PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797857

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797857

Data Center Immersion Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

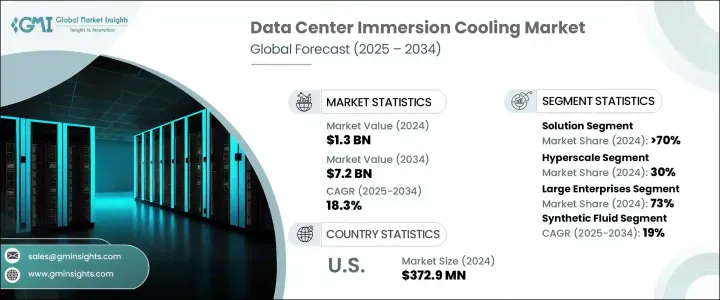

The Global Data Center Immersion Cooling Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 18.3% to reach USD 7.2 billion by 2034. This rapid growth is largely driven by the rising adoption of artificial intelligence, machine learning, and high-performance computing-all of which generate substantial heat loads and require advanced cooling solutions. Immersion cooling has emerged as a critical technology to support these demanding applications, particularly in facilities where traditional air-based systems are no longer sufficient. The growing complexity and density of server infrastructure, especially within hyperscale environments and crypto mining operations, further highlight the need for more effective heat management systems. With higher power requirements and performance expectations across digital workloads, operators are increasingly transitioning to immersion-based systems to reduce energy usage, enhance efficiency, and maintain optimal equipment performance.

North America continues to dominate the landscape due to its strong ecosystem of hyperscale data centers and early adoption of next-generation cooling methods, enabling a seamless shift to high-density computing without compromising thermal reliability. The region benefits from a highly developed digital infrastructure and substantial investments by major cloud service providers that are rapidly scaling operations. This creates an ideal environment for implementing immersion cooling systems, which not only improve energy efficiency but also reduce operational costs. Government incentives and regulatory focus on sustainable IT practices have further accelerated adoption. Additionally, North America's mature tech talent pool and research-driven approach to data center optimization position the region at the forefront of innovation in thermal management solutions, reinforcing its leadership in the global market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 18.3% |

In 2024, the solution segment accounted 70% share, generating USD 900 million. This segment includes all core hardware such as pumps, heat exchangers, immersion tanks, filters, and fluid distribution units. These elements together form the structural foundation needed to implement immersion cooling effectively. These systems not only support high thermal loads but also outperform traditional cooling methods in heat dissipation, allowing data centers to accommodate more servers within the same footprint. Additionally, immersion cooling offers better space utilization and reduces the operational energy required to keep hardware at optimal temperatures, supporting long-term sustainability goals and cost savings across large-scale facilities.

The hyperscale data centers segment generated USD 400 million in 2024. These large-scale infrastructure hubs are designed to handle massive volumes of data processing and require maximum operational efficiency. Immersion cooling has become increasingly vital in these environments due to its ability to support dense configurations while minimizing energy consumption. With extensive deployments of compute-intensive workloads, hyperscale operators seek to reduce their carbon footprint and optimize thermal performance. As the demand for scalable and high-efficiency systems grows, immersion cooling continues to be integrated into new facility designs and retrofitted into existing structures to improve performance metrics and reduce downtime.

United States Data Center Immersion Cooling Market held 72% share and generated USD 372.9 million in 2024. The country remains at the forefront of immersion cooling deployment, driven by a high concentration of technology firms and early adopters of innovative infrastructure. The demand for efficient and scalable cooling methods has grown significantly alongside the expansion of data centers run by cloud providers and tech companies. With the country hosting a substantial number of hyperscale operators and being home to many of the world's largest data processing facilities, investment in immersion systems continues to surge.

Leading players in the Global Data Center Immersion Cooling Market include Vertiv, Green Revolution Cooling, Bitfury Group, Asperitas, LiquidCool Solutions, Submer, and Fujitsu. To strengthen their market position, companies in the data center immersion cooling industry are focusing on targeted strategies such as expanding product portfolios to include modular and scalable immersion systems suited for different data center sizes and densities. Many firms are enhancing R&D efforts to optimize fluid types, improve thermal conductivity, and extend component lifespan. Collaboration with cloud providers, colocation centers, and enterprise clients is a major tactic, enabling customized solutions tailored to specific workload needs. Several manufacturers are also prioritizing international expansion, especially in regions with emerging high-performance computing demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Cooling technique

- 2.2.4 Cooling fluid

- 2.2.5 Organization size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in rack power density and thermal challenges

