PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716697

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716697

E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

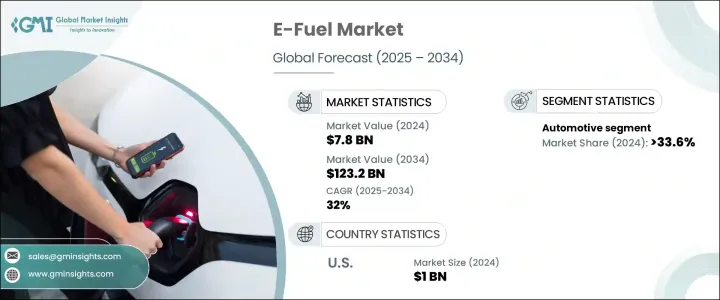

The Global E-Fuel Market was valued at USD 7.8 billion in 2024 and is projected to grow at a remarkable CAGR of 32% from 2025 to 2034. This growth can largely be attributed to advancements in renewable energy technologies, increasing environmental awareness, and stricter carbon emission regulations. E-fuels are emerging as a promising solution to overcome the limitations of hydrogen fuel cells and battery electric vehicles (BEVs), offering a viable energy storage option. Governments worldwide are introducing favorable policies and incentives that encourage the development of e-fuels, which is driving investments in related infrastructure.

The rise in environmental concerns, particularly about greenhouse gas emissions from industries like aviation, shipping, and heavy transport, is spurring the demand for alternative energy solutions. These sectors are difficult to decarbonize, making e-fuels a compelling choice. Government regulations and incentives play a crucial role in facilitating e-fuel adoption, with many regions establishing frameworks for integrating renewable fuels into their energy systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $123.2 Billion |

| CAGR | 32% |

Technological advancements and innovations in the e-fuel production process are also contributing to market growth. Improved methods for electrolysis and carbon capture are helping lower production costs and increase the economic viability of e-fuels. The integration of renewable energy sources, such as wind and solar power, into e-fuel production is reducing the carbon footprint and operational expenses, further supporting industry expansion.

The e-fuel market is segmented based on product type, with categories including e-gasoline, e-diesel, e-kerosene, e-methanol, and ethanol. Among these, e-gasoline is gaining popularity, particularly in the automotive sector, as a drop-in fuel for existing internal combustion engine (ICE) vehicles. This growth is driven by the desire to decarbonize the automobile industry without requiring significant changes to the current infrastructure.

By application, the market is primarily divided into automotive, marine, aviation, and industrial sectors, with the automotive sector accounting for over 33.6% of the market share in 2024. The automotive e-fuel segment is growing as a key strategy to reduce emissions from ICE vehicles, especially in regions where the infrastructure or cost barriers hinder the widespread adoption of electric vehicles (EVs). E-fuels like e-gasoline and e-diesel provide a practical solution, enabling existing fuel stations and vehicle engines to continue operating without disruption.

In the U.S., the e-fuel market has seen rapid growth, with values increasing from USD 0.7 billion in 2022 to USD 1 billion in 2024. This growth is largely fueled by initiatives like the Inflation Reduction Act, which provides incentives for sustainable energy technologies. Additionally, partnerships between companies to produce e-fuel in facilities across the country are contributing to this growth, with a focus on powering delivery fleets and reducing reliance on traditional fuel sources.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fischer-tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 E-Gasoline

- 7.3 E-Diesel

- 7.4 E-Kerosene

- 7.5 Ethanol

- 7.6 E-Methanol

- 7.7 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Marine

- 8.4 Aviation

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Netherlands

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Arcadia eFuels

- 10.2 Archer Daniels Midland

- 10.3 Ballard Power Systems

- 10.4 Ceres Power Holding

- 10.5 Clean Fuels Alliance America

- 10.6 Climeworks

- 10.7 Electrochaea

- 10.8 eFuel Pacific

- 10.9 ExxonMobil

- 10.10 FuelCell Energy

- 10.11 HIF Global

- 10.12 Infra Synthetic Fuels

- 10.13 LanzaJet

- 10.14 Liquid Wind

- 10.15 MAN Energy Solutions

- 10.16 Norsk e-Fuel

- 10.17 Porsche

- 10.18 Sunfire