PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1578767

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1578767

Vietnam Silicon Steel Import Research Report 2024-2033

Silicon Steel (E-steel, lamination steel, electrical steel, silicon electrical steel, relay steel, transformer steel) is a type of electrical steel with a high silicon content, primarily used as a soft magnetic material in power industry equipment such as transformers, generators, and electric motors. Its high silicon content gives it excellent magnetic properties, such as low iron loss and high magnetic permeability, making it widely applicable in power equipment. Depending on the silicon content and manufacturing process, electrical steel is categorized into two main types non-oriented electrical steel and grain-oriented electrical steel. Non-oriented electrical steel is generally used to manufacture equipment like electric motors and generators, while grain-oriented electrical steel is mainly used in transformer cores due to its superior magnetic performance in a specific direction.

INFOGRAPHICS

Electrical steel is a special alloy, suitable for electromagnetic equipment cores such as motors, generators, and transformers, as it reduces power loss. It is an iron alloy with silicon as the main added element (replacing carbon). The specific formulation is customized according to the required magnetic properties, typically featuring advantages such as small hysteresis area, low power loss per cycle, low core loss, and high permeability.

In international trade, silicon steel products are rolled flat materials, distinguished by a width of 600 millimeters.

The upstream and downstream industries of silicon steel are closely related. The upstream sectors include ore mining and smelting, especially the supply of high-purity iron ore and materials containing silicon elements. The downstream industries primarily include the power equipment manufacturing sector, such as transformers, generators, and electric motors. These industries have significant demand for silicon steel, particularly in the context of expanding and upgrading power infrastructure, which has driven a continuous increase in silicon steel demand. Globally, major silicon steel producers include Japan's Nippon Steel, Korea's POSCO, and China's Baosteel Group.

In Vietnam, the application of silicon steel is mainly concentrated in the machinery manufacturing and power equipment sectors. According to CRI, in recent years, Vietnam's industrialization process has accelerated, with the government heavily investing in infrastructure development and upgrading the domestic power transmission and distribution network. Meanwhile, the increased demand for efficient electric motors and generators in industries such as electronics, household appliances, and automobiles has further boosted silicon steel demand.

However, Vietnam's local production capacity is limited due to lack of the necessary steel industry foundation, technology, and equipment, especially in producing grain-oriented silicon steel, which requires advanced technical standards. Also, Vietnam's smelting technology and equipment have not yet fully met these requirements. Furthermore, Vietnam's limited resources of high-quality iron ore are insufficient to support silicon steel production, making large-scale production of such products less cost-effective. Therefore, Vietnam's silicon steel market demand is mainly reliant on imports.

Based on the data from CRI, Vietnam's total silicon steel imports exceeded USD 170 million in 2023, with imports of silicon steel over 600 mm in width accounting for more than USD 100 million. From January to June 2024, Vietnam's cumulative silicon steel imports surpassed USD 90 million, and the import volume is expected to maintain a steady growth rate in the coming years.

CRI indicates that the main sources of Vietnam's silicon steel imports between 2021 and 2024 include China, Japan, and Singapore. Key exporters to Vietnam include companies such as CORE STEEL CO., LTD, SUMITOMO CORPORATION TAIWAN LTD, and BAOSTEEL SINGAPORE PTE LTD.

The primary importers of silicon steel in Vietnam are related to the steel processing, machinery manufacturing sectors, as well as distributors and wholesalers. According to CRI, these companies are mostly foreign-invested enterprises, including JFE SHOJI STEEL VIETNAM CO., LTD, TOSHIBA INDUSTRIAL PRODUCTS ASIA, and POSCO VIETNAM PROCESSING CENTER CO., LTD.

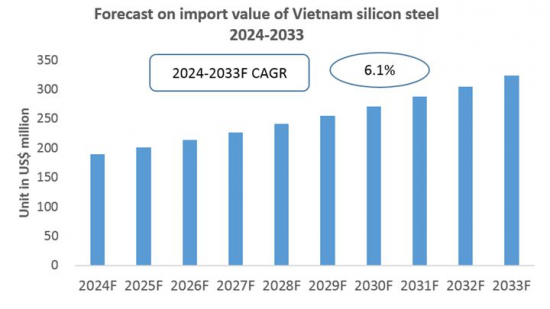

Overall, as Vietnam's economy develops, with rising per capita income levels and an expanding consumer goods market, its related manufacturing industries are also advancing. Silicon steel, as an essential material, holds a significant position in the industrial development of both Vietnam and the global market. CRI forecasts that Vietnam's Silicon steel imports will continue to grow in the coming years.

