PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673897

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673897

Algorithmic Trading Market, By Type, By Deployment, By Organization Size, By Geography

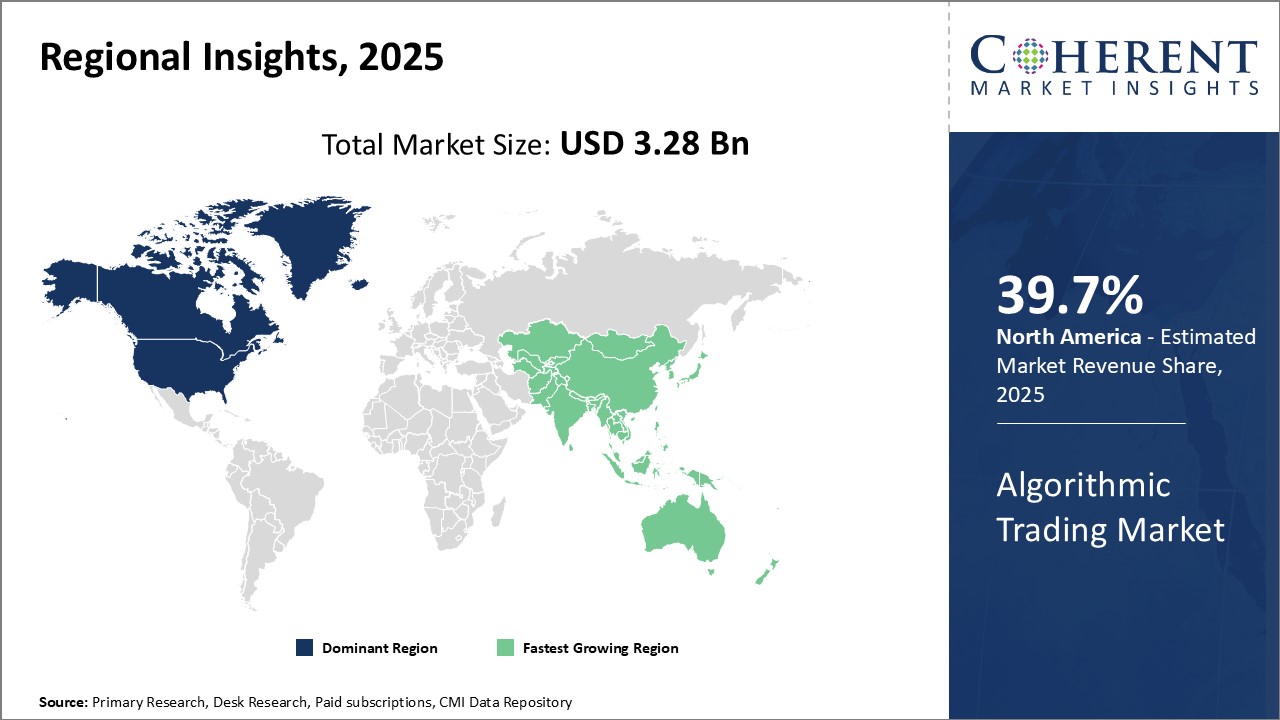

Global Algorithmic Trading Market is estimated to be valued at USD 3.28 Bn in 2025 and is expected to reach USD 6.05 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.1% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 3.28 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.10% | 2032 Value Projection: | USD 6.05 Bn |

Global algorithmic trading market growth is driven by increasing automation and data analytics in the financial sector. Algorithmic trading utilizes quantitative and qualitative factors to analyze market behavior and execute trades accordingly. It allows for high-frequency and automated execution of transactions based on pre-defined rules and variables. This reduces human errors and minimizes marginal transaction costs. The growth of FinTech solutions further boosts the development of more sophisticated trading algorithms capable of processing huge volumes of data at speeds exceeding human capabilities. Major players are investing heavily in R&D to develop AI and machine learning based advanced algorithms for predictive analysis and optimal trade execution. Global algorithmic trading market can witness growth as automation is core to trading operations.

Market Dynamics:

Global algorithmic trading market growth is driven by the need for speed, efficiency and accuracy in capital markets. Growing volumes of market data and real-time trading necessitate automated systems for optimal order execution. However, high initial investment and regulatory compliances can hamper the market growth. Developing economies experiencing increase in financial technology adoption and online trading can offer market growth opportunities. Increasing popularity of AI and cloud computing makes algorithmic strategies more powerful by enabling analysis of unconventional data sources. This prompt vendors to offer cloud-based algorithmic solutions. However, cybersecurity risks and inability to match human judgment can hamper the market growth.

Key features of the study:

- This report provides in-depth analysis of the global algorithmic trading market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global algorithmic trading market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include 63 moons technologies limited, AlgoTrader, Argo Software Engineering, Citadel LLC, FlexTrade Systems, Inc., Hudson River Trading, InfoReach, Inc., Lime Trading Corp., Marquee by Goldman Sachs, MetaQuotes Ltd, Optiver, Quanthouse, Refinitiv Limited, Software AG, Symphony.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- Global algorithmic trading market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global algorithmic trading market.

Detailed Segmentation:

- By Type

- Institutional Investors

- Retail Investors

- Long-term Traders

- Short-term Traders

- By Deployment

- Cloud-based

- On-premises

- By Organization Size

- Small and Medium Enterprises

- Large Enterprises

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- 63 moons technologies limited

- AlgoTrader

- Argo Software Engineering

- Citadel LLC

- FlexTrade Systems, Inc.

- Hudson River Trading

- InfoReach, Inc.

- Lime Trading Corp.

- Marquee by Goldman Sachs

- MetaQuotes Ltd

- Optiver

- Quanthouse

- Refinitiv Limited

- Software AG

- Symphony

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By Deployment

- Market Snippet, By Organization Size

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Algorithmic Trading Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Institutional Investors

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Retail Investors

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Long-term Traders

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Short-term Traders

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

5. Global Algorithmic Trading Market, By Deployment, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Cloud-based

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- On-premises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

6. Global Algorithmic Trading Market, By Organization Size, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Small and Medium Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Large Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

7. Global Algorithmic Trading Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.K.

- Germany

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

8. Competitive Landscape

- Company Profiles

- 63 moons technologies limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- AlgoTrader

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Argo Software Engineering

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Citadel LLC

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- FlexTrade Systems, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hudson River Trading

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- InfoReach, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Lime Trading Corp.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Marquee by Goldman Sachs

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- MetaQuotes Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Optiver

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Quanthouse

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Refinitiv Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Software AG

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Symphony

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- 63 moons technologies limited

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Research Methodology

- References

- Research Methodology

- About us and Sales Contact