PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673958

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673958

U.S. Heavy Duty Construction Equipment Market, By Equipment Type, By Application, By Sales Channel

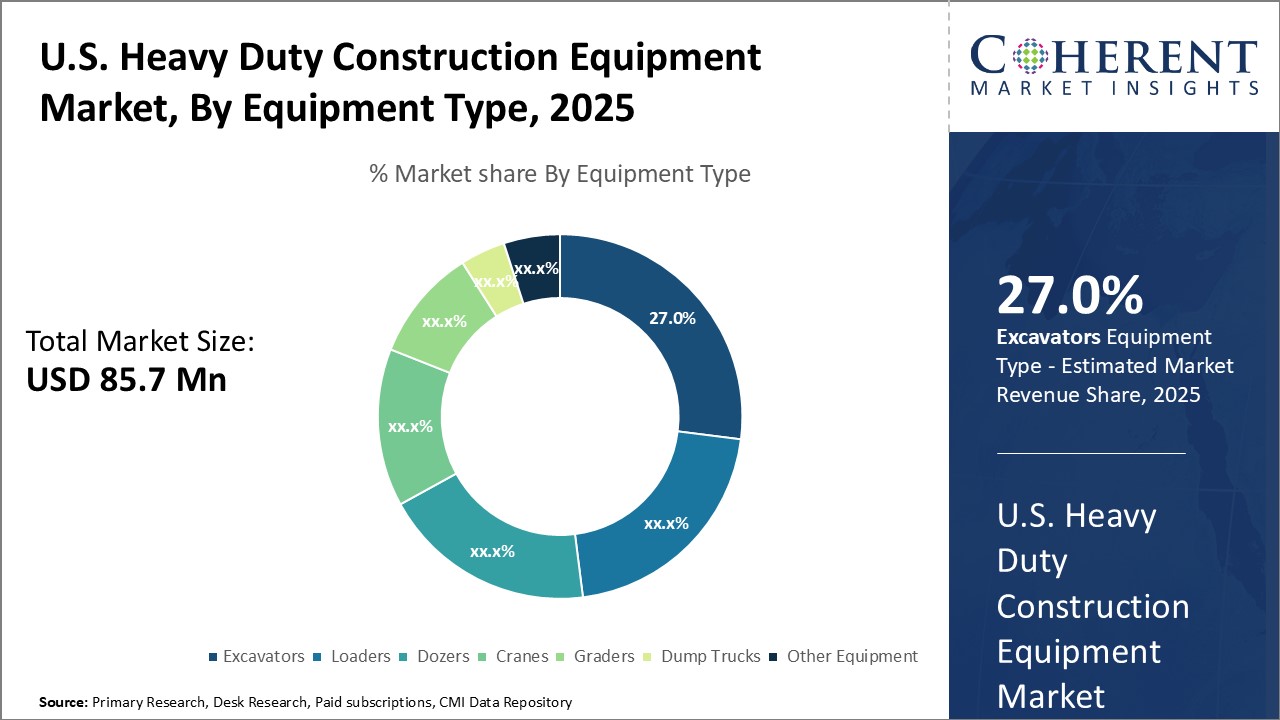

Global U.S. Heavy Duty Construction Equipment Market is estimated to be valued at USD 85.7 Mn in 2025 and is expected to reach USD 120.7 Mn by 2032, growing at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 85.7 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.00% | 2032 Value Projection: | USD 120.7 Mn |

The U.S. heavy duty construction equipment market has been witnessing steady growth over the past few years. Construction equipment refers to heavy- duty vehicles, specially designed for civil engineering and construction purposes. Some key heavy duty equipment used in construction activities includes excavators, loaders, backhoes, dozers, graders, scrapers, compactors, cranes and others. Growth in infrastructure projects related to roads, bridges, dams, airports and commercial buildings has significantly driven the demand for construction equipment such as earthmovers, material handlers and cranes. Furthermore, rapid urbanization and growth of residential and commercial construction have also propelled the need for heavy machinery that can efficiently complete projects within tight timelines. The entry of several new players in the market has intensified competition and pushed companies to focus on production of fuel-efficient and technologically advanced heavy equipment.

