PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708543

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708543

Petroleum Liquid Feedstock Market, By Feedstock Type, By Application, By Geography

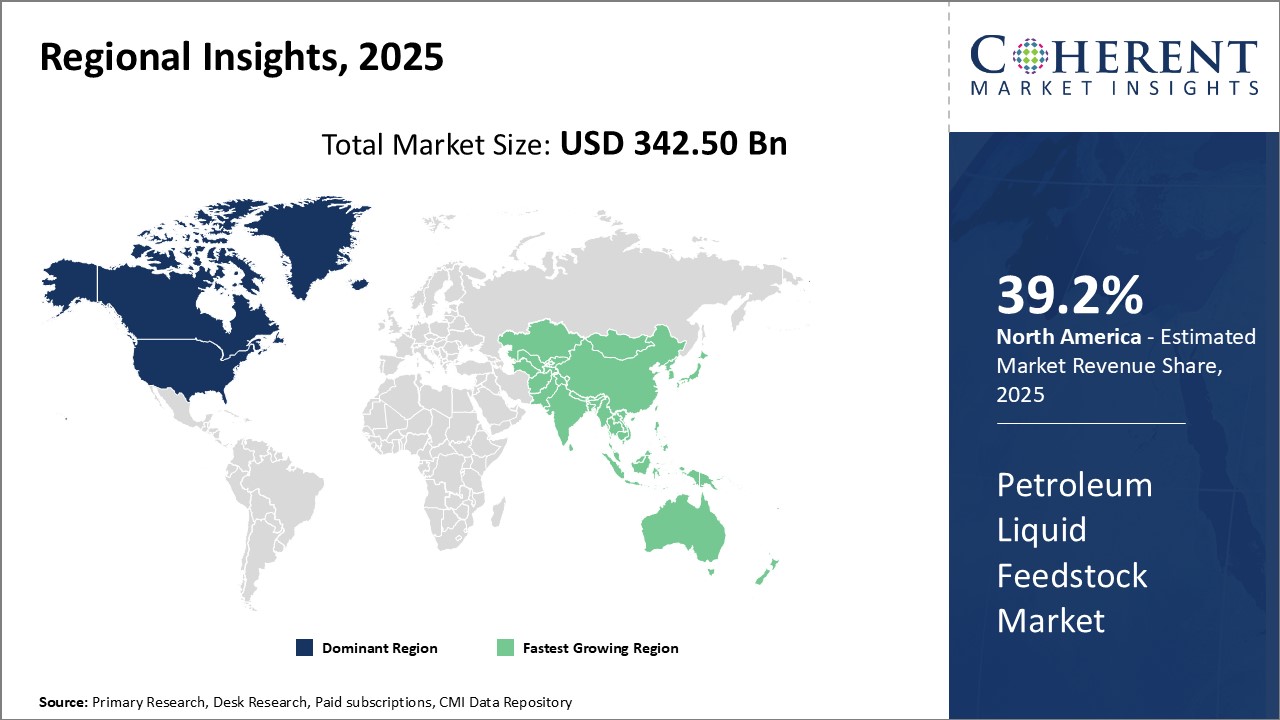

Global Petroleum Liquid Feedstock Market is estimated to be valued at USD 342.50 Bn in 2025 and is expected to reach USD 472.69 Bn by 2032, growing at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 342.50 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 4.70% | 2032 Value Projection: | USD 472.69 Bn |

The global petroleum liquid feedstock market has been witnessing significant growth over the past few years owing to the growing demand for refined petroleum products across various end-use industries. Petroleum liquid feedstock such as naphtha, gas oil, and others are important raw materials used in the production of petrochemicals and refined petroleum products like gasoline, diesel, and other fuels. With rapid industrialization and urbanization in emerging economies, the energy demand has increased substantially, driving the need for petroleum refineries worldwide. Moreover, various government initiatives focused on improving national energy security through domestic oil production has boosted investments in new refining facilities. The market is expected to further expand going forward with rising crude oil consumption globally.

