PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685061

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685061

Armored Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

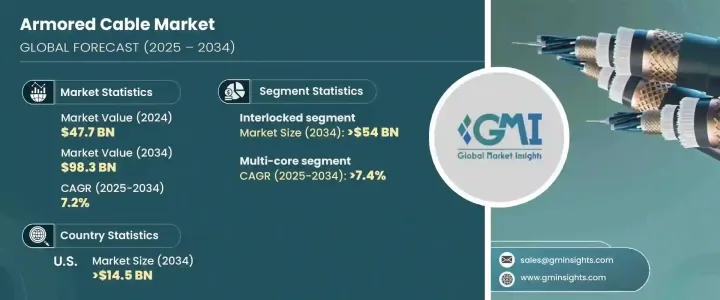

The Global Armored Cable Market reached a valuation of USD 47.7 billion in 2024 and is projected to expand at a CAGR of 7.2% from 2025 to 2034. This rapid growth stems from the increasing need for secure, durable, and reliable wiring solutions across industries such as construction, energy, and manufacturing. As global infrastructure projects accelerate, particularly in emerging economies, armored cables are gaining traction due to their superior ability to withstand mechanical damage, harsh weather conditions, and environmental challenges.

Urbanization and the rise in construction activities for residential, commercial, and industrial spaces are further fueling demand, particularly in areas prone to adverse environmental conditions. Additionally, advancements in manufacturing processes, including the integration of stronger materials and innovative designs, are bolstering the market by enhancing cable durability and performance. Rising awareness of electrical safety standards across industries is also significantly driving the adoption of armored cables.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $47.7 Billion |

| Forecast Value | $98.3 Billion |

| CAGR | 7.2% |

As industries shift toward sustainable and efficient energy solutions, the need for robust wiring infrastructure to support renewable energy projects, such as solar and wind farms, is intensifying. Armored cables are increasingly being utilized for their ability to provide safe and reliable power transmission, even in demanding outdoor environments. Moreover, as digital transformation advances globally, the telecommunications sector is adopting armored cables for their capacity to protect critical communication networks from physical damage and interference. This confluence of technological, environmental, and industrial factors continues to drive market growth, positioning armored cables as an indispensable component in modern infrastructure development.

The interlocked armored cable segment is anticipated to generate USD 54 billion by 2034, driven by its mechanical protection, flexibility, and cost-effectiveness. Designed with a metal strip wrapped around the cable core, interlocked armored cables offer exceptional resistance to physical damage and external pressures. This design makes them highly suitable for industries such as construction, industrial facilities, and outdoor installations, where cables are subjected to challenging conditions. Their durability and reliability make them an essential solution for applications requiring enhanced mechanical strength.

In the core type category, multi-core armored cables are projected to grow at a CAGR of 7.4% through 2034. These cables, which house multiple electrical circuits within a single cable, simplify installation and reduce overall project costs, making them ideal for industries such as manufacturing, telecommunications, and construction. Their ability to support efficient power distribution and streamline wiring in confined spaces is particularly advantageous in environments where space optimization and reliability are critical.

The US armored cable market is expected to generate USD 14.5 billion by 2034, driven by growing investments in advanced electrical infrastructure across critical sectors such as construction, telecommunications, and energy. The country's expanding urbanization, coupled with the development of smart city projects, is further accelerating the demand for dependable wiring solutions. Additionally, the growth of renewable energy projects, particularly in solar and wind power, is creating new opportunities for armored cables, which are essential for ensuring safe power transmission in rugged and outdoor environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Armor Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 Interlocked

- 5.3 Continuously corrugated welded

Chapter 6 Market Size and Forecast, By Core Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Single core

- 6.3 Multi-core

Chapter 7 Market Size and Forecast, By End User, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Manufacturing

- 7.4 Mining

- 7.5 Construction

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Anixter

- 9.2 AT&T

- 9.3 Atkore

- 9.4 Belden

- 9.5 Finolex

- 9.6 Furukawa Electric

- 9.7 Havells

- 9.8 Helukabel

- 9.9 KEI Industries

- 9.10 Leoni Cables

- 9.11 LS Cable & System

- 9.12 Nexans

- 9.13 NKT

- 9.14 Okonite

- 9.15 Omni Cables

- 9.16 Polycab

- 9.17 Prysmian

- 9.18 Riyadh Cables

- 9.19 RR Kabel

- 9.20 Southwire

- 9.21 Sumitomo Electric