PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928997

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928997

North America Medium Voltage Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

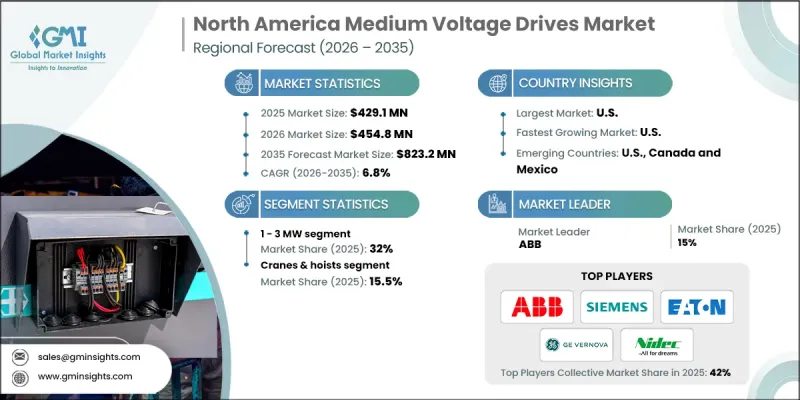

North America Medium Voltage Drives Market was valued at USD 429.1 million in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 823.2 million by 2035.

Market development is supported by strong capital allocation toward industrial expansion and manufacturing modernization, along with rising demand for energy-efficient motor control technologies. Increased focus on operational optimization and adherence to strict energy performance standards is accelerating product uptake across industries. Supportive regulatory frameworks promoting lower energy consumption and improved system efficiency are reshaping adoption trends. Broader use of advanced motor control architectures in high-load industrial operations, combined with growing preference for digitally enabled systems that deliver accurate speed regulation and efficiency gains, continues to drive growth. Heightened attention to industrial decarbonization, supported by policy-driven efficiency programs, is further strengthening market potential. Regulatory pressure to reduce energy losses, paired with industry-wide digital transformation efforts aimed at lowering operational expenses, is reinforcing demand for next-generation medium voltage drives. Compliance-focused investments and long-term cost optimization strategies are accelerating the transition toward technologically advanced MV drive solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $429.1 Million |

| Forecast Value | $823.2 Million |

| CAGR | 6.8% |

The 1-3 MW power rating segment held 32% share in 2025 and is forecast to grow at a CAGR of 7% through 2035. Rising automation levels, infrastructure upgrades, and renewable energy integration are supporting segment expansion, while efficiency-focused initiatives are encouraging the replacement of outdated systems with modern MV drives.

The cranes and hoists application segment held 15.5% share in 2025 and is expected to grow at 6.5% CAGR through 2035. Demand is driven by the requirement for controlled motion, improved energy performance, and operational safety in heavy material handling environments, where MV drives reduce wear, improve load control, and enhance equipment uptime.

United States Medium Voltage Drives Market accounted for 71.8% share in 2025, generating USD 308.1 million. Ongoing industrial infrastructure upgrades, coupled with rising preference for dependable and efficient motor control systems, are supporting market strength. Policy support for sustainable technologies and strict emission reduction mandates continue to reinforce long-term growth prospects.

Key companies operating in the North America Medium Voltage Drives Market include Siemens, ABB, Schneider Electric, Rockwell Automation, Eaton, Danfoss, GE Vernova, Emerson Electric, WEG, Yaskawa America, Nidec Industrial Solutions, Fuji Electric Corp. of America, Innomotics, Delta Electronics, TMEIC, Teco-Westinghouse, Benshaw Inc, TRIOL CORPORATION, Wolong Electric America LLC, VEM Group, and Emotron. Companies operating in the North America Medium Voltage Drives Market are strengthening their market position through continuous technology innovation, efficiency-focused product development, and strategic partnerships. Many players are expanding their portfolios with digitally enabled MV drives that support predictive maintenance, remote monitoring, and advanced analytics. Investment in energy-optimized designs helps customers meet regulatory requirements while lowering total operating costs. Manufacturers are also enhancing service capabilities through lifecycle support, system upgrades, and customized solutions tailored to industrial requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by country

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Power range trends

- 2.4 Drive trends

- 2.5 Sales channel trends

- 2.6 Application trends

- 2.7 End use trends

- 2.8 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of medium voltage drives

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2025

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Range, 2022 - 2035 (Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 1 MW

- 5.3 1 - 3 MW

- 5.4 3 - 7 MW

- 5.5 > 7 MW

Chapter 6 Market Size and Forecast, By Drive, 2022 - 2035 (Units & USD Million)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

- 6.4 Servo

Chapter 7 Market Size and Forecast, By Sales Channel, 2022 - 2035 (Units & USD Million)

- 7.1 Key trends

- 7.2 Direct to end use

- 7.3 Direct to machine builder

- 7.4 Direct to systems integrator

- 7.5 Distribution/partner

Chapter 8 Market Size and Forecast, By Application, 2022 - 2035 (Units & USD Million)

- 8.1 Key trends

- 8.2 Pump

- 8.3 Fan

- 8.4 Cranes & hoists

- 8.5 Conveyor

- 8.6 Compressor

- 8.7 Extruder

- 8.8 Others

Chapter 9 Market Size and Forecast, By End Use, 2022 - 2035 (Units & USD Million)

- 9.1 Key trends

- 9.2 Oil & gas

- 9.3 Power generation

- 9.4 Mining & metals

- 9.5 Pulp & paper

- 9.6 Marine

- 9.7 Others

Chapter 10 Market Size and Forecast, By Country, 2022 - 2035 (Units & USD Million)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Benshaw Inc

- 11.3 Danfoss

- 11.4 Delta Electronics

- 11.5 Eaton

- 11.6 Emerson Electric

- 11.7 Emotron

- 11.8 Fuji Electric Corp. of America

- 11.9 GE Vernova

- 11.10 Innomotics

- 11.11 Nidec Industrial Solutions

- 11.12 Rockwell Automation

- 11.13 Schneider Electric

- 11.14 Siemens

- 11.15 TECO-Westinghouse

- 11.16 TMEIC

- 11.17 TRIOL CORPORATION

- 11.18 VEM Group

- 11.19 WEG

- 11.20 Wolong Electric America, LLC

- 11.21 Yaskawa America