PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667144

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667144

DC Vacuum Insulated Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

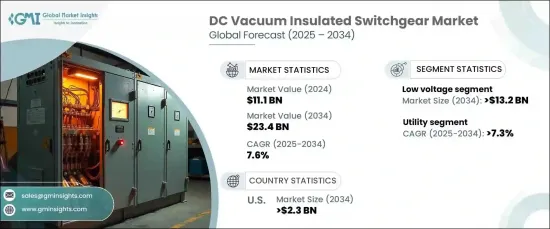

The Global DC Vacuum Insulated Switchgear Market reached USD 11.1 billion in 2024 and is set to grow at a compelling CAGR of 7.6% between 2025 and 2034. This growth trajectory reflects the transformative changes reshaping the energy landscape, driven by mounting investments in renewable energy integration and the surging adoption of electrified transportation systems. These advanced switchgears, known for their enhanced safety features, compact design, and exceptional ability to manage high-voltage DC applications, are rapidly becoming indispensable in the modernization of energy grids. As nations transition to cleaner and more sustainable energy sources, the demand for efficient and reliable power distribution solutions is escalating, positioning DC vacuum insulated switchgear as a cornerstone of this evolution.

The increasing deployment of High Voltage Direct Current (HVDC) transmission systems is a significant catalyst for market growth. HVDC networks, designed to minimize energy losses during long-distance power transmission, are ideal for expansive renewable energy projects and cross-border electricity exchange. These systems are instrumental in addressing global energy needs, particularly as governments and industries prioritize sustainability and operational efficiency. Additionally, innovations in vacuum insulation technology have greatly enhanced the reliability, lifespan, and cost-effectiveness of these switchgears, reducing maintenance demands and bolstering their appeal across industrial, utility, and commercial applications. Regulatory policies in regions like Asia-Pacific and Europe further amplify their adoption by encouraging grid sustainability and energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.1 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 7.6% |

By voltage, the low-voltage segment is expected to generate USD 13.2 billion by 2034, driven by its expanding applications in renewable energy systems, electric vehicle (EV) charging networks, and industrial automation. Low-voltage DC switchgears are particularly valued for their compact size, cost efficiency, and operational reliability, making them ideal for dense urban infrastructures and smart city projects. Their scalability and adaptability to meet evolving energy demands make them a preferred solution for modern power distribution systems, especially as cities strive for smarter, more efficient energy management.

The utility sector, forecasted to grow at a CAGR of 7.3% through 2034, underscores its critical role in grid modernization and renewable energy integration. Utilities are increasingly turning to vacuum insulated switchgears for their unmatched reliability, safety features, and compact footprint. These systems support efficient power distribution while minimizing energy losses, aligning perfectly with the rising adoption of solar and wind energy, which often rely on DC transmission for optimal performance.

In the United States, the DC vacuum insulated switchgear market is poised to generate USD 2.3 billion by 2034. Investments in urbanization, grid modernization, and renewable energy infrastructure are key drivers of this growth. With their space-saving design, robust high-voltage handling capacity, and enhanced safety features, these switchgears are ideally suited for modern urban environments. Industries upgrading outdated electrical systems increasingly recognize the importance of these technologies in boosting energy efficiency and minimizing maintenance requirements, cementing their role in the next generation of energy solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Strategic dashboard

- 3.2 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, ‘000 Units)

- 4.1 Key trends

- 4.2 Low

- 4.3 Medium

- 4.4 High

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial & industrial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Turkey

- 6.5.4 South Africa

- 6.5.5 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Bharat Heavy Electricals

- 7.3 CG Power and Industrial Solutions

- 7.4 E + I Engineering

- 7.5 Eaton

- 7.6 Fuji Electric

- 7.7 General Electric

- 7.8 HD Hyundai Electric

- 7.9 Hitachi

- 7.10 Hyosung Heavy Industries

- 7.11 Lucy Group

- 7.12 Mitsubishi Electric

- 7.13 Ormazabal

- 7.14 Schneider Electric

- 7.15 Siemens

- 7.16 Skema

- 7.17 Toshiba