PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705917

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705917

Gasoline Direct Injection Device Market, By Fuel Injector Type, By Vehicle Type, By Engine Capacity, Sales Channel, By Geography

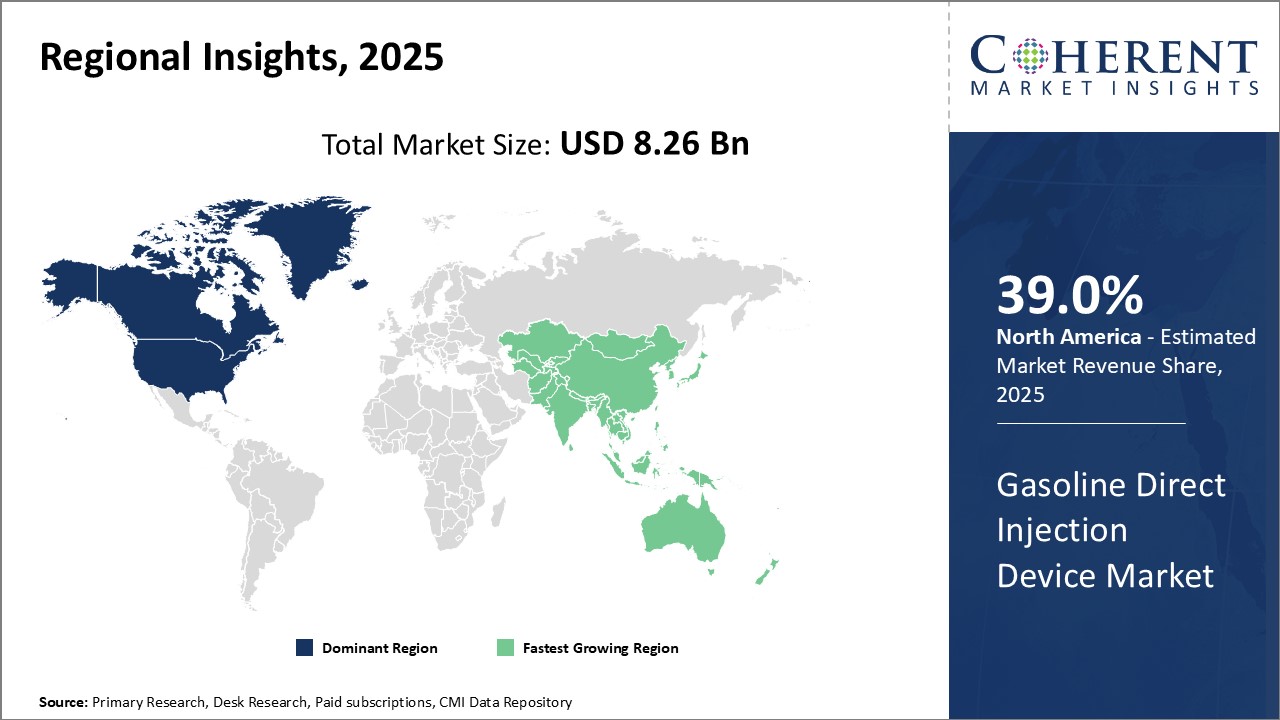

Global Gasoline Direct Injection Device Market is estimated to be valued at USD 8.26 Bn in 2025 and is expected to reach USD 12.68 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 8.26 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.30% | 2032 Value Projection: | USD 12.68 Bn |

Gasoline direct injection technology involves directly injecting fuel into the combustion chamber of a spark-ignition engine. In a port fuel injection system, fuel is injected into the intake port, while in direct injection, the fuel is sprayed directly into the combustion chamber. This allows for greater control over fuel delivery timing and quantity. The advantages of GDI over conventional port fuel injection systems include improved fuel efficiency, lower emissions, better throttle response and torque. With growing environmental regulations mandating lower vehicle emissions and increasing demand for fuel-efficient vehicles worldwide, the adoption of gasoline direct injection technology is expected to rise significantly in the coming years.

Market Dynamics:

The global gasoline direct injection device market is primarily driven by stringent emission norms demanding enhanced fuel efficiency and reduced tailpipe emissions. Various regions and countries have implemented more stringent emission standards like Euro 6, BS6 and China 6 which is compelling automakers to adopt advanced fuel injection technologies like GDI. Additionally, growing consumer preference for high-performance vehicles with quick acceleration and responsiveness is also favoring the adoption of GDI systems. However, factors like the higher costs associated with manufacturing and maintenance of GDI devices as compared to conventional port fuel injection systems may hinder the market growth. Moreover, technical challenges related to direct injection of fuel into the combustion chamber like carbon build-up can restrain the market growth. The development of advanced coating materials to address engine fouling issues presents a major opportunity in this market.

