PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705990

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705990

Burial Insurance Market, By Insurance Coverage, By Premium Payment Type, By Customer Age Group, By Distribution Channel, By Geography

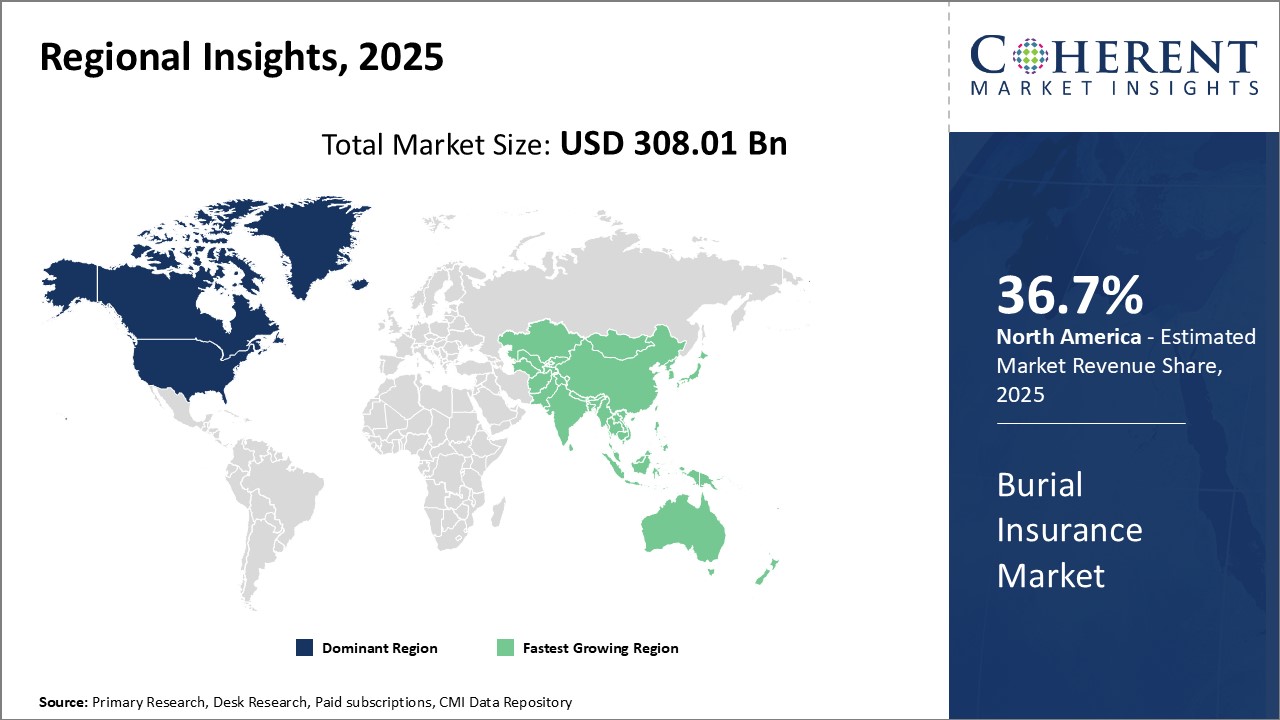

Global Burial Insurance Market is estimated to be valued at USD 308.01 Bn in 2025 and is expected to reach USD 457.36 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 308.01 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.80% | 2032 Value Projection: | USD 457.36 Bn |

The global burial insurance market has been witnessing steady growth in the recent years. Burial insurance, also known as funeral planning insurance, is a type of life insurance that provides payout to cover the costs associated with burial or cremation of the insured person upon their death. With rising life expectancy and increasing costs related to last rites and ceremonies, more individuals are opting for burial insurance policies. The growing elderly population base susceptible to health issues and medical expenses further substantiates the need for such insurance plans. Manufacturers are leveraging technological solutions to automate claims processing and provide efficient customer services aiding the market expansion. However, factors like economic downturns affecting individual spending may impede the market progress to a certain extent during the forecast period.

Market Dynamics:

The key drivers fueling the global burial insurance market include rapid growth of the aged population worldwide susceptible to health issues, rising funeral costs necessitating monetary protection, and increasing awareness among consumers about pre-planning funeral arrangements. However, the market growth can be restrained by factors such as economic slowdowns negatively impacting individual spending, stringent underwriting procedures followed by insurers, and preference for alternative saving instruments over insurance. On the opportunities front, digitization of insurance processes, customized plans as per client needs, and favorable government regulations are expected to unlock new avenues for the players in the coming years.

(Key Features of the Study):

This report provides in-depth analysis of the global burial insurance market, and provides market size (USD Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global burial insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Gerber Life, Foresters Financial, Allianz Life, AIG, American National, Assurity Life Insurance Company, Transamerica, Americo Financial Life and Annuity Insurance Company, Baltimore Life, AAA Life Insurance Company, State Farm, Sagicor Life Insurance Company, Mutual of Omaha, United Home Life Insurance Company, and New York Life Insurance Company

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global burial insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global burial insurance market

Market Segmentation

- Insurance Coverage Insights (Revenue, USD Bn, 2020 - 2032)

- Level Death Benefit

- Guaranteed Acceptance

- Modified or Graded Death Benefit

- Premium Payment Type Insights (Revenue, USD Bn, 2020 - 2032)

- Monthly

- Quarterly

- Annually

- Customer Age Group Insights (Revenue, USD Bn, 2020 - 2032)

- Over 50

- Over 60

- Over 70

- Over 80

- Distribution Channel Insights (Revenue, USD Bn, 2020 - 2032)

- Direct Sales

- Insurance Brokers

- Online Platforms

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Gerber Life

- Foresters Financial

- Allianz Life

- AIG

- American National

- Assurity Life Insurance Company

- Transamerica

- Americo Financial Life and Annuity Insurance Company

- Baltimore Life

- AAA Life Insurance Company

- State Farm

- Sagicor Life Insurance Company

- Mutual of Omaha

- United Home Life Insurance Company

- New York Life Insurance Company

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Burial Insurance Market, By Insurance Coverage

- Global Burial Insurance Market, By Premium Payment Type

- Global Burial Insurance Market, By Customer Age Group

- Global Burial Insurance Market, By Distribution Channel

- Global Burial Insurance Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Driver

- Restraint

- Opportunity

- Impact Analysis

- Key Developments

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

- Industry Trends

4. Global Burial Insurance Market, By Insurance Coverage, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Level Death Benefit

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Guaranteed Acceptance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Modified or Graded Death Benefit

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Burial Insurance Market, By Premium Payment Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Monthly

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Quarterly

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Annually

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Burial Insurance Market, By Customer Age Group, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Over 50

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Over 60

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Over 70

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Over 80

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Burial Insurance Market, By Distribution Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Direct Sales

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Insurance Brokers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online Platforms

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

8. Global Burial Insurance Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

9. Competitive Landscape

- Gerber Life

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Foresters Financial

- Allianz Life

- AIG

- American National

- Assurity Life Insurance Company

- Transamerica

- Americo Financial Life and Annuity Insurance Company

- Baltimore Life

- AAA Life Insurance Company

- State Farm

- Sagicor Life Insurance Company

- Mutual of Omaha

- United Home Life Insurance Company

- New York Life Insurance Company

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. References and Research Methodology

- References

- Research Methodology

- About us