PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871311

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871311

Bone Void Fillers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

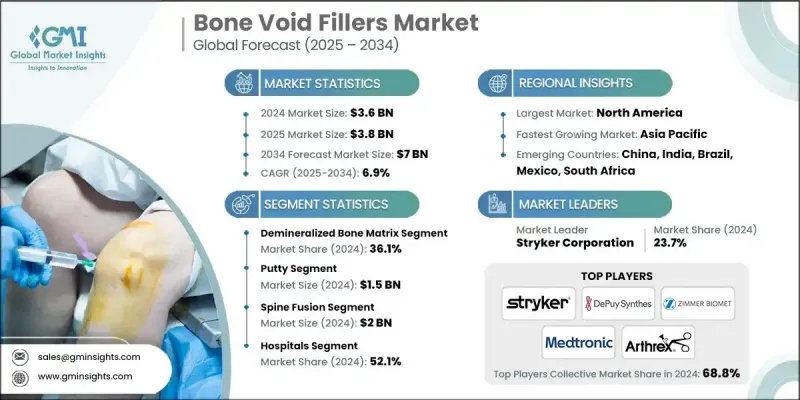

The Global Bone Void Fillers Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 7 billion by 2034.

The market expansion is fueled by the rising number of orthopedic and trauma surgeries and the increasing prevalence of bone-related conditions, such as fractures and osteoporosis. A major trend is the shift from conventional autografts and allografts to synthetic and bioactive bone void fillers, including calcium phosphate, bioactive glass, and composite scaffolds. These alternatives provide predictable resorption rates, lower infection risks, and superior biocompatibility, making them ideal for widespread clinical use. The demand for injectable bone void fillers is also increasing, as they facilitate minimally invasive procedures, reduce surgical time, and improve patient recovery. Rising global life expectancy, urbanization, and the growing incidence of degenerative skeletal diseases and trauma-related injuries are further driving market growth, especially across both developed and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $7 Billion |

| CAGR | 6.9% |

The demineralized bone matrix (DBM) segment held a 36.1% share in 2024 and is projected to grow at a CAGR of 6.1% during 2025-2034. DBM is favored for its high osteoinductive potential, biocompatibility, and versatility in clinical applications. Derived from processed allograft bone, DBM retains key organic components, including collagen, bone morphogenetic proteins, and growth factors, which promote new bone formation and effective graft integration. Available in multiple delivery formats, such as putty, paste, gel, and strips, it allows surgeons flexibility in orthopedic, trauma, and spinal fusion procedures.

The putty segment generated USD 1.5 billion in 2024 and is expected to grow at a CAGR of 7.2% through 2034. Surgeons prefer putty due to its cohesive, moldable texture, which allows precise placement in irregular or complex bone defects. Its superior handling and adaptability make it ideal for applications in spinal fusion, craniofacial reconstruction, orthopedic trauma, and dental surgeries.

North America Bone Void Fillers Market held a 48.9% share in 2024. The region benefits from advanced healthcare infrastructure, high surgical volumes, and the presence of leading players offering minimally invasive solutions and innovative bone graft substitutes. Early adoption of bioactive and injectable fillers, along with significant investment in R&D and clinical trials, has reinforced North America's leadership in this sector.

Key companies operating in the Global Bone Void Fillers Market include Arthrex, Bioventus, Medline, Medtronic, Abyrx, Stryker, Baxter International, DePuy Synthes (Johnson & Johnson), Bonesupport, Acumed, and Zimmer Biomet. Companies in the Bone Void Fillers Market are enhancing their presence through strategic initiatives. They are investing in research and development to introduce advanced biomaterials with superior osteoinductivity, resorption rates, and biocompatibility. Partnerships and collaborations with hospitals, surgical centers, and distributors help expand market reach and improve adoption of innovative products. Mergers and acquisitions are used to strengthen technological capabilities and scale production. Firms are also focusing on regulatory approvals, product certifications, and clinical trials to enhance credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Material type trends

- 2.2.3 Form trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of bone disorders and injuries

- 3.2.1.2 Rise in geriatric population

- 3.2.1.3 Advancements in surgical techniques

- 3.2.1.4 Growing orthopedic surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with bone disorders

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward minimally invasive and injectable solutions

- 3.2.3.2 Advancement in bioactive and antibiotic-eluting fillers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Demineralized bone matrix

- 5.3 Calcium sulfate

- 5.4 Collagen matrix

- 5.5 Tricalcium phosphate/calcium phosphate based

- 5.6 Other material types

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gel

- 6.3 Granules

- 6.4 Paste / injectable

- 6.5 Putty

- 6.6 Other forms

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Spine fusion

- 7.3 Bone fracture

- 7.4 Joint reconstruction

- 7.5 Dental / cranio-maxillofacial surgery (CMF)

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abyrx

- 10.2 Acumed

- 10.3 Arthrex

- 10.4 Baxter International

- 10.5 Bioventus

- 10.6 Bonesupport

- 10.7 DePuy Synthes (Johnson & Johnson)

- 10.8 Medline

- 10.9 Medtronic

- 10.10 Stryker

- 10.11 Zimmer Biomet