PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667018

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667018

Fiber Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

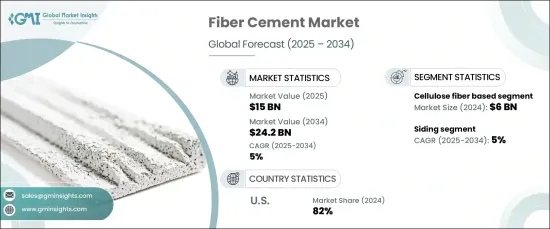

The Global Fiber Cement Market, valued at USD 15 billion in 2024, is set for substantial growth with an anticipated CAGR of 5% from 2025 to 2034. This positive trajectory is being driven by the increasing demand for sustainable, durable construction materials, especially as industries shift toward eco-friendly alternatives. Fiber cement, recognized for its strength, versatility, and low environmental impact, has garnered widespread adoption across diverse sectors, including residential, commercial, and industrial construction. As consumers and construction professionals continue to prioritize green building practices, fiber cement's popularity has surged. Its ability to combine cost-effectiveness with exceptional performance in harsh weather conditions makes it a go-to solution for modern construction projects. In addition to being durable, fiber cement also offers significant advantages, such as low maintenance and long-lasting protection against the elements, solidifying its position as a prime choice for eco-conscious builders.

The market is divided by product type, with key categories including cellulose fiber-based, synthetic fiber-based, mineral fiber-based, and others. Among these, the cellulose fiber-based segment is expected to lead, generating approximately USD 6 billion in 2024. This segment is projected to grow at a CAGR of 5.2% over the forecast period, benefiting from the rising demand for renewable and biodegradable materials. Made from plant-derived fibers, cellulose-based fiber cement is gaining traction due to its eco-friendly nature, making it particularly appealing in an age when sustainability is becoming a top priority in construction. The cellulose fibers' recyclability, biodegradability, and renewable properties continue to contribute to the segment's growth as the building industry looks to reduce its carbon footprint.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15 Billion |

| Forecast Value | $24.2 Billion |

| CAGR | 5% |

When it comes to applications, fiber cement is used in siding, roofing, molding and trim, flooring, and more. Of these, the siding segment is the most prominent, accounting for approximately 40% of the total market share in 2024. With a growth rate expected to match the overall market at a CAGR of 5%, fiber cement siding is becoming the preferred option in areas prone to extreme weather conditions. Renowned for its durability and resistance to rot, termites, and moisture, fiber cement siding provides an excellent alternative to traditional wood, which requires frequent maintenance and treatment. Builders and homeowners are increasingly opting for fiber cement siding due to its long lifespan and low maintenance needs, making it an ideal solution for sustainable, weather-resistant building practices.

The U.S. market for fiber cement is one of the largest, holding an impressive 82% share in 2024. This strong market presence is attributed to the rising demand for green building materials as more projects aim for sustainability certifications. Fiber cement is seen as a more eco-friendly alternative to carbon-heavy materials like wood and vinyl, thanks to its composition of natural materials such as sand, cement, and cellulose fibers. The material's recyclability, lower environmental impact during production, and longevity are key selling points in the growing trend of green construction. The push for eco-conscious construction is expected to keep driving demand for fiber cement, ensuring its continued growth and widespread adoption in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose fiber based

- 5.3 Synthetic fiber based

- 5.4 Mineral fiber based

- 5.5 Others (natural fiber based, etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Siding

- 6.3 Roofing

- 6.4 Molding & trim

- 6.5 Flooring

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ArcelorMittal

- 10.2 Boral Limited

- 10.3 China National Building Material

- 10.4 CSR Limited

- 10.5 Etex Group

- 10.6 Everest Industries Limited

- 10.7 Finolex Industries

- 10.8 Hume Cement

- 10.9 James Hardie Industries

- 10.10 Mahaphant Fibre Cement Public

- 10.11 Nichiha Corporation

- 10.12 Pioneer Cement Limited

- 10.13 Saint-Gobain

- 10.14 Siam Cement Group

- 10.15 Toray Industries