PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699364

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699364

Commercial Diesel Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

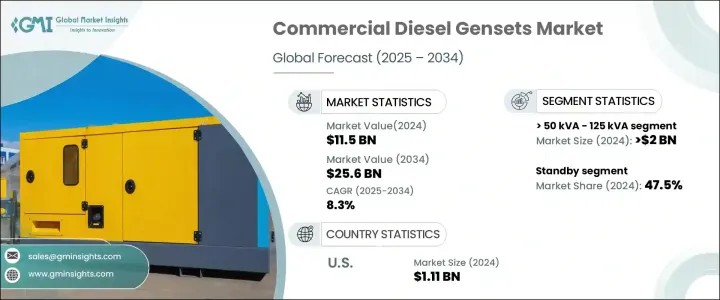

The Global Commercial Diesel Gensets Market reached USD 11.5 billion in 2024 and is projected to expand at a CAGR of 8.3% from 2025 to 2034. The rising need for reliable and uninterrupted power supply across industries such as construction, healthcare, manufacturing, and telecommunications is a major driver of market growth. As businesses strive to maintain operational continuity, the demand for backup power solutions continues to surge. Emerging economies, in particular, are witnessing rapid infrastructure development, fueling the adoption of diesel gensets. The market is also experiencing a growing reliance on decentralized power generation, further contributing to its expansion.

The increasing frequency of power outages caused by aging electrical grids, extreme weather events, and surging electricity demand is pushing industries to seek alternative power solutions. In regions with unreliable grid infrastructure, diesel gensets play a crucial role in ensuring business continuity. Additionally, commercial establishments such as data centers, hotels, and hospitals are investing in high-performance gensets to mitigate risks associated with power failures. The ability of these gensets to provide emergency power and support critical applications is significantly boosting their adoption. The commercial sector is expected to maintain steady demand as businesses and institutions recognize the long-term cost benefits and operational efficiency of diesel gensets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 8.3% |

Environmental regulations are shaping market dynamics, driving manufacturers to innovate and develop cleaner, more fuel-efficient gensets. Stricter emission norms, including the Tier 4 regulations enforced in several regions, have led to the production of advanced diesel gensets with reduced emissions. These innovations are helping businesses comply with sustainability goals while ensuring reliable power generation. The integration of smart monitoring systems and automation features is further enhancing the appeal of modern diesel gensets, allowing users to optimize fuel consumption and reduce operational costs.

The market for commercial diesel gensets with a power rating of <= 50 kVA is forecasted to grow at a CAGR of 8% through 2034. This growth is largely driven by the rising demand for cost-effective and dependable backup power solutions. As industries and small businesses become more aware of the importance of an uninterrupted power supply, the deployment of these gensets across diverse applications is increasing. Their affordability and efficiency make them a preferred choice for small commercial setups and temporary power needs at construction sites.

The peak shaving segment is also expected to expand at a CAGR of 8% through 2034, driven by the challenge of managing peak demand in electricity consumption. With industries and commercial facilities facing significant peak demand charges and strains on the power grid, diesel gensets are proving to be an effective solution for reducing electricity costs. These gensets help businesses optimize energy consumption, lower utility expenses, and improve overall grid reliability.

The US commercial diesel genset market generated USD 1.11 billion in 2024, driven by the increasing challenges faced by electrical grids in handling higher demand loads. The aftermath of severe hurricanes, including Hurricane Irma and Hurricane Harvey, has further underscored the importance of resilient backup power solutions. Additionally, the expansion of data centers and the continuous development of educational institutions across the country are fueling demand for commercial diesel gensets. Businesses and public facilities are prioritizing reliable energy solutions to prevent disruptions, further solidifying the market's upward trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Healthcare

- 6.4 Data centers

- 6.5 Educational institutions

- 6.6 Government centers

- 6.7 Hospitality

- 6.8 Retail sales

- 6.9 Real estate

- 6.10 Commercial complex

- 6.11 Infrastructure

- 6.12 Others

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Standby

- 7.3 Peak shaving

- 7.4 Prime/continuous

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.4.11 Myanmar

- 8.4.12 Bangladesh

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 Ashok Leyland

- 9.3 Atlas Copco

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 Deere & Company

- 9.7 FG Wilson

- 9.8 Generac Power Systems, Inc.

- 9.9 HIMOINSA

- 9.10 Huu Toan

- 9.11 J C Bamford Excavators Ltd.

- 9.12 Kirloskar Oil Engines Limited

- 9.13 Kohler Co.

- 9.14 Mahindra Powerol

- 9.15 Mitsubishi Heavy Industries, Ltd.

- 9.16 Powerica Limited

- 9.17 Rolls-Royce plc

- 9.18 SUDHIR POWER LTD.

- 9.19 SUPERNOVA GENSET

- 9.20 Wartsila