Topics covered:

The Import and Export of Silicon Steel in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Silicon Steel in Vietnam (2021-2024)

Total Import Value and Percentage Change of Silicon Steel in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Silicon Steel in Vietnam (January-June 2024)

Total Import Value and Percentage Change of Silicon Steel in Vietnam (January-June 2024)

Average Import Price of Silicon Steel in Vietnam (2021-2024)

Top 10 Sources of Silicon Steel Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Silicon Steel in Vietnam and Their Supply Volume

Top 10 Importers of Silicon Steel in Vietnam and Their Import Volume

How to Find Distributors and End Users of Silicon Steel in Vietnam

How Foreign Enterprises Enter the Silicon Steel Market of Vietnam

Forecast for the Import of Silicon Steel in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Silicon Steel Imports Market

2 Analysis of Silicon Steel Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Silicon Steel in Vietnam

- 2.1.1 Import Value and Volume of Silicon Steel in Vietnam

- 2.1.2 Import Prices of Silicon Steel in Vietnam

- 2.1.3 Apparent Consumption of Silicon Steel in Vietnam

- 2.1.4 Import Dependency of Silicon Steel in Vietnam

- 2.2 Major Sources of Silicon Steel Imports in Vietnam

3 Analysis of Major Sources of Silicon Steel Imports in Vietnam (2021-2024)

- 3.1 China

- 3.1.1 Analysis of Vietnam's Silicon Steel Import Volume and Value from China

- 3.1.2 Analysis of Average Import Price

- 3.2 Singapore

- 3.2.1 Analysis of Vietnam's Silicon Steel Import Volume and Value from Singapore

- 3.2.2 Analysis of Average Import Price

- 3.3 Japan

- 3.3.1 Analysis of Vietnam's Silicon Steel Import Volume and Value from Japan

- 3.3.2 Analysis of Average Import Price

- 3.4 South Korea

- 3.5 Taiwan

- 3.6 Indonesia

4 Analysis of Major Suppliers in the Import Market of Silicon Steel in Vietnam (2021-2024)

- 4.1 CORE STEEL CO, LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Silicon Steel Exports to Vietnam

- 4.2 SUMITOMO CORPORATION TAIWAN LTD

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Silicon Steel Exports to Vietnam

- 4.3 BAOSTEEL SINGAPORE PTE LTD

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Silicon Steel Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Silicon Steel Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Silicon Steel Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Silicon Steel Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Silicon Steel Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Silicon Steel Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Silicon Steel Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Silicon Steel Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Silicon Steel in Vietnam (2021-2024)

- 5.1 JFE SHOJI STEEL VIETNAM CO, LTD

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Silicon Steel Imports

- 5.2 TOSHIBA INDUSTRIAL PRODUCTS ASIA

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Silicon Steel Imports

- 5.3 POSCO VIETNAM PROCESSING CENTER CO, LTD

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Silicon Steel Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Silicon Steel Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Silicon Steel Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Silicon Steel Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Silicon Steel Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Silicon Steel Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Silicon Steel Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Silicon Steel Imports

6. Monthly Analysis of Silicon Steel Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Silicon Steel Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Silicon Steel Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Silicon Steel in Vietnam, 2024-2033

Disclaimer

Service Guarantees

List of Charts

- Chart 2021-2024 Import Value and Volume of Silicon Steel in Vietnam

- Chart 2021-2024 Average Import Price of Silicon Steel in Vietnam

- Chart 2021-2024 Import Dependency of Silicon Steel in Vietnam

- Chart Top 10 Import Sources of Silicon Steel in Vietnam (2021-2024)

- Chart Top 10 Import Sources of Silicon Steel in Vietnam (2022)

- Chart Top 10 Import Sources of Silicon Steel in Vietnam (2023)

- Chart Top 10 Import Sources of Silicon Steel in Vietnam (2024)

- Chart Top 10 Suppliers of Silicon Steel Imports in Vietnam (2021-2024)

- Chart Top 10 Suppliers of Silicon Steel Imports in Vietnam (2022)

- Chart Top 10 Suppliers of Silicon Steel Imports in Vietnam (2023)

- Chart Top 10 Suppliers of Silicon Steel Imports in Vietnam (2024)

- Chart Value and Volume of Silicon Steel Imported from China to Vietnam (2021-2024)

- Chart Value and Volume of Silicon Steel Imported from Singapore to Vietnam (2021-2024)

- Chart Value and Volume of Silicon Steel Imported from Japan to Vietnam (2021-2024)

- Chart Value and Volume of Silicon Steel Imported from South Korea to Vietnam (2021-2024)

- Chart Top 10 Importers of Silicon Steel in Vietnam (2021-2024)

- Chart Top 10 Importers of Silicon Steel in Vietnam (2022)

- Chart Top 10 Importers of Silicon Steel in Vietnam (2023)

- Chart Top 10 Importers of Silicon Steel in Vietnam (2024)

- Chart Forecast for the Import of Silicon Steel in Vietnam (2024-2033)