PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1578769

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1578769

Research Report on China's Uranium Resource Import 2024-2033

In recent years, China's nuclear power industry has developed rapidly. As of June 30, 2024, China had 56 commercial nuclear power units in operation, with a total installed capacity of approximately 58.2 million kilowatts. By the end of 2023, there were 26 nuclear power units under construction, with a total installed capacity of 30.3 million kilowatts. China has maintained the world's largest installed capacity of nuclear power units under construction for several consecutive years. As China's installed nuclear power capacity increases, the country's demand for uranium resources continues to rise. Due to the scarcity of domestic uranium resources, with total reserves of no more than 200,000 tons and high extraction costs, China needs to import large quantities of uranium each year.

INFOGRAPHICS

In 2023, China imported 13,123.7 tons of uranium resources, a year-on-year decrease of 3.6%, while the import value reached 1.94 billion USD, a year-on-year increase of 47.5%. According to CRI's analysis, from January to July 2024, China imported 9,517.8 tons of uranium resources, a year-on-year decrease of 4.8%, with an import value of 1.55 billion USD, a year-on-year increase of 28.7%.

From 2018 to 2023, the average import price of uranium resources fluctuated significantly. In 2019, the average import price of uranium in China was 125.2 USD per kilogram, a year-on-year increase of 38.3%. According to CRI's analysis, from 2019 to 2021, the average import price of uranium resources continuously declined, reaching 96.5 USD per kilogram in 2021. In 2022, the average import price of uranium resources surged to 147.7 USD per kilogram, a 53% increase compared to 2021. In 2023, the average import price slightly decreased to 137.7 USD per kilogram.

China primarily imports two types of uranium resources: natural uranium and enriched U-235 uranium. In 2023, China imported 16,866.8 tons of natural uranium, accounting for 96.6% of the total import volume, with an import value of 1.87 billion USD, representing 78.0% of the total import value. In 2023, China imported natural uranium from four countries and regions. According to CRI's analysis, Kazakhstan was China's largest source of natural uranium imports by volume. In 2023, China imported 11,132.5 tons of natural uranium from Kazakhstan, accounting for 66.0% of the total natural uranium imports, with an import value of 1.27 billion USD, accounting for 67.8% of the total natural uranium import value.

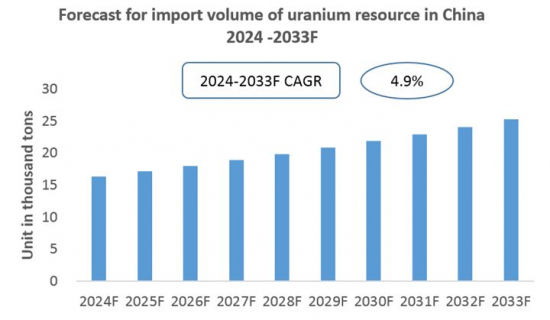

China's domestic uranium resources are insufficient, leading to a heavy reliance on imports. Nuclear power generation in China accounts for about 5% of the country's total electricity generation, indicating significant room for growth. CRI predicts that from 2024 to 2033, as China's nuclear power installed capacity continues to increase, the demand for uranium resources will keep rising, and China's uranium resources imports are expected to grow steadily.

Topics Covered:

China's Uranium Resource Imports and Major Sources, 2018-2023

Key Drivers and Market Opportunities for China's Uranium Resource Imports

What are the main drivers, challenges, and opportunities for China's uranium resource imports during the forecast period of 2024-2033?

Which countries are the major sources of China's uranium resource imports, and what are their export size and average price?

What is the expected revenue for China's uranium resource import market during the forecast period of 2024-2033?

What strategies have the key players in the market implemented to increase their market share in this industry?

Which segment of the Chinese uranium resource import market is expected to dominate the market by 2033?

What are the competitive advantages of the key players in China's uranium resource import market?

What is the impact of economic uncertainty on China's uranium resource imports?

What are the main limiting factors restricting the growth of China's uranium resource imports?

