PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708610

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708610

Edge Banding Materials Market, By Material Type, By Application, By Geography

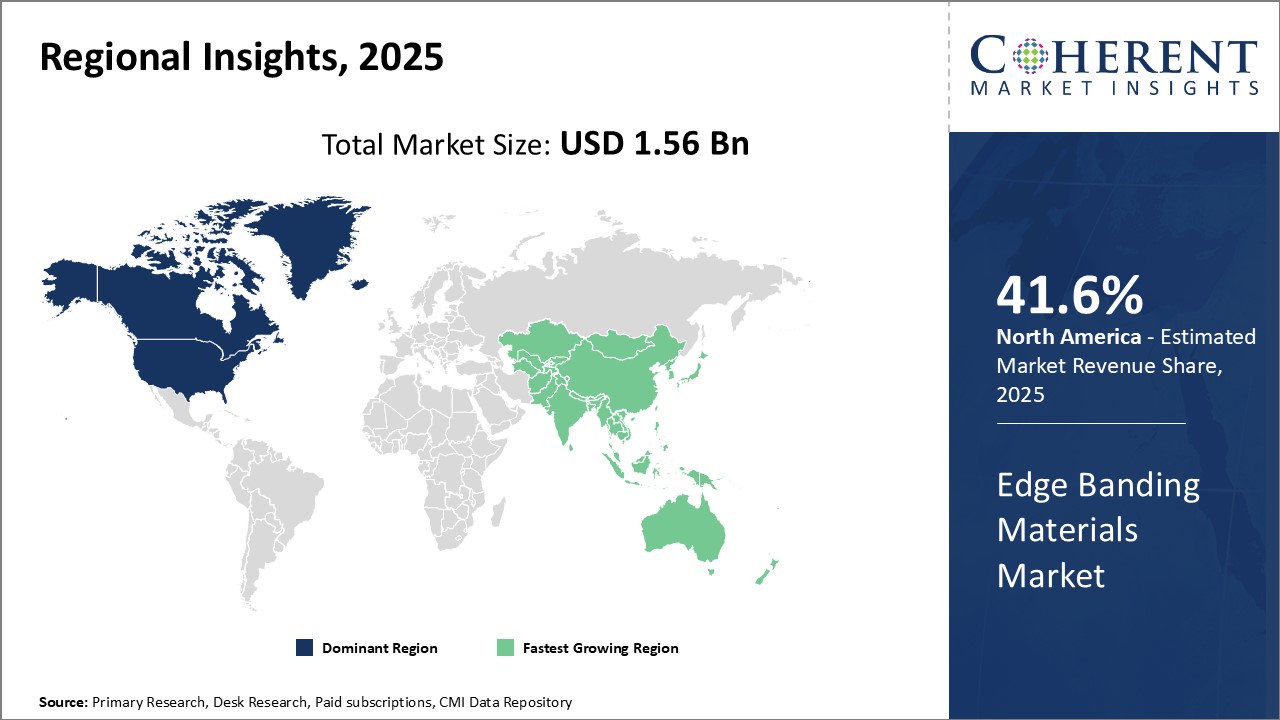

Global Edge Banding Materials Market is estimated to be valued at USD 1.56 Bn in 2025 and is expected to reach USD 3.00 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 1.56 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.80% | 2032 Value Projection: | USD 3.00 Bn |

Edge banding materials refer to narrow strips of material like plastic or wood that are applied to the edges of wood panels, boards, and doors. They help protect the exposed edges from damage and also enhance the aesthetic appeal of the product. The global edge banding materials market has been growing steadily owing to the rising demand for furniture from the residential and commercial construction industries. As people are spending more time at home, they are investing in high-quality and aesthetically pleasing furniture which utilizes edge banding materials. Various materials like PVC, ABS, and wood have been used in edge banding based on their properties, availability, and price. Plastic-based materials are popular choices due to attributes like durability, water resistance, and variety of colors available. Going forward, the market is expected to be driven by growing urbanization and real estate development activities worldwide along with innovations in material properties.

