PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708950

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708950

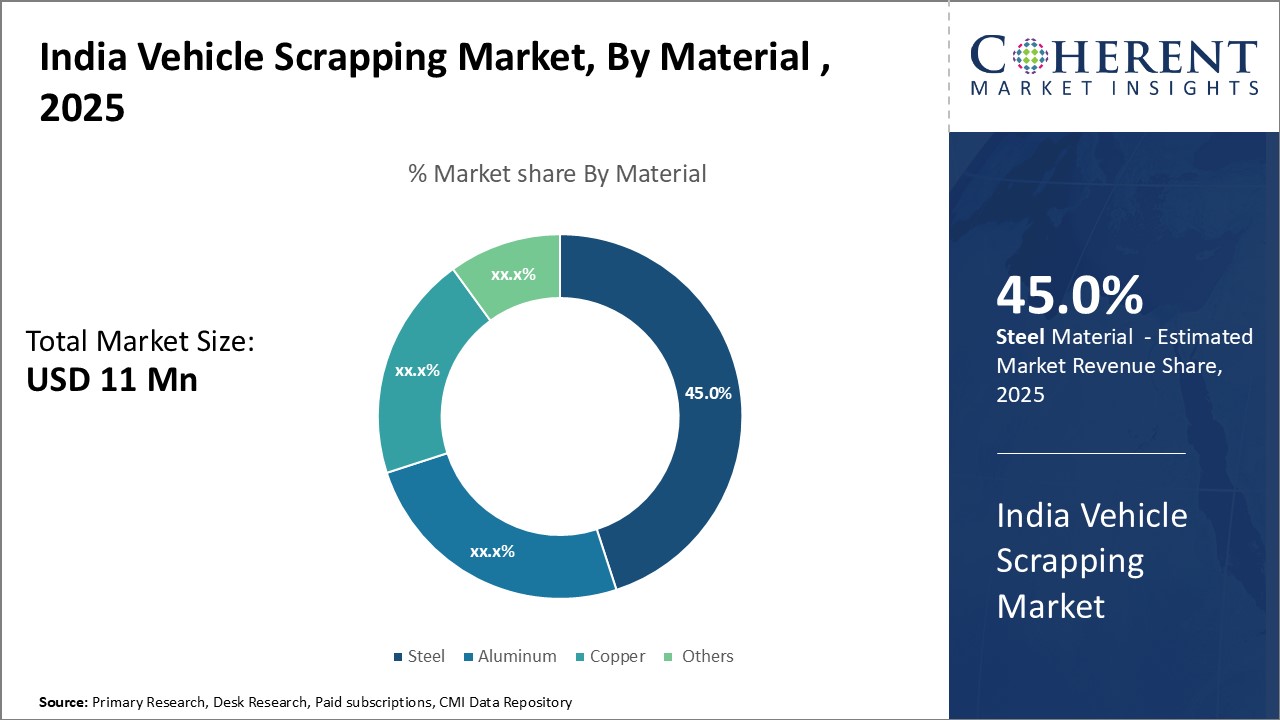

India Vehicle Scrapping Market, By Material (Steel, Aluminum, Copper, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (New Products, Reusable Parts)

India Vehicle Scrapping Market is estimated to be valued at USD 11.0 Mn in 2025 and is expected to reach USD 47.9 Mn by 2032, growing at a compound annual growth rate (CAGR) of 23.4% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 11.0 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 23.40% | 2032 Value Projection: | USD 47.9 Mn |

The automotive industry in India has shown impressive growth over the past decade. With rising incomes and purchase power, personal vehicle ownership in India is on the rise. However, India is also grappling with mounting vehicle scrappage. Old and obsolete commercial vehicles plying on roads contribute significantly to air pollution. Recognizing this challenge, in 2016 the Indian government put forth a policy for scrapping old vehicles. However, lack of infrastructure and unclear guidelines had hampered its implementation. In recent years, focus on strict emission norms and impetus on electric vehicles have renewed interest in developing a robust vehicle scrapping ecosystem in India. Several global leaders have also announced investments in setting up automotive dismantling and recycling facilities in India. It is expected that a well-regulated vehicle scrapping program can boost replacement demand for new vehicles and support India's transition to more environment-friendly mobility solutions.

Market Dynamics

The key drivers propelling the growth of India's vehicle scrapping market include stringent emission norms by the government to curb air pollution, rise in aging vehicles, availability of incentives under voluntary and mandatory vehicle scrapping policies, and economic viability of recycling automotive parts. However, factors like inadequacies in infrastructure for quality inspection and dismantling facilities, lack of organized sector participation, and uncertainties over resale value of discarded parts pose challenges. There is vast opportunity for Indian dismantling and recycling technology providers to set up operations and collaborate with insurance companies, lending institutions, and automakers. Developing a circular economy approach by reusing components can boost sustainable automotive manufacturing and maintenance in India.

Key features of the study:

This report provides in-depth analysis of the India vehicle scrapping market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

It profiles key players in the India vehicle scrapping market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

Key companies covered as a part of this study include Maruti Suzuki Toyotsu India (MSTI), CERO Recycling, Tata Motors Re.Wi.Re, Kaiho Sangyo Co. Ltd, Mjunction Services Ltd, Go Green ELV Handlers, Goodvalue Auto Scrap Pvt Ltd, Goenka Motors Pvt Ltd, KD Ecosystem, Mahindra MSTC Recycling Pvt Ltd, and SRI NEELAYUM PRECOATED STEEL.

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

India vehicle scrapping market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the India vehicle scrapping market.

Market Segmentation

- Material Insights (Revenue, USD Mn, 2020 - 2032)

- Steel

- Aluminum

- sCopper

- Others

- Vehicle Type Insights (Revenue, USD Mn, 2020 - 2032)

- Passenger Vehicles

- Commercial Vehicles

- Application Insights (Revenue, USD Mn, 2020 - 2032)

- New Products

- Reusable Parts

- Key Players Insights

- Maruti Suzuki Toyotsu India (MSTI)

- CERO Recycling

- Tata Motors Re.Wi.Re

- Kaiho Sangyo Co. Ltd

- Mjunction Services Ltd

- Go Green ELV Handlers

- Goodvalue Auto Scrap Pvt Ltd

- Goenka Motors Pvt Ltd

- KD Ecosystem

- Mahindra MSTC Recycling Pvt Ltd

- SRI NEELAYUM PRECOATED STEEL

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- India Vehicle Scrapping Market, By Material

- India Vehicle Scrapping Market, By Vehicle Type

- India Vehicle Scrapping Market, By Application

3. Market Dynamics, Regulations, And Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

- Industry Trends

4. India Vehicle Scrapping Market, By Material, 2025-2032, (USD Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Steel

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Aluminum

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Copper

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

5. India Vehicle Scrapping Market, By Vehicle Type, 2025-2032, (USD Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Passenger Vehicles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Commercial Vehicles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

6. India Vehicle Scrapping Market, By Application, 2025-2032, (USD Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- New Products

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Reusable Parts

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

7. Competitive Landscape

- Maruti Suzuki Toyotsu India (MSTI)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CERO Recycling

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Tata Motors Re.Wi.Re

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Kaiho Sangyo Co. Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Mjunction Services Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Go Green ELV Handlers

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Goodvalue Auto Scrap Pvt Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Goenka Motors Pvt Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- KD Ecosystem

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Mahindra MSTC Recycling Pvt Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- SRI NEELAYUM PRECOATED STEEL

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us