PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773267

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773267

Europe Compliance Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

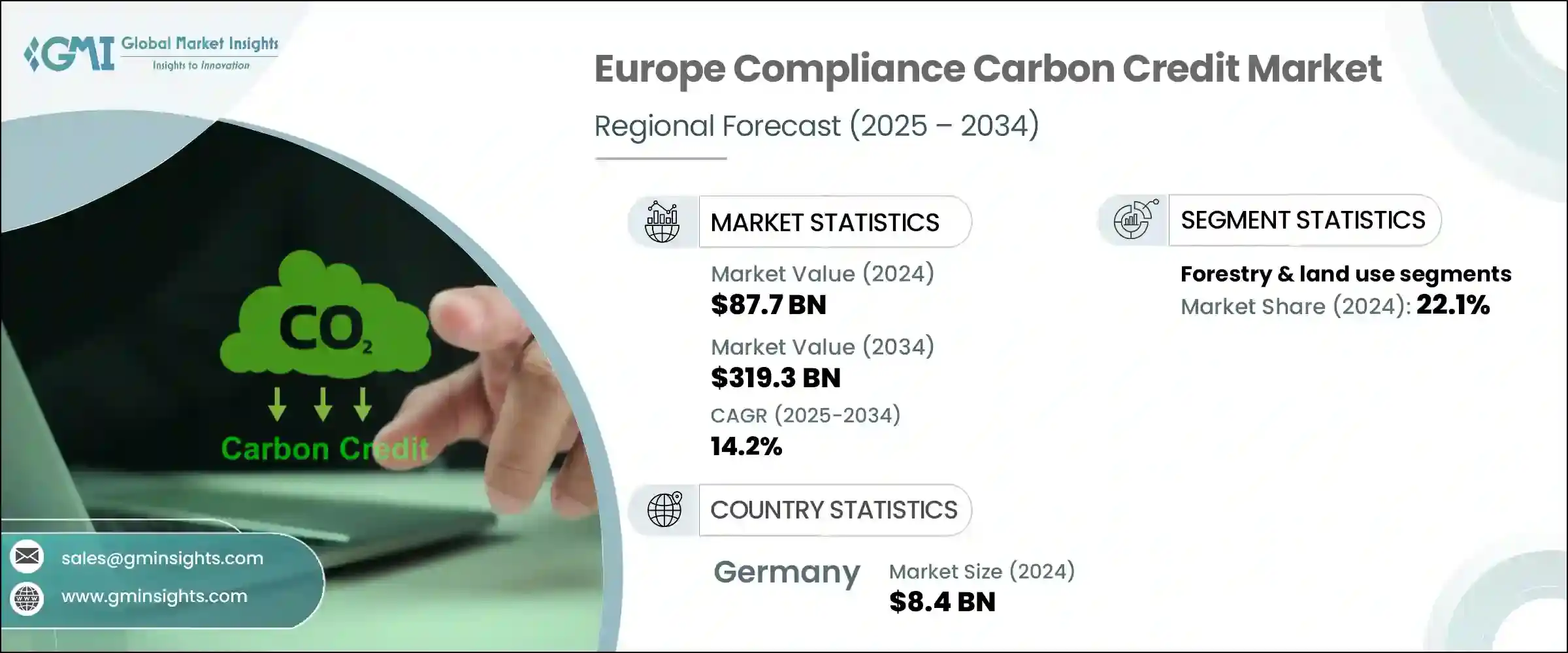

Europe Compliance Carbon Credit Market was valued at USD 87.7 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 319.3 billion by 2034. The growth is driven by increasingly strict climate policies that cap total emissions, making companies accountable for genuine, verifiable CO2 reductions. As more standards emerge, businesses are establishing rigorous carbon accounting and verification frameworks. This not only boosts confidence in carbon-offset projects but also presents opportunities for firms that need to buy credits to balance emissions they can't yet eliminate. Public support, investor expectations, and consumer demand also encourage policymakers to strengthen the trading system.

Introducing carbon pricing mechanisms into regulatory frameworks such as the EU Emissions Trading System (ETS) effectively transforms carbon dioxide emissions into a financial liability. This shift encourages companies to reassess their energy strategies, as continuing with carbon-intensive operations directly impacts their bottom line. By assigning a tangible price to each metric ton of CO2 released, organizations are financially incentivized to cut emissions through efficiency improvements or by adopting low-carbon technologies. These costs also make long-term investments in renewable energy and green innovation more appealing, as the return on investment grows in comparison to rising carbon penalties. As a result, carbon pricing acts as both a deterrent and a motivator, discouraging pollution while accelerating the transition toward cleaner, more sustainable business models across sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $87.7 Billion |

| Forecast Value | $319.3 Billion |

| CAGR | 14.2% |

In 2024, the forestry and land-use initiatives segment accounted for a 22.1% share. Efforts such as reforestation, afforestation, sustainable forest management, and preventing deforestation are gaining traction as effective, verified carbon sinks. These projects not only contribute to carbon sequestration but also support wider biodiversity conservation targets, generating high-quality removal credits essential for achieving net-zero commitments.

Germany Compliance Carbon Credit Market generated USD 8.4 billion in 2024. This growth is driven by the country's heavy industries adapting to more stringent emissions limits, alongside increased investment in hydrogen infrastructure and advanced carbon capture technologies, positioning Germany as a leader in comprehensive climate action efforts.

Top players in Europe Compliance Carbon Credit Market include ALLCOT, Atmosfair, BP p.l.c., Bluesource, CarbonClear, CDP, Climate Impact Partners, Climate Neutral Group, 3 Degrees, EcoAct, Ecosecurities, PwC, Shell, South Pole, The Carbon Trust, and TotalEnergies-shuffled across the landscape. Companies in Europe compliance carbon credit space are scaling up by standardizing and digitizing carbon accounting systems to ensure transparent, real-time tracking and compliance.

They are investing in high-quality, nature-based projects such as reforestation and sustainable land use to generate credible removal credits. Collaborative partnerships with governments, NGOs, and local communities are enhancing project legitimacy, while strategic acquisitions of carbon asset developers secure long-term supply. Leading providers are expanding consulting and verification services, helping businesses implement robust offset strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2025

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategic initiative

- 3.4 Competitive benchmarking

- 3.5 Strategic dashboard

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 4.1 Key trends

- 4.2 Agriculture

- 4.3 Carbon capture

- 4.4 Chemical process

- 4.5 Energy efficiency

- 4.6 Industrial

- 4.7 Forestry & land use

- 4.8 Renewable energy

- 4.9 Transportation

- 4.10 Waste management

- 4.11 Others

Chapter 5 Market Size and Forecast, By Country, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Denmark

- 5.3 France

- 5.4 Germany

- 5.5 Norway

- 5.6 Poland

- 5.7 Switzerland

- 5.8 UK

Chapter 6 Company Profiles

- 6.1 ALLCOT

- 6.2 Atmosfair

- 6.3 BP p.l.c.

- 6.4 Bluesource

- 6.5 CarbonClear

- 6.6 CDP

- 6.7 Climate Impact Partners

- 6.8 Climate Neutral Group

- 6.9 3 Degrees

- 6.10 EcoAct

- 6.11 Ecosecurities

- 6.12 PwC

- 6.13 Shell

- 6.14 South Pole

- 6.15 The Carbon Trust

- 6.16 TotalEnergies