PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1511534

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1511534

China Polyoxymethylene Import Research Report 2024-2033

On May 19, 2024, the Ministry of Commerce of China issued a notice announcing that it will launch an anti-dumping investigation into imports of polyoxymethylene copolymer originating from the European Union, the United States, Japan and Taiwan (China), and that the investigation is expected to take one year. According to CRI, the polyformaldehyde products can be divided into two main categories based on the structure, homopolymer and copolymer.

Polyoxymethylene copolymer synthesized from formaldehyde, with high mechanical strength, high fatigue resistance, high creep resistance and other good mechanical properties, is able to partially replace copper, zinc, tin and other metal materials, and can be used directly or after modification for automotive parts, electronical appliances, electronics and appliances, machinery, daily necessities, sports equipment, medical equipment, construction materials and other fields.

On October 23, 2023, the Tariff Commission of the State Council of China decided, based on the recommendation of the Ministry of Commerce, to continue to impose anti-dumping duties on imports of polyoxymethylene copolymer originating from South Korea, Thailand and Malaysia for an implementation period of 5 years starting from October 24, 2023.

On April 22, 2024, the Ministry of Commerce of China received an anti-dumping investigation application formally submitted by a number of enterprises on behalf of the polyoxymethylene copolymer industry in mainland China. The applicants requested an anti-dumping investigation on imported polyoxymethylene copolymer originating from the European Union, the United States, Japan and Taiwan (China).

According to the evidence provided by the applicant and the preliminary review by the Ministry of Commerce of China, the applicants' polyoxymethylene copolymer production accounted for more than 50% of the total production of similar products in mainland China in 2021, 2022 and 2023, which is in line with the provisions for the application of anti-dumping investigation by the relevant industries in mainland China. At the same time, the application contains the content and relevant evidence required for the filing of an anti-dumping investigation. Based on the review results, the Ministry of Commerce of China decided to initiate an anti-dumping investigation on imports of polyoxymethylene copolymer originating from the European Union, the United States, Japan and Taiwan (China) from May 19, 2024.

This investigation would start on May 19, 2024, and should normally be completed by May 19, 2025, with a six-month extension under special circumstances.

In 2023, China imported about 329,900 tons of polyoxymethylene, with an import value of US$664 million. According to CRI, in 2023, China imported polyoxymethylene copolymer from more than 40 countries and regions. The main import sources are the United States, Taiwan (China), South Korea, Japan, Germany, etc. Among them, Taiwan (China) is the largest import source by import volume and the second largest source in terms of import value.

In 2023, China imported about 464 million tons of polyoxymethylene from Taiwan (China), with an import value of US$87.23 million, accounting for 14.1% and 13.1% of China's total import volume and total import value of polyoxymethylene copolymer, respectively. CRI predicts that in the next few years, imports of polyoxymethylene copolymer from the EU, the United States, Japan and Taiwan (China) will show a certain decline.

Economic growth has led to an increase in consumption levels and demand for new products, which has directly promoted the demand for high-performance materials. At the same time, technological advances have also promoted the development of new applications for new materials outside of traditional fields, such as uses in sustainable energy and high-tech products. For example, for electric vehicles and renewable energy equipment, polyoxymethylene copolymer is an ideal choice for accessories and components due to its lightweight and durable properties. CRI predicts that as global awareness of sustainable development and environmental protection increases, the development and application of environmentally friendly polyoxymethylene copolymer products will also become an important trend.

Therefore, it can be predicted that the consumption of polyoxymethylene in the world and China will continue to grow in the next few years.

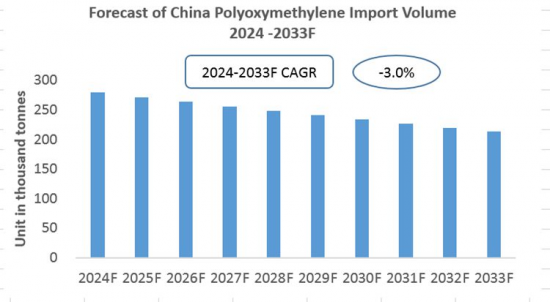

CRI expects that with the continuous growth of China's domestic polyoxymethylene production capacity and output, as well as the improvement of technology level, the import volume and value of polyoxymethylene are projected to show a certain decline in the next few years. However, since it is difficult for China to produce enough high-end polyoxymethylene copolymer products in the short term, the amount of polyoxymethylene imported by China will remain at more than 200,000 tons per year from 2024 to 2033.

