PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766361

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766361

Automotive Acoustic Engineering Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

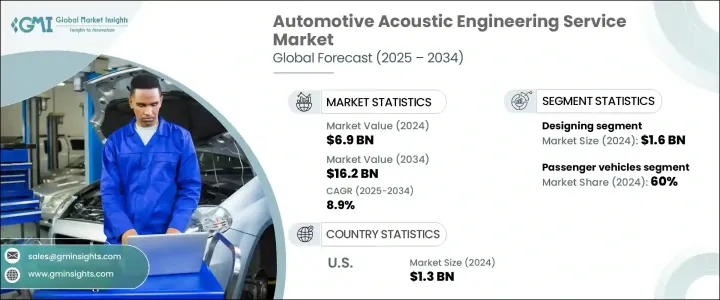

The Global Automotive Acoustic Engineering Service Market was valued at USD 6.9 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 16.2 billion by 2034. The surge in demand is largely influenced by the need for quieter and more comfortable driving experiences, stricter global noise regulations, and the industry-wide transition toward electric mobility. As the structure and powertrains of vehicles change, particularly with the reduced engine noise in EVs, automakers and Tier 1 suppliers are placing renewed focus on noise, vibration, and harshness (NVH) refinement.

Leading companies are leveraging technologies such as virtual acoustic testing, digital simulation, and sound material optimization to shape the auditory signature of vehicles while cutting costs and development time. The market is particularly dynamic in Europe and Asia-Pacific, where manufacturers are deploying advanced software platforms and simulation environments to manage NVH performance across vehicle types. These services not only help meet regulatory compliance but also support differentiation in an increasingly competitive automotive landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 8.9% |

The design phase segment generated USD 1.6 billion in 2024. This segment plays a critical role in shaping acoustic profiles from the earliest phases of development. Key activities include selecting sound-insulating materials, building sound packages, and simulating acoustic environments using 3D tools and AI-powered platforms. The rise of digital twins and predictive acoustic modeling allows OEMs to customize NVH treatments across vehicle platforms-from compact EVs to large SUVs-improving product quality while maintaining cost efficiency. These early-stage services enable manufacturers to fine-tune sound characteristics before physical prototyping begins.

Passenger vehicles represented a 60% share in 2024, continuing to dominate due to heightened consumer focus on cabin comfort, noise isolation, and refined acoustic experiences. With EVs eliminating engine noise, secondary sounds like road and HVAC noise have become more noticeable. This shift is prompting carmakers to invest in better soundproofing materials, precision tuning, and advanced simulation software to deliver a quieter, more premium in-vehicle experience. The expanding presence of autonomous features and connected infotainment systems also increases the need for well-managed soundscapes in passenger vehicles.

U.S. Automotive Acoustic Engineering Service Market generated USD 1.3 billion in 2024 and is forecasted to grow at a CAGR of 7.8% through 2034. This leadership in North America stems from a strong automotive manufacturing base, significant R&D investment, and early adoption of advanced NVH technologies. OEMs like Tesla, Ford Motor Company, and General Motors are increasing their focus on acoustic design and sound calibration to enhance user experience and meet tightening noise-level regulations. Research institutions and innovation hubs across regions such as Michigan and California provide a robust ecosystem for acoustic testing and product validation, further reinforcing the U.S.'s regional dominance.

Key players shaping the Global Automotive Acoustic Engineering Service Market include Siemens, Gentex, Schaeffler Engineering, FEV Group, EDAG Engineering, Faurecia, Catalyst Acoustics, Continental, Autoneum, and Bertrandt. Companies in the automotive acoustic engineering service market are enhancing their market presence through investment in digital simulation platforms, AI-integrated acoustic modeling, and real-time NVH analytics. Strategic partnerships with OEMs for collaborative development are helping engineering firms co-design tailored acoustic solutions for EVs and hybrid platforms. Firms are also expanding service offerings into early-phase design consultation and post-production validation using smart sensors and data-based tuning. Enhancing R&D capabilities through global innovation centers and acquiring niche tech firms are enabling faster product rollout. Emphasis on sustainable and lightweight acoustic materials aligns with environmental regulations while meeting performance standards. Market leaders are also extending services to developing markets with growing automotive demand, supporting localization efforts, and building long-term client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Process

- 2.2.3 Offering

- 2.2.4 Solution

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for enhanced features in vehicle

- 3.2.1.2 Stringent government regulations on vehicle noise

- 3.2.1.3 Rise in sales of premium vehicles

- 3.2.1.4 Advancements in acoustic engineering technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Complexity in multi-material and lightweight designs

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of EV and autonomous vehicle markets

- 3.2.3.2 Adoption of AI-driven NVH analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Process, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Designing

- 5.3 Development

- 5.4 Testing

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Physical

- 6.3 Virtual

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Calibration

- 7.3 Vibration

- 7.4 Simulation

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedans

- 8.2.2 Hatchbacks

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Medium Commercial Vehicles (MCV)

- 8.3.3 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Interior

- 9.3 Body & structure

- 9.4 Powertrain

- 9.5 Drivetrain

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adler Pelzer

- 11.2 Autoneum

- 11.3 AVL List

- 11.4 Bertrandt

- 11.5 Catalyst Acoustics

- 11.6 Continental

- 11.7 DESIGNA

- 11.8 EDAG Engineering

- 11.9 Faurecia SA

- 11.10 FEV Group

- 11.11 Gentex

- 11.12 HEAD

- 11.13 Horiba

- 11.14 IAV GmbH

- 11.15 Roechling

- 11.16 Schaeffler

- 11.17 Siemens

- 11.18 Spectris

- 11.19 STS Group

- 11.20 Vibroacoustic