PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1511532

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1511532

Malaysia Plastic Industry Research Report 2024-2033

Malaysia is one of the economically advanced countries in Southeast Asia, with a per capita GDP reaching USD 13,034 in 2023. The plastics industry in Malaysia serves sectors such as packaging, electronics, automotive, and construction. The industry is well-developed and a significant contributor to high-skilled and high-income employment in the country. In 2019, investments exceeding MYR 18 billion (approximately USD 3.769 billion) flowed towards Malaysia, spurring over 1,500 manufacturing projects. According to CRI, despite the global economic slowdown and the EU's restrictions on single-use plastics, Malaysia's plastic industry shows considerable growth potential driven by the demand for electronics, pharmaceuticals, and food and beverage products.

Following the pandemic, Malaysia's plastic industry experienced a recovery. In 2023, Malaysia's imports of plastics and related products reached USD 8.479 billion. China was a major source, with Malaysia importing USD 2.189 billion worth of plastics from China, accounting for 25.81% of the total imports for the year based on the analysis of CRI.

In terms of exports, the value of Malaysia's plastics and plastic products decreased during the pandemic but quickly rebounded, surpassing pre-pandemic levels. In 2023, Malaysia's exports of plastics and related products amounted to USD 9.032 billion. China, Singapore, and Indonesia were the main export markets, with exports to China reaching USD 2.168 billion, representing about 24% of the total.

In December 2021, the Malaysian government released the "Malaysia Plastic Sustainability Roadmap 2021-2030" as a comprehensive strategy to address plastic waste issues. The demand for bioplastics is also driving the development of the plastic industry in Malaysia.

Malaysia's plastic industry holds substantial potential for foreign investors. The sector has promising investment prospects in high-end plastic products and engineering plastics in the coming years. Advanced waste management infrastructure also supports plastic recycling.

The Malaysian plastic market comprises many foreign or joint venture enterprises, competing alongside local companies. According to CRI, key local players include BP Plastics Holding Bhd and Commercial Plastic Industries. Foreign and joint venture firms dominate significant market shares, including Toray Plastics Sdn Bhd, Polyplastics Asia-Pacific Sdn Bhd, and Lotte Chemical Titan Holding Berhad. Notably, Toray Plastics Sdn Bhd established a plant in Malaysia in 1990, commencing production in early 1992; Polyplastics Asia-Pacific Sdn Bhd established the PAP Kuantan plant in 2000 with a production capacity of 30,000 tons annually; and Lotte Chemical Titan Holding Berhad began constructing its polypropylene plant in 2017.

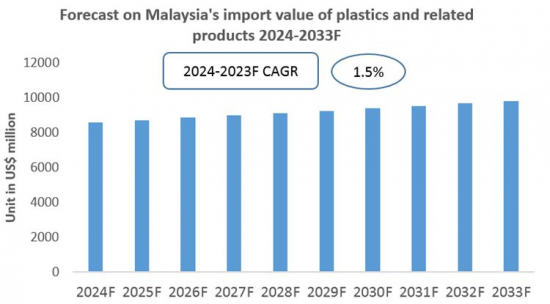

CRI projects that the market size of Malaysia's plastic industry will continue to grow in the coming years. Both imports and exports are expected to rise. By 2033, Malaysia's imports of plastics and related products are projected to reach USD 9.84 billion, with a CAGR of approximately 1.5% from 2024 to 2033.

Topics covered:

Overview of Malaysia's Plastics Industry

Economic Conditions and Policies for Malaysia's Plastics Industry

How Foreign Investment Enters Malaysia's Plastics Market

Market Size of Malaysia's Plastics Industry (2024-2033)

Analysis of Major Plastics Manufacturers in Malaysia

Key Drives and Market Opportunities for the Plastics Industry in Malaysia

What are the Major Drivers, Challenges, and Opportunities for the Plastics Industry in Malaysia during the Forecast Period 2024-2033?

Who are the Main Players in Malaysia's Plastics Market and What are their Competitive Advantages?

What is the Expected Revenue of Malaysia's Plastics Market during the Forecast Period 2024-2033?

What Strategies have the Major Market Players Adopted to Increase their Market Share in the Industry?

Which Segment of Malaysia's Plastics Market is Expected to Dominate the Market by 2032?

What are the Main Adverse Factors Facing Malaysia Plastics Industry?