Topics covered:

Analysis of China's Polyoxymethylene Import Policies

Polyoxymethylene Imports in China from 2019-2023 and Main Sources

Main Drivers and Market Opportunities for Polyoxymethylene Imports in China

What are the main drivers, challenges, and opportunities for Polyoxymethylene imports in China during the 2024-2033 forecast period?

Who are the key players in China's Polyoxymethylene import market, and what are their competitive advantages?

What is the expected revenue for the Polyoxymethylene import market in China during the 2024-2033 forecast period?

Polyoxymethylene Imports from Japan to China from 2019-2024

Polyoxymethylene Imports from South Korea to China from 2019-2024

Polyoxymethylene Imports from Thailand to China from 2019-2024

Polyoxymethylene Imports from the United States to China from 2019-2024

Polyoxymethylene Imports from Saudi Arabia to China from 2019-2024

Monthly Status of Polyoxymethylene Imports in China from 2021-2024

What strategies have major market players adopted to increase their market share in this industry?

Which segment of China's Polyoxymethylene import market is expected to dominate by 2032?

What are the competitive advantages of the main participants in China's Polyoxymethylene import market?

What are the major limiting factors restraining the growth of Polyoxymethylene imports in China?

Table of Contents

1. Analysis of China's Polyoxymethylene Imports from 2019 to 2023

- 1.1. The Scale of China's Polyoxymethylene Import

- 1.1.1. The Volume of China's Polyoxymethylene Import

- 1.1.2. The Value of China's Polyoxymethylene Import

- 1.1.3. The Price of China's Polyoxymethylene Import

- 1.1.4 The Consumption of China's Polyoxymethylene

- 1.1.5. China's Polyoxymethylene Import Dependence

- 1.2. China's Main Polyoxymethylene Import Sources

- 1.2.1. by Import Volume

- 1.2.2. by Import Value

2. Analysis of China's Main Polyoxymethylene Import Sources from 2019 to 2023

- 2.1. Taiwan (China)

- 2.1.1 Analysis of Import Volume

- 2.1.2 Analysis of Import Value

- 2.1.3 Analysis of Average Import Price

- 2.2. United States

- 2.2.1 Analysis of Import Volume

- 2.2.2 Analysis of Import Value

- 2.2.3 Analysis of Average Import Price

- 2.3. Germany

- 2.3.1 Analysis of Import Volume

- 2.3.2 Analysis of Import Value

- 2.3.3 Analysis of Average Import Price

- 2.4. South Korea

- 2.5. Japan

- 2.6. Other Countries

3. Monthly Analysis of Polyoxymethylene in China, 2021-2024

- 3.1 Analysis of Monthly Import Volume

- 3.2 Analysis of Monthly Import Value

- 3.3 Forecast of Monthly Average Import Price

4. Analysis of the Main Factors Affecting China's Polyoxymethylene Imports

- 4.1 Policy

- 4.1.1 Current Status of Import Policy

- 4.1.2 Trend Forecast of Import Policy

- 4.2 Economic

- 4.2.1 Market Price

- 4.2.2 Growth Trend of China's Polyoxymethylene Production Capacity

- 4.3 Technical

5. China Polyoxymethylene Import Outlook, 2024-2033

- 5.1 China Polyoxymethylene Import Volume Forecast, 2024-2033

- 5.2 China Polyoxymethylene Import Value Forecast, 2024-2033

- 5.3 Forecast of China's Average Import Price of Polyoxymethylene from 2024 to 2033

- 5.4 Forecast of China's Main Import Sources of Polyoxymethylene from 2024 to 2033

Disclaimer

Service Guarantees

LIST OF CHARTS

- Chart China Polyoxymethylene Import Volume from 2019 to 2023

- Chart China Polyoxymethylene Import Value from 2019 to 2023

- Chart China Average Import Price of Polyoxymethylene from 2019 to 2023

- Chart China Polyoxymethylene Import Dependence from 2019 to 2023

- Chart China Main Import Sources of Polyoxymethylene from 2019 to 2023 (by Import Volume)

- Chart China Main Import Sources of Polyoxymethylene from 2019 to 2023 (by Import Value)

- Chart The Amount of Japan Polyoxymethylene Imported by China from 2019 to 2023

- Chart The Amount of American Polyoxymethylene Imported by China from 2019 to 2023

- Chart The Amount of German Polyoxymethylene Imported by China from 2019 to 2023

- Chart The Amount of Korean Polyoxymethylene Imported by China from 2019 to 2023

- Chart Forecast of China Polyoxymethylene Import Volume from 2024 to 2033

- Chart Forecast of China Polyoxymethylene Import Value from 2024 to 2033