Market Dynamics:

The global petroleum liquid feedstock market is driven by factors such as growing demand for gasoline and other refined petroleum fuels from the transportation sector. Rapid industrial growth especially in the Asia Pacific region boosting petrochemical production, rising investment in new greenfield refineries, and expansion of existing refineries. However, the market growth can be restricted due to stringent environmental regulations curbing emissions from fuel combustion, increasing focus on renewable energy sources, and geopolitical tensions affecting crude oil supply. On the positive side, technological advancements in refinery processes improving yields and developing unconventional oil and gas reserves creating new feedstock sources present key opportunities for the market players over the coming years.

Key Features of the Study:

- This report provides in-depth analysis of the global petroleum liquid feedstock market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global petroleum liquid feedstock market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include ExxonMobil Corporation, Chevron Phillips Chemical Company, China National Petroleum Corporation (CNPC), Royal Dutch Shell, BP plc (British Petroleum), Sinopec (China Petroleum & Chemical Corporation), TotalEnergies SE, Lukoil, Eni S.p.A., ConocoPhillips, Marathon Petroleum Corporation, Valero Energy Corporation, Repsol S.A., Petroleo Brasileiro S.A. (Petrobras), Phillips 66, HollyFrontier Corporation, Indian Oil Corporation Limited, PetroChina Company Limited, EOG Resources, Inc., and Occidental Petroleum Corporation

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global petroleum liquid feedstock market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global petroleum liquid feedstock market

Detailed Segmentation:

- Feedstock Type Insights (Revenue, USD Bn, 2020 - 2032)

- Crude Oil

- Natural Gas Liquids (NGLs)

- Refinery Residues

- Application Insights (Revenue, USD Bn, 2020 - 2032)

- Gasoline Production

- Diesel/Jet Fuel Production

- Petrochemicals Production

- Others

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- ExxonMobil Corporation

- Chevron Phillips Chemical Company

- China National Petroleum Corporation (CNPC)

- Royal Dutch Shell

- BP plc (British Petroleum)

- Sinopec (China Petroleum & Chemical Corporation)

- TotalEnergies SE

- Lukoil

- Eni S.p.A.

- ConocoPhillips

- Marathon Petroleum Corporation

- Valero Energy Corporation

- Repsol S.A.

- Petroleo Brasileiro S.A. (Petrobras)

- Phillips 66

- HollyFrontier Corporation

- Indian Oil Corporation Limited

- PetroChina Company Limited

- EOG Resources, Inc.

- Occidental Petroleum Corporation

Table of Contents

1. RESEARCH OBJECTIVES AND ASSUMPTIONS

- Research Objectives

- Assumptions

- Abbreviations

2. MARKET PURVIEW

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Petroleum Liquid Feedstock Market, By Feedstock Type

- Global Petroleum Liquid Feedstock Market, By Application

3. MARKET DYNAMICS, REGULATIONS, AND TRENDS ANALYSIS

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Petroleum Liquid Feedstock Market, By Feedstock Type, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Crude Oil

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Natural Gas Liquids (NGLs)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Refinery Residues

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Petroleum Liquid Feedstock Market, By Application, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Gasoline Production

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Diesel/Jet Fuel Production

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Petrochemicals Production

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Petroleum Liquid Feedstock Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025,2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2020 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Feedstock Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. COMPETITIVE LANDSCAPE

- ExxonMobil Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Chevron Phillips Chemical Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- China National Petroleum Corporation (CNPC)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Royal Dutch Shell

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- BP plc (British Petroleum)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Sinopec (China Petroleum & Chemical Corporation)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- TotalEnergies SE

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Lukoil

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Eni S.p.A.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- ConocoPhillips

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Marathon Petroleum Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Valero Energy Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Repsol S.A.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Petroleo Brasileiro S.A. (Petrobras)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Phillips 66

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- HollyFrontier Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Indian Oil Corporation Limited

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PetroChina Company Limited

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- EOG Resources, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Occidental Petroleum Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us