Market Dynamics:

The U.S. heavy duty construction equipment market has been experiencing steady growth owing to various driver such as growing investments in public infrastructure projects, increasing residential and commercial construction activities, and rapid urbanization. However, high initial purchase and operational costs associated with heavy duty machines continue to restraint market growth to some extent. Meanwhile, developments around connected equipment, autonomous machinery, and hybrid-electric technologies present lucrative opportunities for heavy equipment manufacturers to tap into. Adoption of alternative fuel such as CNG and LPG compatible equipment as well as development of equipment for renewable energy projects also offer new prospects. But fluctuations in crude oil prices and trade policies continue to pose challenges.

Key Features of the Study:

This report provides in-depth analysis of the U.S. heavy duty construction equipment market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the U.S. heavy duty construction equipment market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include AB Volvo, Atlas Copco, Caterpillar, Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore, Hitachi Construction Machinery Co. Ltd., Hyundai Construction Equipment Americas, Inc., JCB, Kobelco, Komatsu, Liebherr Group, SANY Group Company Ltd., Volvo Construction Equipment, and XCMG

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global U.S. heavy duty construction equipment market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global U.S. heavy duty construction equipment market.

Detailed Segmentation:

- By Equipment Type

- Excavators

- Loaders (Wheel Loaders, Skid-Steer Loaders, Backhoe Loaders)

- Dozers

- Cranes

- Graders

- Dump Trucks

- Other Equipment (Compactors, Pavers, Trenchers, etc.)

- By Application

- Infrastructure

- Commercial Construction

- Residential Construction

- Mining

- Oil & Gas

- Others (Agriculture, Forestry, etc.)

- By Sales Channel

- OEM (Original Equipment Manufacturers)

- Aftermarket

- Rental

- Key Players Insights

- AB Volvo

- Atlas Copco

- Caterpillar, Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Infracore

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Construction Equipment Americas, Inc.

- JCB

- Kobelco

- Komatsu

- Liebherr Group

- SANY Group Company Ltd.

- Volvo Construction Equipment

- XCMG

Table of Contents

1. RESEARCH OBJECTIVES AND ASSUMPTIONS

- Research Objectives

- Assumptions

- Abbreviations

2. MARKET PURVIEW

- Report Description

- Market Definition and Scope

- Executive Summary

- U.S. Heavy Duty Construction Equipment Market, By Equipment Type

- U.S. Heavy Duty Construction Equipment Market, By Application

- U.S. Heavy Duty Construction Equipment Market, By Sales Channel

3. MARKET DYNAMICS, REGULATIONS, AND TRENDS ANALYSIS

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. U.S. Heavy Duty Construction Equipment Market, By Equipment Type, 2025-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Excavators

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Loaders (Wheel Loaders, Skid-Steer Loaders, Backhoe Loaders)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Dozers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Cranes

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Graders

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Dump Trucks

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Other Equipment (Compactors, Pavers, Trenchers, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

5. U.S. Heavy Duty Construction Equipment Market, By Application , 2025-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Infrastructure

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Commercial Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Residential Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Mining

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Oil & Gas

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Others (Agriculture, Forestry, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

6. U.S. Heavy Duty Construction Equipment Market, By Sales Channel, 2025-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- OEM (Original Equipment Manufacturers)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Aftermarket

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Rental

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

7. COMPETITIVE LANDSCAPE

- AB Volvo

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Atlas Copco

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Caterpillar, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CNH Industrial N.V.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Deere & Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Doosan Infracore

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Hitachi Construction Machinery Co. Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Hyundai Construction Equipment Americas, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- JCB

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Kobelco

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Komatsu

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Liebherr Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- SANY Group Company Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Volvo Construction Equipment

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- XCMG

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us