PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1538937

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1538937

Vietnam Ethylene Glycol Import Research Report 2024-2033

Ethylene glycol (EG) is an organic compound that normally appears as a colorless, odorless, and viscous liquid with a sweet taste. Its chemical formula is C2H6O2. Ethylene glycol has a high boiling point, low freezing point, low volatility, hygroscopic properties, and excellent solubility, making it easily mixable with water, alcohol, ether, and other chemical materials in various proportions. It is widely used in industrial and commercial fields.

INFOGRAPHICS

The primary uses of ethylene glycol include the production of antifreeze, coolant, cleaning agents, polyester fibers and resins, and as a vital solvent and raw material in the chemical industry. In antifreeze, ethylene glycol lowers the freezing point of water, preventing car engines from freezing in cold weather. It is an essential raw material in the production of polyester fibers and resins, widely used in the textile, packaging, and plastics industries. Additionally, ethylene glycol is used in hydraulic brake fluid, electrolytic capacitors, paint and plastic solvents, ink, cellophane softeners, plasticizers, solvents, synthetic fibers, and wax manufacturing, demonstrating its diverse applications.

The major producers of ethylene glycol in the Asia-Pacific region and globally include China, the United States, and Saudi Arabia. These countries have strong production capacities and technical advantages. According to CRI, China is the largest producer of ethylene glycol globally, with low production costs and high output, giving it significant competitive strength. Saudi Arabia leverages its abundant oil resources and the extension of its petrochemical industry chain to become one of the world's major ethylene glycol suppliers. The United States leads in ethylene glycol production technology and equipment, producing high-quality products and using shale gas as an alternative raw material, thus capable of exporting to global market.

As Vietnam's economy and manufacturing sector grow, the market size for ethylene glycol in Vietnam is expanding. CRI indicates that ethylene glycol is primarily used in the chemical industry and, notably, in the textile and plastics industries, which are key economic pillars in Vietnam with extensive downstream sectors. The construction, footwear, and auto parts manufacturing industries also have significant demand for ethylene glycol.

However, due to the weak petrochemical industry foundation in Vietnam, its production capacity for ethylene glycol is limited. According to CRI, Vietnam's ethylene glycol market heavily relies on imports. With the rapid economic development and industrialization in Vietnam, the demand for ethylene glycol is expected to increase significantly in the coming years.

CRI data shows that in 2023, Vietnam's ethylene glycol import value reached US$ 270 million. The market demand in 2024 is even stronger, with the import value of ethylene glycol from January to May 2024 already approaching US$ 150 million.

According to CRI, from 2021 to 2024, the main sources of Vietnam's ethylene glycol imports include Saudi Arabia, Singapore, and Taiwan. Key exporters of ethylene glycol to Vietnam are SABIC ASIA PACIFIC PTE LTD, SHELL EASTERN CHEMICALS, and NAN YA PLASTICS CORPORATION.

The main importers of ethylene glycol in Vietnam are companies in the chemical and plastics industries. CRI analyses that the importers of ethylene glycol in Vietnam are mainly foreign-invested enterprises, including BILLION INDUSTRIAL (VIET NAM), FAR EASTERN POLYTEX (VIETNAM), and FORMOSA INDUSTRIES CORPORATION. In recent years, many Chinese chemical companies have established factories in Vietnam and imported chemical raw materials such as ethylene glycol.

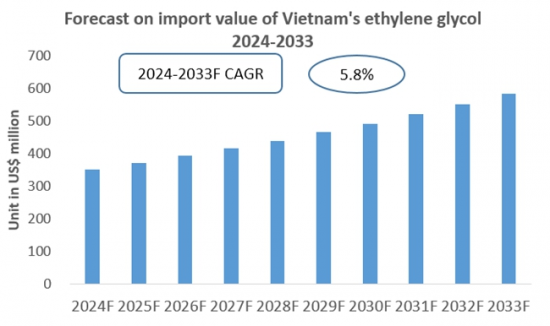

Overall, with Vietnam's population growth, industrial development, and ongoing urbanization, the market size for ethylene glycol in Vietnam will continue to rise. CRI predicts that in the coming years, Vietnam's import value of ethylene glycol is expected to maintain its growth trend.

