PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667150

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667150

Super Junction MOSFET Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

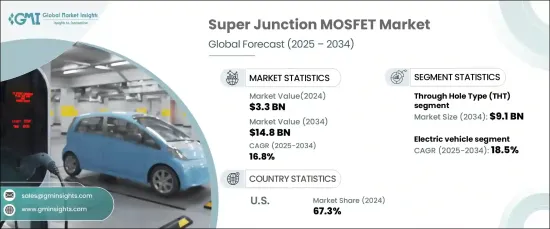

The Global Super Junction MOSFET Market, valued at USD 3.3 billion in 2024, is anticipated to expand at a CAGR of 16.8% from 2025 to 2034. This rapid growth is largely attributed to increasing emphasis on energy efficiency across various industries. Super junction MOSFETs play a crucial role in minimizing conduction and switching losses, enhancing overall system efficiency. These devices are indispensable in energy-intensive sectors such as renewable energy, industrial automation, and electric vehicles, where improving power density and reducing energy consumption are vital. The growing adoption of energy-efficient technologies in power electronics, along with advancements in high-voltage applications, continues to propel the demand for super junction MOSFETs. Industries such as telecommunications, automotive, and data centers are increasingly deploying these components to support efficient energy conversion, reliable performance, and compact system designs. The market's trajectory reflects the need for advanced power solutions in line with global trends toward sustainable and energy-efficient innovations.

The market is segmented by type into Through Hole Type (THT) and Surface Mount Type (SMT). The THT segment is forecasted to reach USD 9.1 billion by 2034, driven by its durability and ability to handle high power dissipation. These MOSFETs are ideal for demanding applications requiring mechanical strength and robust thermal management. Common use cases include power supplies, automotive systems, and industrial equipment. Despite the shift toward miniaturized technologies, THT MOSFETs remain vital for high-current applications in harsh environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 16.8% |

Conversely, SMT MOSFETs are gaining traction for their compact design and superior performance in high-frequency scenarios. These components excel in applications where space efficiency and heat dissipation are critical, such as consumer electronics, telecommunications, and renewable energy systems. SMT devices reduce parasitic inductance and improve circuit performance, making them suitable for modern, high-density electronic systems that require advanced thermal management.

On the application front, super junction MOSFETs are extensively used in energy and power systems, inverters, industrial setups, and electric vehicles. The electric vehicle segment is expected to exhibit the fastest growth, with a projected CAGR of 18.5% between 2025 and 2034. These MOSFETs enhance the energy efficiency of EV powertrains, charging stations, and battery management systems, optimizing overall vehicle performance.

In North America, the United States dominates the market, accounting for 67.3% of regional revenue in 2024. Growth is fueled by investments in renewable energy, EV infrastructure, and industrial automation, alongside government initiatives promoting clean energy and stringent efficiency regulations. These factors create a robust ecosystem for the continued advancement and adoption of super junction MOSFET technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for energy efficiency

- 3.6.1.2 Rapid growth in power electronics applications

- 3.6.1.3 Advancements in semiconductor technology

- 3.6.1.4 Growing automotive sector and shift towards renewable energy system

- 3.6.1.5 Expansion in the production of uninterruptible power systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing costs and complex production processes

- 3.6.2.2 Technological advancements and rapid innovation cycles

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Through hole type

- 5.3 Surface mount type

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Energy and power

- 6.3 Consumer electronics

- 6.4 Inverter and UPS

- 6.5 Electric vehicle

- 6.6 Industrial system

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alpha and Omega Semiconductor

- 8.2 Diodes Incorporated

- 8.3 Fuji Electric

- 8.4 Infineon Technologies

- 8.5 KEC Corporation

- 8.6 Microchip Technology

- 8.7 Mitsubishi Electric

- 8.8 Nantong Hornby Electronic Co., Ltd.

- 8.9 Nexperia

- 8.10 NXP Semiconductors

- 8.11 ON Semiconductor

- 8.12 OS ELECTRONICS Co., Ltd.

- 8.13 Renesas Electronics

- 8.14 Richtek Technology Corporation

- 8.15 ROHM Semiconductor

- 8.16 SemiHow

- 8.17 STMicroelectronics

- 8.18 Texas Instruments

- 8.19 Toshiba Corporation

- 8.20 Vishay Intertechnology