Table of Contents

- 1. 2018-2023 China's Uranium Resources Import Analysis

- 1.1. China's Uranium Resources Import Scale

- 1.1.1. Import Volume of Uranium Resources in China

- 1.1.2. Import Value of Uranium Resources in China

- 1.1.3. Import Price of Uranium Resources in China

- 1.1.4. Apparent Consumption of Uranium Resources in China

- 1.1.5. Import Dependence of Uranium Resources in China

- 1.2. Major Import Sources of Uranium Resources in China

- 1.2.1. By Import Volume

- 1.2.2. By Import Value

2. China's Natural Uranium Import Analysis, 2018-2023

- 2.1. Natural Uranium Import Volume

- 2.2. Natural Uranium Import Volume

- 2.3. Natural Uranium Import Prices

- 2.4. Import Dependence of Natural Uranium

- 2.5. Import Analysis of Natural Uranium by Type

- 2.5.1. Natural Uranium Imports by Type

- 2.5.2. Import Value of Natural Uranium by Category

- 2.5.3. Import Prices of Natural Uranium by Category

- 2.6. Sources of Natural Uranium Imports

- 2.6.1. By Import Volume

- 2.6.2. By Import Value

- 3. 2018-2023 China Import Analysis of Enriched Uranium

- 3.1. Import Volume of Enriched Uranium

- 3.2. Import Value of Enriched Uranium

- 3.3. Import Price of Enriched Uranium

- 3.4. Import Dependence of Enriched Uranium

- 3.5. Analysis of Various Types of Enriched Uranium Imports

- 3.5.1. Enriched Uranium Imports by Type

- 3.5.2. Import Value of Enriched Uranium by Type

- 3.5.3. Import Prices of Various Types of Enriched Uranium

- 3.6. Import Sources of Enriched Uranium

- 3.6.1. By Import Volume

- 3.6.2. By Import Value

- 4. 2018-2023 Analysis of Major Import Sources of Uranium Resources in China

- 4.1. Analysis of Uranium Resources Imports from Kazakhstan

- 4.2. Analysis of Uranium Resources Imports from Namibia

- 4.3. Analysis of Uranium Resources Imports from Uzbekistan

- 4.4. Analysis of Uranium Resources Imports from the Russian Federation

- 4.5. Analysis of Uranium Imports into Germany

- 4.6. Analysis of Other Uranium Resources Imports

5. China's Uranium Resource Import Outlook 2024-2033

- 5.1. Factors Affecting China's Uranium Resource Imports

- 5.1.1. Favorable Factors

- 5.1.2. Unfavorable Factors

- 5.2. China's Uranium Resource Import Forecast, 2024-2033

- 5.2.1. Import Volume Forecast

- 5.2.2. Forecast of Major Import Sources

- 5.2.3. Forecast of Major Imported Uranium Resources Types

Disclaimer

Service Guarantees

LIST OF CHARTS

- Chart Import Volume of Uranium Resources in China, 2018-Jul 2024

- Chart Import Value of Uranium Resources in China, 2018-Jul 2024

- Chart Average Import Price of Uranium Resources in China, 2018-Jul 2024

- Chart Operation of Nuclear Power in China, 2018-Jun 2024

- Chart China's Electricity Production Statistics from Operating Nuclear Power Units, Jan-Dec 2023

- Chart China's Electricity Production Statistics from Operating Nuclear Power Units, Jan-Jun 2024

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2018

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2019

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2020

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2021

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2022

- Chart Major Sources of China's Uranium Resource Imports by Volume, 2023

- Chart Major Sources of China's Uranium Resource Imports by Value, 2018

- Chart Major Sources of China's Uranium Resource Imports by Value, 2022

- Chart Major Sources of China's Uranium Resource Imports by Value, 2023

- Chart Import Volume of Natural Uranium in China, 2018-2023

- Chart Import Value of Natural Uranium in China, 2018-2023

- Chart Average Import Price of Natural Uranium in China, 2018-2023

- Chart Major Sources of Natural Uranium Imports in China by Volume, 2023

- Chart Major Sources of Natural Uranium Imports in China by Value, 2023

- Chart Import Volume of Enriched Uranium in China, 2018-2023

- Chart Import Value of Enriched Uranium in China, 2018-2023

- Chart Average Import Price of Enriched Uranium in China, 2018-2023

- Chart Major Sources of Enriched Uranium Imports in China by Volume, 2023

- Chart Major Sources of Enriched Uranium Imports in China by Value, 2023

- Chart Import Volume of Uranium Resources from Kazakhstan, 2018-2023

- Chart Import Value of Uranium Resources from Kazakhstan, 2018-2023

- Chart Average Import Price of Uranium Resources from Kazakhstan, 2018-2023

- Chart Import Volume of Uranium Resources from Namibia, 2018-2023

- Chart Import Value of Uranium Resources from Namibia, 2018-2023

- Chart Average Import Price of Uranium Resources from Namibia, 2018-2023

- Chart Import Volume of Uranium Resources from Uzbekistan, 2018-2023

- Chart Import Value of Uranium Resources from Uzbekistan, 2018-2023

- Chart Average Import Price of Uranium Resources from Uzbekistan, 2018-2023

- Chart Size of Imported Natural Uranium from the Russian Federation, 2018-2023

- Chart Average Import Price of Natural Uranium from the Russian Federation, 2018-2023

- Chart Size of Imported Enriched Uranium from the Russian Federation, 2018-2023

- Chart Average Import Price of Enriched Uranium from the Russian Federation, 2018-2023

- Chart Size of Imported Depleted Uranium from Germany, 2018-2023

- Chart Average Import Price of Depleted Uranium from Germany, 2018-2023

- Chart Forecast for Natural Uranium Import Volume in China, 2024-2033

- Chart Forecast for Enriched Uranium Import Volume in China, 2024-2033

- Chart Forecast for Uranium Resource Import Volume in China, 2024-2033