Market Dynamics:

The global edge banding materials market is expected to witness healthy growth over the forecast period owing to several factors such as increasing construction of residential and commercial buildings worldwide, rising disposable income of the middle-class population, and growing demand for aesthetically appealing and durable furniture. Additionally, advancements in edge banding materials such as innovative designs, self-heal properties, scratch and water resistance, UV resistance, etc. are expanding the application scope of these materials, thereby propelling the market growth. However, fluctuating raw material prices coupled with high cost of plastic-based materials is expected to hinder market expansion. Also, stringent environmental regulations regarding plastic use may pose a challenge. Key opportunities lie in the growing popularity of online furniture shopping and demand for eco-friendly materials. Market players could gain by capitalizing on these opportunities through product differentiation and portfolio expansion.

Key Features of the Study:

- This report provides in-depth analysis of the global edge banding materials market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, and competitive strategies adopted by key players.

- It profiles key players in the global edge banding materials market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Liaoning Lituo Decoration Materials Co., Ltd., PRI Edgebanding, Maxave, Shanghai Fujuan Group Co., Ltd., Mobelkant, Edgebanding Services, Inc. (ESI), Hangzhou Yodean Import and Export Co., Ltd., Hangzhou Dawei Decorative Material Co., Ltd., Charter Industries, E3 GROUP, REHAU, Bhagyalaxmi Polymer Industries, Portakal, Richies, Huali, Pegasus, Asis Plywood Pvt. Ltd., Shirdi Industries, Mivaan Enterprises, and Pyramid Impex International

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global edge banding materials market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global edge banding materials market

Detailed Segmentation:

- Material Type Insights (Revenue, USD Bn, 2020 - 2032)

- PVC (Polyvinyl Chloride)

- ABS (Acrylonitrile Butadiene Styrene)

- Melamine

- Wood Veneer

- Others

- Application Insights (Revenue, USD Bn, 2020 - 2032)

- Furniture

- Cabinetry

- Flooring

- Others

- By Regional Insights (Revenue, USD Bn 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Liaoning Lituo Decoration Materials Co., Ltd.

- PRI Edgebanding

- Maxave

- Shanghai Fujuan Group Co., Ltd.

- Mobelkant

- Edgebanding Services, Inc. (ESI)

- Hangzhou Yodean Import and Export Co., Ltd.

- Hangzhou Dawei Decorative Material Co., Ltd.

- Charter Industries

- E3 GROUP

- REHAU

- Bhagyalaxmi Polymer Industries

- Portakal

- Richies

- Huali

- Pegasus

- Asis Plywood Pvt. Ltd.

- Shirdi Industries

- Mivaan Enterprises

- Pyramid Impex International

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Material Type

- Market Snippet, By Application

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Application Trend

4. Global Edge Banding Materials Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Edge Banding Materials Market - COVID-19

- Impact Analysis

5. Global Edge Banding Materials Market, By Material Type, 2020-2032 (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- PVC (Polyvinyl Chloride)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- ABS (Acrylonitrile Butadiene Styrene)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Melamine

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Wood Veneer

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Others

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

6. Global Edge Banding Materials Market, By Application, 2020-2032 (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Furniture

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Cabinetry

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Flooring

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Others

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

7. Global Edge Banding Materials Market, By Region, 2020-2032 (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- North America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Countries

- U.S.

- Canada

- Latin America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Countries

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Countries

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Countries

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Sub-regions/Countries

- Israel

- GCC Countries

- Rest of the Middle East

- Africa

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 - 2032

- Market Size and Forecast, By Material Type, 2020- 2032 (US$ Bn)

- Market Size and Forecast, By Application, 2020- 2032 (US$ Bn)

- Sub-regions/Countries

- South Africa

- North Africa

- Central Africa

8. Competitive Landscape

- Heat Map Analysis

- Market Share Analysis (3x3 Matrix)

- Company Profiles

- Liaoning Lituo Decoration Materials Co., Ltd.

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- PRI Edgebanding

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Maxave

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Shanghai Fujuan Group Co., Ltd.

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Mobelkant

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Edgebanding Services, Inc. (ESI)

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Hangzhou Yodean Import and Export Co., Ltd.

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Hangzhou Dawei Decorative Material Co., Ltd.

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Charter Industries

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- E3 GROUP

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- REHAU

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Bhagyalaxmi Polymer Industries

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Portakal

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Richies

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Huali

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Pegasus

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Asis Plywood Pvt. Ltd.

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Shirdi Industries

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Mivaan Enterprises

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Pyramid Impex International

- Company Overview

- Material Type Portfolio

- Recent Developments/Updates

- Liaoning Lituo Decoration Materials Co., Ltd.

9. Analyst Recommendation

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Section

- References

- Research Methodology

- About Us and Sales Contact