PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1518925

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1518925

Vietnam Polycarbonate Import Research Report 2024-2033

Polycarbonate (PC) is a transparent, colorless thermoplastic with excellent physical and mechanical properties. It is easy to process, mold, and thermoform. Its properties include high impact resistance, high transparency, excellent thermal stability, and weather resistance, as well as high strength and hardness. Due to these outstanding characteristics, polycarbonate is widely used in fields that require high-performance materials.

Polycarbonate's main applications include electronics and electrical appliances, building materials, automotive making, optical engineering and other industries. In electronics and electrical appliances, polycarbonate is often used to manufacture mobile phone cases, computer parts, and home appliance casings. It is also used for data storage devices. In building materials, it is used to make weather-resistant transparent roofs, windows, and light covers. In the automotive industry, polycarbonate is used for making lamp covers, dashboards, and other interior parts. In the optical field, polycarbonate is commonly used to produce high-quality optical discs, eyeglass lenses, and optical lenses. In recent years, the application of polycarbonate in 3D printing has also been increasingly widespread.

In the Asia-Pacific region and globally, the main producers of polycarbonate include Teijin Chemicals, Bayer, GE Plastics, Samsung, and Chimei Corporation.

Vietnam's manufacturing industry has developed rapidly in recent years, and the plastic industry and its downstream sectors, such as construction, automotive parts manufacturing, electrical cables and wires, textiles and clothing, daily necessities etc., all have significant market expansion potential. According to CRI's analysis, in 2023, Vietnam's plastic raw material import volume and import value were 6.82 million tons and US$ 9.76 billion, respectively. It is expected that Vietnam's plastic products export value will reach US$ 3.15 billion in 2024, indicating that the downstream industries of synthetic resins in Vietnam are flourishing, and the demand scale for synthetic resins is increasing. The import volume of polycarbonate in Vietnam is also on the rise.

According to CRI's analysis, the domestic production capacity of raw materials in Vietnam's plastic industry is insufficient, with about 70% of the raw materials being imported, showing a high dependence on imports. In 2023, Vietnam's total import value of polycarbonate exceeded US$ 600 million. CRI's data has reported that from January to May 2024, Vietnam's cumulative import value of polycarbonate was close to US$ 300 million, and market demand is continuously growing.

In Vietnam, with the rapid development of industry and manufacturing, the demand for high-performance materials such as polycarbonate is also growing rapidly. The electronics and electrical appliance manufacturing industry and the automotive industry in Vietnam have a particularly strong demand for polycarbonate. Due to the limited domestic production capacity, Vietnam's polycarbonate market heavily relies on imported products.

According to CRI's analysis, the main sources of Vietnam's polycarbonate imports from 2021 to 2024 include Japan, South Korea, China, Hong Kong, etc. The main companies exporting this product to Vietnam include LOTTE CHEMICAL, IVICT, and Pla Matels.

The main importers of polycarbonate in Vietnam are manufacturers of plastic materials and products, dealers, and logistics companies, mainly foreign-invested enterprises. The major importers include TENMA, NAGASE VIETNAM CO., LAMVN, etc. According to CRI's analysis, many of these companies are subsidiaries of multinational companies in this industry in Vietnam.

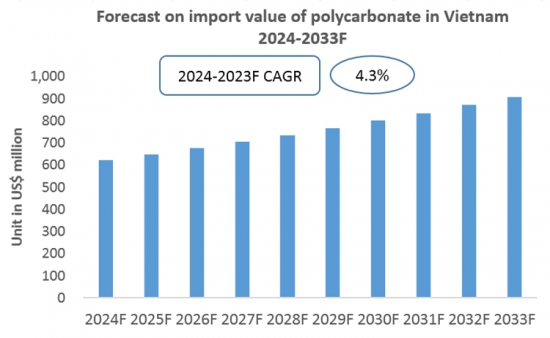

Overall, with the growth of Vietnam's population and the continued development of the manufacturing industry, the demand for polycarbonate will continue to increase. CRI expects that in the next few years, Vietnam's polycarbonate imports will continue to maintain a growth trend.

Topics covered:

The Import and Export of Polycarbonate in Vietnam (2021-2024)

Total Import Volume of Polycarbonate in Vietnam (2021-2024)

Total Import Value and Growth Rate of Polycarbonate in Vietnam (2021-2024)

Total Import Value and Growth Rate of Polycarbonate in Vietnam (January-May 2024)

Average Import Price of Polycarbonate in Vietnam (2021-2024)

Top 10 Sources of Polycarbonate Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Polycarbonate in Vietnam and Their Supply Volume

Top 10 Importers of Polycarbonate in Vietnam and Their Import Volume

How to Find Distributors and End Users of Polycarbonate in Vietnam

How Foreign Enterprises Enter the Plastic Raw Material Market of Vietnam

Forecast for the Import of Polycarbonate in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Plastic Raw Material Market

