PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740964

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740964

Off Grid Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

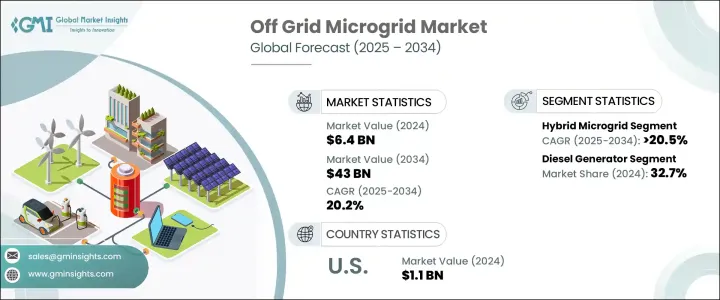

The Global Off Grid Microgrid Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 43 billion by 2034, driven by the rising need for continuous, uninterrupted power across various sectors. Critical infrastructures like military bases and emergency response centers increasingly prioritize energy security, as grid outages and cyber-attacks pose serious operational threats. Remote and hard-to-reach areas, where fuel supply lines are often unreliable and costly, push the demand for off-grid microgrids as a cost-effective and sustainable alternative. The rising frequency of climate-related disasters is intensifying the need for energy systems that can operate independently from centralized power grids.

Global interest in decentralized, resilient energy solutions is growing rapidly, especially in underserved regions that historically lacked access to reliable electricity. Off-grid microgrids are emerging as a key solution to bridge energy gaps, enable disaster recovery, and support critical missions without reliance on vulnerable grid networks. As the world continues to shift towards clean energy, the market is benefitting from heightened investment in electrification initiatives, renewable energy integration, and sustainable development goals. The expanding capabilities of smart control systems, advanced energy storage, and hybrid power setups are enhancing microgrid performance, making them more accessible and appealing to a broader set of users ranging from rural communities to major industrial facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $43 Billion |

| CAGR | 20.2% |

As the industry grows, advancements in renewable energy technologies are further accelerating adoption. Increasing investments in sustainable electrification projects are making off-grid microgrids more affordable and accessible worldwide. Systems powered by renewable sources like solar and wind are enhancing energy reliability and resilience, especially in remote and disaster-prone regions. The global shift toward sustainability is pushing the demand for secure, independent energy solutions that operate even when traditional grids fail.

The AC microgrid segment is expected to generate USD 21.4 billion by 2034, fueled by the rising demand for reliable and efficient energy systems. AC microgrids have become the preferred option due to their seamless integration with existing infrastructure and widespread compatibility with residential, commercial, and industrial AC loads. Recent innovations in inverter and control technologies are boosting the operational efficiency of AC microgrids, making them an even more attractive choice for both new installations and upgrades of older systems.

In addition to AC microgrids, the combined heat and power (CHP) segment captured a 19.1% share in 2024. CHP systems, which produce electricity and heat from a single energy source, deliver superior energy efficiency and are favored by industries and commercial operations aiming to cut operational costs and reduce environmental impact. By capturing and reusing waste heat, these systems maximize output and sustainability.

The U.S. Off Grid Microgrid Market generated USD 1.1 billion in 2024, backed by growing demand for energy independence and rising investments in renewable infrastructure. Adoption is soaring in remote and underserved areas where traditional grid access remains unreliable. Critical sectors like the military, emergency response, and rural communities are increasingly relying on off-grid microgrids to meet energy security goals while businesses and governments align their sustainability initiatives with long-term resilience strategies.

Key players in the Global Off Grid Microgrid Market include ALEC Energy, ABB, Eaton, General Electric, Enphase Energy, Generac Power Systems, HOMER Energy, Hitachi Energy, OutBack Power, Siemens, SMA Solar Technology, Schneider Electric, Trojan Battery Company, Tesla, and Tata Power Solar Systems. Companies are strengthening their market positions by integrating renewable energy sources, investing in advanced energy storage, and enhancing system scalability and flexibility. Collaborations with local governments and businesses are also helping accelerate deployment, improve funding access, and promote the widespread adoption of off-grid microgrids.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grid Type, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 AC

- 5.3 DC

- 5.4 Hybrid

Chapter 6 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Diesel generators

- 6.3 Natural gas

- 6.4 Solar PV

- 6.5 CHP

- 6.6 Others

Chapter 7 Market Size and Forecast, By Storage Device, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Lithium-ion

- 7.3 Lead acid

- 7.4 Flow battery

- 7.5 Flywheels

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 Educational institutes

- 8.4 Military

- 8.5 Utility

- 8.6 Industrial/ commercial

- 8.7 Remote

- 8.8 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Russia

- 9.3.5 Spain

- 9.3.6 Italy

- 9.3.7 Denmark

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Middle East and Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.5.4 Iran

- 9.5.5 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 ALEC Energy

- 10.3 Eaton

- 10.4 Enphase Energy

- 10.5 General Electric

- 10.6 Generac Power Systems

- 10.7 Hitachi Energy

- 10.8 HOMER Energy

- 10.9 OutBack Power

- 10.10 Schneider Electric

- 10.11 Siemens

- 10.12 SMA Solar Technology

- 10.13 Tesla

- 10.14 Trojan Battery Company

- 10.15 Tata Power Solar Systems