Key Features of the Study:

- This report provides in-depth analysis of the global gasoline direct injection device market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global gasoline direct injection device market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Robert Bosch GmbH, Denso Corporation, Delphi Automotive LLP, Continental AG, Magneti Marelli, TI Fluid Systems, Stanadyne LLC, Keihin Corporation, Eaton Corporation, Infineon Technologies, STMicroelectronics, GP Performance, Marelli Europe S.p.A., Woodward Inc., PurePower Technologies, Renesas Electronics, MSR-Jebsen Technologies, Currawong Engineering, Aisin Seiki Co., Ltd., and Hitachi Automotive Systems

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global gasoline direct injection device market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global gasoline direct injection device market

Detailed Segmentation-

- Fuel Injector Type Insights (Revenue, USD Bn, 2020 - 2032)

- Solenoid Injectors

- Piezo Injectors

- Others

- Vehicle Type Insights (Revenue, USD Bn, 2020 - 2032)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Engine Capacity Insights (Revenue, USD Bn, 2020 - 2032)

- Below 2.0 Liters

- 0 to 3.0 Liters

- Above 3.0 Liters

- Sales Channel Insights (Revenue, USD Bn, 2020 - 2032)

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Regional Insights (Revenue, USD Bn 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Robert Bosch GmbH

- Denso Corporation

- Delphi Automotive LLP

- Continental AG

- Magneti Marelli

- TI Fluid Systems

- Stanadyne LLC

- Keihin Corporation

- Eaton Corporation

- Infineon Technologies

- STMicroelectronics

- GP Performance

- Marelli Europe S.p.A.

- Woodward Inc.

- PurePower Technologies

- Renesas Electronics

- MSR-Jebsen Technologies

- Currawong Engineering

- Aisin Seiki Co., Ltd.

- Hitachi Automotive Systems

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Fuel Injector Type

- Market Snippet, By Vehicle Type

- Market Snippet, By Engine Capacity

- Market Snippet, By Sales Channel

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trend

4. Global Gasoline Direct Injection Device Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Gasoline Direct Injection Device Market - COVID-19

- Impact Analysis

5. Global Gasoline Direct Injection Device Market, By Fuel Injector Type, 2020-2032 (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Solenoid Injectors

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Piezo Injectors

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Others

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

6. Global Gasoline Direct Injection Device Market, By Vehicle Type, 2020-2032 (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Passenger Cars

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Light Commercial Vehicles

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Heavy Commercial Vehicles

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

7. Global Gasoline Direct Injection Device Market, By Engine Capacity, 2020-2032 (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Below 2.0 Liters

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- 2.0 to 3.0 Liters

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Above 3.0 Liters

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

8. Global Gasoline Direct Injection Device Market, By Sales Channel, 2020-2032 (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Original Equipment Manufacturer (OEM)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Aftermarket

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

9. Global Gasoline Direct Injection Device Market, By Region, 2020-2032 (US$ Mn)

- Introduction

- Market Share Analysis, By Region, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- North America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Countries

- U.S.

- Canada

- Latin America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Countries

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Countries

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Countries

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Sub-regions/Countries

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Fuel Injector Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Vehicle Type, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Engine Capacity, 2020- 2032 (US$ Mn)

- Market Size and Forecast, By Sales Channel, 2020- 2032 (US$ Mn)

- Sub-regions/Countries

- South Africa

- North Africa

- Central Africa

10. Competitive Landscape

- Heat Map Analysis

- Market Share Analysis (3x3 Matrix)

- Company Profiles

- Robert Bosch GmbH

- Company Overview

- Fuel Injector Type Portfolio

- Recent Developments/Updates

- Denso Corporation

- Delphi Automotive LLP

- Continental AG

- Magneti Marelli

- TI Fluid Systems

- Stanadyne LLC

- Keihin Corporation

- Eaton Corporation

- Infineon Technologies

- STMicroelectronics

- GP Performance

- Marelli Europe S.p.A.

- Woodward Inc.

- PurePower Technologies

- Renesas Electronics

- MSR-Jebsen Technologies

- Currawong Engineering

- Aisin Seiki Co., Ltd.

- Hitachi Automotive Systems

- Robert Bosch GmbH

11. Analyst Recommendation

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. Section

- References

- Research Methodology

- About Us and Sales Contact