Topics covered:

The Import and Export of Ethylene Glycol in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Ethylene Glycol in Vietnam (2021-2024)

Total Import Value and Percentage Change of Ethylene Glycol in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Ethylene Glycol in Vietnam (January-May 2024)

Total Import Value and Percentage Change of Ethylene Glycol in Vietnam (January-May 2024)

Average Import Price of Ethylene Glycol in Vietnam (2021-2024)

Top 10 Sources of Ethylene Glycol Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Ethylene Glycol in Vietnam and Their Supply Volume

Top 10 Importers of Ethylene Glycol in Vietnam and Their Import Volume

How to Find Distributors and End Users of Ethylene Glycol in Vietnam

How Foreign Enterprises Enter the Ethylene Glycol Market of Vietnam

Forecast for the Import of Ethylene Glycol in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Ethylene Glycol Products Market

2 Analysis of Ethylene Glycol Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Ethylene Glycol in Vietnam

- 2.1.1 Import Value and Volume of Ethylene Glycol in Vietnam

- 2.1.2 Import Prices of Ethylene Glycol in Vietnam

- 2.1.3 Apparent Consumption of Ethylene Glycol in Vietnam

- 2.1.4 Import Dependency of Ethylene Glycol in Vietnam

- 2.2 Major Sources of Ethylene Glycol Imports in Vietnam

3 Analysis of Major Sources of Ethylene Glycol Imports in Vietnam (2021-2024)

- 3.1 Saudi Arabic

- 3.1.1 Analysis of Import Value and Volume

- 3.1.2 Analysis of Average Import Price

- 3.2 Singapore

- 3.2.1 Analysis of Import Value and Volume

- 3.2.2 Analysis of Average Import Price

- 3.3 Taiwan

- 3.3.1 Analysis of Import Value and Volume

- 3.3.2 Analysis of Average Import Price

- 3.4 Malaysia

- 3.5 Thailand

- 3.6 Kuwait

4 Analysis of Major Suppliers in the Import Market of Ethylene Glycol in Vietnam (2021-2024)

- 4.1 SABIC ASIA PACIFIC PTE LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.2 SHELL EASTERN CHEMICALS

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.3 NAN YA PLASTICS CORPORATION

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Ethylene Glycol Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Ethylene Glycol Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Ethylene Glycol in Vietnam (2021-2024)

- 5.1 BILLION INDUSTRIAL (VIET NAM)

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Ethylene Glycol Imports

- 5.2 FAR EASTERN POLYTEX (VIETNAM)

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Ethylene Glycol Imports

- 5.3 FORMOSA INDUSTRIES CORPORATION

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Ethylene Glycol Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Ethylene Glycol Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Ethylene Glycol Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Ethylene Glycol Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Ethylene Glycol Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Ethylene Glycol Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Ethylene Glycol Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Ethylene Glycol Imports

6. Monthly Analysis of Ethylene Glycol Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Ethylene Glycol Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Ethylene Glycol Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Ethylene Glycol in Vietnam, 2024-2033

Disclaimer

Service Guarantees

List of Charts

- Chart 2021-2024 Import Value and Volume of Ethylene Glycol in Vietnam

- Chart 2021-2024 Average Import Price of Ethylene Glycol in Vietnam

- Chart 2021-2024 Import Dependency of Ethylene Glycol in Vietnam

- Chart Top 10 Import Sources of Ethylene Glycol in Vietnam (2021-2024)

- Chart Top 10 Import Sources of Ethylene Glycol in Vietnam (2022)

- Chart Top 10 Import Sources of Ethylene Glycol in Vietnam (2023)

- Chart Top 10 Import Sources of Ethylene Glycol in Vietnam (2024)

- Chart Top 10 Suppliers of Ethylene Glycol Imports in Vietnam (2021-2024)

- Chart Top 10 Suppliers of Ethylene Glycol Imports in Vietnam (2022)

- Chart Top 10 Suppliers of Ethylene Glycol Imports in Vietnam (2023)

- Chart Top 10 Suppliers of Ethylene Glycol Imports in Vietnam (2024)

- Chart Value and Volume of Ethylene Glycol Imported from Saudi Arabic to Vietnam (2021-2024)

- Chart Value and Volume of Ethylene Glycol Imported from Singapore to Vietnam (2021-2024)

- Chart Value and Volume of Ethylene Glycol Imported from Taiwan to Vietnam (2021-2024)

- Chart Value and Volume of Ethylene Glycol Imported from Thailand to Vietnam (2021-2024)

- Chart Top 10 Importers of Ethylene Glycol in Vietnam (2021-2024)

- Chart Top 10 Importers of Ethylene Glycol in Vietnam (2022)

- Chart Top 10 Importers of Ethylene Glycol in Vietnam (2023)

- Chart Top 10 Importers of Ethylene Glycol in Vietnam (2024)

- Chart Forecast for the Import of Ethylene Glycol in Vietnam (2024-2033)