providers to distribute programming more effectively while maintaining lower transmission delays.

U.S. Satellite Modem Market reached USD 173.8 million in 2025. Market expansion in the country is being supported by rising requirements for dependable communication across remote locations, defense networks, and enterprise IT systems. The adoption of next-generation technologies, including advanced backhaul solutions and connected device ecosystems, is encouraging the use of flexible, software-driven modem platforms that offer higher adaptability and performance.

Key companies operating in the Global Satellite Modem Market include Hughes Network Systems, Gilat Satellite Networks Ltd., Comtech EF Data Corporation, Iridium Communications Inc., NOVELSAT, ORBCOMM INC., Ayecka Communication Systems Ltd., Datum Systems Inc., ND SATCOM, Ntvsat, and Amplus Communication Pvt. Ltd. Companies active in the Global Satellite Modem Market are strengthening their competitive positions through continuous innovation, strategic partnerships, and portfolio expansion. Many players are prioritizing research and development to enhance data speeds, security capabilities, and interoperability with evolving satellite architectures. Investments in software-defined and scalable modem platforms are helping companies address diverse customer requirements across commercial, government, and defense sectors. Strategic alliances with satellite operators and network providers are enabling broader market access and improved service integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Channel type trends

- 2.2.2 Data rate trends

- 2.2.3 Application trends

- 2.2.4 End Use industry trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-speed internet access in remote areas

- 3.2.1.2 Growing adoption of satellite communication for maritime and aviation connectivity

- 3.2.1.3 Expansion of satellite-based broadcasting and media services

- 3.2.1.4 Increasing deployment of satellite networks for military & defense applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dependence on atmospheric conditions

- 3.2.2.2 Technological obsolescence

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of low earth orbit (LEO) satellite constellations

- 3.2.3.2 Miniaturization and power efficiency for small satellite platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Channel Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Single Channel Per Carrier (SCPC) modem

- 5.3 Multiple Channel Per Carrier (MCPC) modem

Chapter 6 Market Estimates and Forecast, By Data Rate, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 High speed

- 6.3 Mid range

- 6.4 Entry level

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Broadcast

- 7.3 Enterprise & broadband

- 7.4 In-flight connectivity

- 7.5 IP trunking

- 7.6 Mobile & backhaul

- 7.7 Offshore communication

- 7.8 Tracking & monitoring

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Energy & utilities

- 8.3 Government

- 8.4 Marine

- 8.5 Media & entertainment

- 8.6 Military & defense

- 8.7 Mining

- 8.8 Oil & gas

- 8.9 Telecommunications

- 8.10 Transportation & logistics

- 8.11 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Comtech EF Data Corporation

- 10.1.2 Hughes Network Systems

- 10.1.3 Iridium Communications Inc.

- 10.1.4 ViaSat Inc.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Datum Systems Inc.

- 10.2.1.2 ORBCOMM INC.

- 10.2.1.3 Teledyne Paradise Datacom

- 10.2.2 Europe

- 10.2.2.1 ND SATCOM

- 10.2.2.2 Rohde & Schwarz Inradios Gmbh

- 10.2.2.3 WORK Microwave GmbH

- 10.2.3 APAC

- 10.2.3.1 ST Engineering

- 10.2.3.2 Gilat Satellite Networks Ltd.

- 10.2.3.3 Thuraya Telecommunications Company

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Amplus Communication Pvt. Ltd.

- 10.3.2 Ayecka Communication Systems Ltd.

- 10.3.3 NOVELSAT

- 10.3.4 Ntvsat

- 10.3.5 SatixFy