- 3.2.1.2 Sustainability and reduction in PUE

- 3.2.1.3 Deployment in hyperscale and high-performance computing environments

- 3.2.1.4 Increasing interest from colocation and enterprise data centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs and design complexity

- 3.2.2.2 Material compatibility and maintenance issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in AI/ML workloads and supercomputing sectors

- 3.2.3.2 Growing edge data center deployments in harsh environments

- 3.2.3.3 Fluid innovation and two-phase systems adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Consumer behavior analysis

- 3.11.1 Preference for OEM vs third-party immersion cooling systems

- 3.11.2 Preference for CAPEX vs OPEX models (full system purchase vs immersion-as-a-service models)

- 3.12 Analysis of aftermarket and service trends

- 3.12.1 Maintenance contracts and performance SLAs for immersion cooling systems

- 3.12.2 Coolant replacement cycles, fluid degradation monitoring, and hardware upgrades

- 3.12.3 Evaluation of OEM vs third-party service and support providers for immersion tanks and components

- 3.13 Analysis of digitalization and automation trends

- 3.13.1 Rise of smart immersion systems with IoT-based thermal and performance monitoring

- 3.13.2 Role of AI/ML in predictive fluid management, system optimization, and fault detection

- 3.13.3 Automation in immersion cooling system deployment, startup, and thermal balancing

- 3.13.4 Integration with DCIM (Data Center Infrastructure Management) and telemetry platforms

- 3.13.5 Digital twin applications for simulating immersion cooling performance and planning retrofits

- 3.14 Case studies and real-world deployments across hyperscale, colocation, HPC, and edge environments

- 3.15 Analysis of impact of renewable integration on data center immersion cooling design

- 3.15.1 Immersion system efficiency in hybrid energy setups (grid + solar + battery)

- 3.15.2 System-level implications of DC-powered vs AC-powered immersion infrastructure

- 3.15.3 Compatibility of immersion cooling with backup storage systems (e.g., lithium-ion, flow batteries)

- 3.15.4 Role of smart inverters and dynamic energy routing in cooling load management

- 3.15.5 Case examples of immersion-cooled, net-zero or low-PUE data centers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Analysis of brand comparison

- 4.7.1 Brand recognition

- 4.7.2 Partnership ecosystem

- 4.7.3 Customer service

- 4.7.4 Distribution network strength

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Cooling fluids

- 5.2.2 Cooling racks/modules

- 5.2.3 Filters

- 5.2.4 Pumps

- 5.2.5 Heat exchangers

- 5.2.6 Others

- 5.3 Service

- 5.3.1 Installation & maintenance

- 5.3.2 Training & consulting

Chapter 6 Market Estimates & Forecast, By Cooling Technique, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Single phase cooling

- 6.3 Two-phase cooling

Chapter 7 Market Estimates & Forecast, By Cooling Fluid, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Mineral oil

- 7.3 Synthetic fluid

- 7.4 Fluorocarbons-based fluid

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Hyperscale

- 9.3 Supercomputing

- 9.4 Enterprise HPC

- 9.5 Cryptocurrency

- 9.6 Edge/5G computing

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Russia

- 10.3.8 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Chile

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Asperitas

- 11.1.2 Dell Technologies

- 11.1.3 Fujitsu

- 11.1.4 Green Revolution Cooling (GRC)

- 11.1.5 Hewlett Packard Enterprise (HPE)

- 11.1.6 Intel

- 11.1.7 Lenovo

- 11.1.8 Submer

- 11.1.9 Supermicro

- 11.1.10 Vertiv

- 11.2 Regional players

- 11.2.1 AMAX

- 11.2.2 Asetek

- 11.2.3 Bitfury Group

- 11.2.4 DCX Liquid Cooling Company

- 11.2.5 Gigabyte Technology

- 11.2.6 Inspur

- 11.2.7 LiquidCool Solutions

- 11.2.8 Midas Immersion Cooling

- 11.2.9 Nautilus Data Technologies

- 11.2.10 Schneider Electric (in collaboration/PoC phase)

- 11.3 Emerging players

- 11.3.1 E3 NV

- 11.3.2 ExaScaler

- 11.3.3 Hypertec

- 11.3.4 Iceotope

- 11.3.5 JetCool

- 11.3.6 QCT (Quanta Cloud Technology)

- 11.3.7 TAICHI Immersion Cooling

- 11.3.8 Teimmers

- 11.3.9 TMGcore

- 11.3.10 Zutacore