2 Analysis of Polycarbonate Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Polycarbonate in Vietnam

- 2.1.1 Import Value and Volume of Polycarbonate in Vietnam

- 2.1.2 Import Prices of Polycarbonate in Vietnam

- 2.1.3 Apparent Consumption of Polycarbonate in Vietnam

- 2.1.4 Import Dependency of Polycarbonate in Vietnam

- 2.2 Major Sources of Polycarbonate Imports in Vietnam

3 Analysis of Major Sources of Polycarbonate Imports in Vietnam (2021-2024)

- 3.1 Japan

- 3.1.1 Analysis of Import Value and Volume

- 3.1.2 Analysis of Average Import Price

- 3.2 South Korea

- 3.2.1 Analysis of Import Value and Volume

- 3.2.2 Analysis of Average Import Price

- 3.3 China

- 3.3.1 Analysis of Import Value and Volume

- 3.3.2 Analysis of Average Import Price

- 3.4 Hong Kong

- 3.5 Singapore

- 3.6 Thailand

4 Analysis of Major Suppliers in the Import Market of Polycarbonate in Vietnam (2021-2024)

- 4.1 LOTTE CHEMICAL

- 4.1.1 Company Profile

- 4.1.2 Analysis of Polycarbonate Exports to Vietnam

- 4.2 IVICT

- 4.2.1 Company Profile

- 4.2.2 Analysis of Polycarbonate Exports to Vietnam

- 4.3 Pla Matels

- 4.3.1 Company Profile

- 4.3.2 Analysis of Polycarbonate Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Profile

- 4.4.2 Analysis of Polycarbonate Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Profile

- 4.5.2 Analysis of Polycarbonate Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Profile

- 4.6.2 Analysis of Polycarbonate Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Profile

- 4.7.2 Analysis of Polycarbonate Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Profile

- 4.8.2 Analysis of Polycarbonate Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Profile

- 4.9.2 Analysis of Polycarbonate Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Profile

- 4.10.2 Analysis of Polycarbonate Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Polycarbonate in Vietnam (2021-2024)

- 5.1 Tenma

- 5.1.1 Company Profile

- 5.1.2 Analysis of Polycarbonate Imports

- 5.2 Nagase Vietnam Co.

- 5.2.1 Company Profile

- 5.2.2 Analysis of Polycarbonate Imports

- 5.3 LAMVN

- 5.3.1 Company Profile

- 5.3.2 Analysis of Polycarbonate Imports

- 5.4 Importer 4

- 5.4.1 Company Profile

- 5.4.2 Analysis of Polycarbonate Imports

- 5.5 Importer 5

- 5.5.1 Company Profile

- 5.5.2 Analysis of Polycarbonate Imports

- 5.6 Importer 6

- 5.6.1 Company Profile

- 5.6.2 Analysis of Polycarbonate Imports

- 5.7 Importer 7

- 5.7.1 Company Profile

- 5.7.2 Analysis of Polycarbonate Imports

- 5.8 Importer 8

- 5.8.1 Company Profile

- 5.8.2 Analysis of Polycarbonate Imports

- 5.9 Importer 9

- 5.9.1 Company Profile

- 5.9.2 Analysis of Polycarbonate Imports

- 5.10 Importer 10

- 5.10.1 Company Profile

- 5.10.2 Analysis of Polycarbonate Imports

6. Monthly Analysis of Polycarbonate Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Polycarbonate Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Polycarbonate Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Polycarbonate in Vietnam, 2024-2033

Disclaimer

Service Guarantees

List of Charts

- Chart 2021-2024 Import Value and Volume of Polycarbonate in Vietnam

- Chart 2021-2024 Average Import Price of Polycarbonate in Vietnam

- Chart 2021-2024 Import Dependency of Polycarbonate in Vietnam

- Chart Top 10 Import Sources of Polycarbonate in Vietnam (2021-2024)

- Chart Top 10 Import Sources of Polycarbonate in Vietnam (2022)

- Chart Top 10 Import Sources of Polycarbonate in Vietnam (2023)

- Chart Top 10 Import Sources of Polycarbonate in Vietnam (2024)

- Chart Top 10 Suppliers of Polycarbonate in Vietnam (2021-2024)

- Chart Top 10 Suppliers of Polycarbonate in Vietnam (2022)

- Chart Top 10 Suppliers of Polycarbonate in Vietnam (2023)

- Chart Top 10 Suppliers of Polycarbonate in Vietnam (2024)

- Chart Quantity of Polycarbonate Imported from China to Vietnam (2021-2024)

- Chart Quantity of Polycarbonate Imported from Taiwan to Vietnam (2021-2024)

- Chart Quantity of Polycarbonate Imported from Thailand to Vietnam (2021-2024)

- Chart Quantity of Polycarbonate Imported from South Korea to Vietnam (2021-2024)

- Chart Top 10 Importers of Polycarbonate in Vietnam (2021-2024)

- Chart Top 10 Importers of Polycarbonate in Vietnam (2022)

- Chart Top 10 Importers of Polycarbonate in Vietnam (2023)

- Chart Top 10 Importers of Polycarbonate in Vietnam (2024)

- Chart Forecast for the Import of Polycarbonate in Vietnam (2024-2033)