Table of Contents

1. Overview of Malaysia

- 1.1 Geography

- 1.2 Demographics of Malaysia

- 1.3 Economic of Malaysia

- 1.4. Minimum Wage in Malaysia, 2013-2023

- 1.5. Impact of COVID-19 on Malaysia' Plastics Industry

2. Development Environment of the Plastics Industry in Malaysia

- 2.1. History of the Plastics Industry in Malaysia

- 2.2. Categories of Plastics in Malaysia

- 2.3. Policies for the Plastics Industry in Malaysia

3. Supply and Demand of the Plastics Industry in Malaysia

- 3.1. Supply of the Plastics Industry in Malaysia

- 3.1.1. Production Capacity

- 3.1.2. Production Volume

- 3.2. Demand of the Plastics Industry in Malaysia

- 3.2.1. Demand Volume

- 3.2.2. Market Size

4. Import and Export of the Plastics Industry in Malaysia

- 4.1. Import of the Plastics Industry in Malaysia

- 4.1.1. Import Volume and Value of Plastics in Malaysia

- 4.1.2. Main Suppliers of Plastics Imports in Malaysia

- 4.2. Export of the Plastics Industry in Malaysia

- 4.2.1. Export Volume and Value of Plastics in Malaysia

- 4.2.2. Main Destinations of Plastics Exports in Malaysia

5. Market Competition of Malaysia's Plastics Industry

- 5.1. Barriers to Entry in Malaysia's Plastics Industry

- 5.1.1. Brand Barriers

- 5.1.2. Quality Barriers

- 5.1.3. Capital Barriers

- 5.2. Competitive Structure of Malaysia's Plastics Industry

- 5.2.1. Bargaining Power of Plastics Suppliers

- 5.2.2. Bargaining Power of Consumers

- 5.2.3. Competitive Landscape of Malaysia's Plastics Industry

- 5.2.4. Potential Entrants in the Plastics Industry

- 5.2.5. Substitutes for Plastics Products

6. Analysis of Major Plastics Brands in Malaysia

- 6.1. BP Plastics Holding Bhd

- 6.1.1. History of BP Plastics Holding Bhd

- 6.1.2. Main Products of BP Plastics Holding Bhd

- 6.1.3. Operating Model of BP Plastics Holding Bhd

- 6.2. Commercial Plastic Industries

- 6.2.1. History of Commercial Plastic Industries

- 6.2.2. Main Products of Commercial Plastic Industries

- 6.2.3. Operating Model of Commercial Plastic Industries

- 6.3. CYL Corporation Bhd

- 6.3.1. History of CYL Corporation Bhd

- 6.3.2. Main Products of CYL Corporation Bhd

- 6.3.3. Operating Model of CYL Corporation Bhd

- 6.4. Toray Plastics Sdn Bhd

- 6.4.1. History of Toray Plastics Sdn Bhd

- 6.4.2. Main Products of Toray Plastics Sdn Bhd

- 6.4.3. Operating Model of Toray Plastics Sdn Bhd

- 6.5. Polyplastics Asia-Pacific Sdn Bhd

- 6.5.1. History of Polyplastics Asia-Pacific Sdn Bhd

- 6.5.2. Main Products of Polyplastics Asia-Pacific Sdn Bhd

- 6.5.3. Operating Model of Polyplastics Asia-Pacific Sdn Bhd

- 6.6. Lotte Chemical Titan Holding Berhad

- 6.6.1. History of Lotte Chemical Titan Holding Berhad

- 6.6.2. Main Products of Lotte Chemical Titan Holding Berhad

- 6.6.3. Operating Model of Lotte Chemical Titan Holding Berhad

- 6.7. Malayan Electro-Chemical Industry Co. Sdn Bhd.

- 6.7.1. History of Malayan Electro-Chemical Industry Co. Sdn Bhd.

- 6.7.2. Main Products of Malayan Electro-Chemical Industry Co. Sdn Bhd.

- 6.7.3. Operating Model of Malayan Electro-Chemical Industry Co. Sdn Bhd.

- 6.8. Sanko Plastics Malaysia

- 6.8.1. History of Sanko Plastics Malaysia

- 6.8.2. Main Products of Sanko Plastics Malaysia

- 6.8.3. Operating Model of Sanko Plastics Malaysia

- 6.9. Scientex

- 6.9.1. History of Scientex

- 6.9.2. Main Products of Scientex

- 6.9.3. Operating Model of Scientex

- 6.10. Teck See Plastic Sdn Bhd

- 6.10.1. History of Teck See Plastic Sdn Bhd

- 6.10.2. Main Products of Teck See Plastic Sdn Bhd

- 6.10.3. Operating Model of Teck See Plastic Sdn Bhd

7. Outlook for Malaysia's Plastics Industry (2024-2033)

- 7.1. Development Factors of Malaysia's Plastics Industry

- 7.1.1. Drivers and Opportunities of the Plastics Industry in Malaysia

- 7.1.2. Threats and Challenges facing the Plastics Industry in Malaysia

- 7.2. Market Supply Forecast for the Plastics Industry in Malaysia

- 7.3. Market Demand Forecast for the Plastics Industry in Malaysia

- 7.4. Import and Export Forecast for the Plastics Industry in Malaysia

Disclaimer

Service Guarantees

List of Charts

- Chart Population of Malaysia, 2008-2023

- Chart GDP Per Capita in Malaysia, 2013-2023

- Chart Related Policies Issued by Malaysia Government for the Plastics Industry, 2019-2023

- Chart Production of Plastics in Malaysia, 2019-2023

- Chart Plastics Domestic Consumption in Malaysia, 2019-2023

- Chart Import Volume of Plastics in Malaysia, 2019-2023

- Chart Import Value of Plastics in Malaysia, 2019-2023

- Chart Main Suppliers and their Import Values of Plastics Imports in Malaysia, 2019-2023

- Chart Export Volume of Plastics and Final Products in Malaysia, 2019-2023

- Chart Export Value of Plastics and Final Products in Malaysia, 2019-2023

- Chart Main Export Destinations and their Export Values for Plastics from Malaysia, 2019-2023

- Chart Production Forecast for Malaysia Plastics, 2024-2033

- Chart Domestic Market Size Forecast for Malaysia Plastics, 2024-2033

- Chart Import Forecast for Malaysia Plastics, 2024-2033

- Chart Export Forecast for Malaysia Plastics, 2024-2033