PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708525

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708525

Industrial Air Compressor Market, By Type, By Application, By Geography

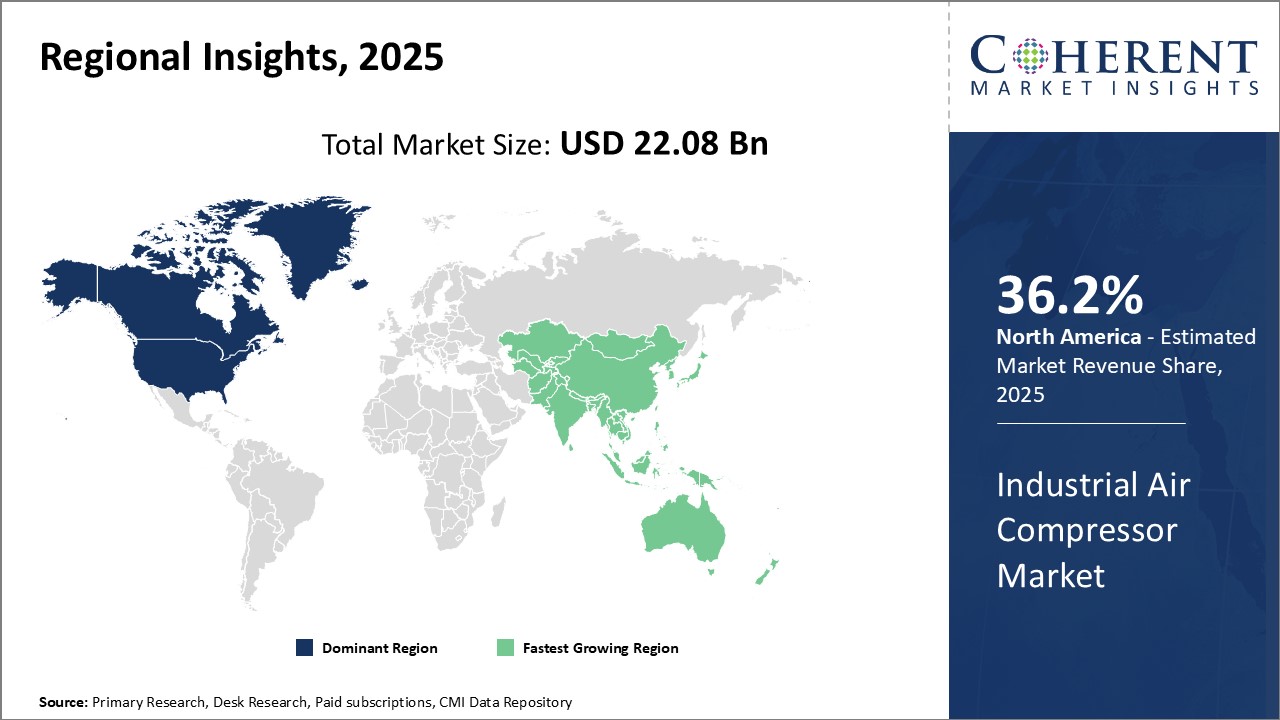

Global Industrial Air Compressor Market is estimated to be valued at USD 22.08 Bn in 2025 and is expected to reach USD 30.89 Bn by 2032, growing at a compound annual growth rate (CAGR) of 4.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 22.08 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 4.90% | 2032 Value Projection: | USD 30.89 Bn |

The global industrial air compressor market has been witnessing steady growth owing to their wide industrial applications. Air compressors help power pneumatic tools for applications ranging from construction to automotive manufacturing. They are also used as a source for compressed air needed to operate or actuate pneumatic and gas pressure equipment and control systems. Rapid industrialization and ongoing infrastructure development activities across major economies have significantly driven the demand for industrial air compressors. Furthermore, advancements in air compressor technology in terms of energy-efficiency and reduced maintenance requirements have expanded their usage. The growing adoption of automation across industries along with the need for uninterrupted workflow has further augmented the market growth. However, rising prices of raw materials may negatively impact the growth of the industrial air compressor market to some extent during the forecast period.

Market Dynamics:

The global industrial air compressor market is primarily driven by rapid industrialization and infrastructural development activities across emerging economies. Rapid urbanization and growing population have significantly boosted the construction volumes worldwide, which, in turn, has raised the demand for industrial air compressors used in pneumatic tools. Ongoing automation of manufacturing processes has also augmented the market growth as compressed air finds extensive applications in automated equipment. Major manufacturers are emphasizing on developing energy-efficient and low-maintenance air compressors to lower production costs for end users. This has increased the adoption rate of compressed air systems in various industries. However, high initial investment and growing raw material prices pose a threat to market expansion. On the other hand, increasing replacement demand from mature markets and emerging applications in food & beverage and power industries present lucrative opportunities for market players.

Key Features of the Study:

- This report provides in-depth analysis of the global industrial air compressor market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global industrial air compressor market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Ingersoll Rand, Atlas Copco, Sullair, Kaeser Kompressoren, Mitsubishi Heavy Industries Compressor Corp., Boge Compressors, Gardner Denver, FS-Curtis, Elgi Equipments, Hitachi Industrial Equipment Systems, Doosan Portable Power, Chicago Pneumatic, Fusheng, Hannover Messe, Graham Corporation, Airman, CompAir, DENAIR, VMAC, and Zhejiang Kaishan Compressor Co. Ltd.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global industrial air compressor market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global industrial air compressor market

Detailed Segmentation-

- Type Insights (Revenue, USD Bn, 2020 - 2032)

- Rotary Screw Compressors

- Piston Compressors

- Centrifugal Compressors

- Others

- Application Insights (Revenue, USD Bn, 2020 - 2032)

- Manufacturing

- Construction

- Automotive

- Oil & Gas

- Food & Beverage

- Others

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Ingersoll Rand

- Atlas Copco

- Sullair

- Kaeser Kompressoren

- Mitsubishi Heavy Industries Compressor Corp.

- Boge Compressors

- Gardner Denver

- FS-Curtis

- Elgi Equipments

- Hitachi Industrial Equipment Systems

- Doosan Portable Power

- Chicago Pneumatic

- Fusheng

- Hannover Messe

- Graham Corporation

- Airman

- CompAir

- DENAIR

- VMAC

- Zhejiang Kaishan Compressor Co. Ltd.

Table of Contents

1. RESEARCH OBJECTIVES AND ASSUMPTIONS

- Research Objectives

- Assumptions

- Abbreviations

2. MARKET PURVIEW

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Industrial Air Compressor Market, By Type

- Global Industrial Air Compressor Market, By Application

3. MARKET DYNAMICS, REGULATIONS, AND TRENDS ANALYSIS

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Industrial Air Compressor Market, By Type, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Rotary Screw Compressors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Piston Compressors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Centrifugal Compressors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Industrial Air Compressor Market, By Application, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Manufacturing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Automotive

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Oil & Gas

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Food & Beverage

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Industrial Air Compressor Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025,2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2020 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- Germany

- U.,K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. COMPETITIVE LANDSCAPE

- Ingersoll Rand

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Atlas Copco

- Sullair

- Kaeser Kompressoren

- Mitsubishi Heavy Industries Compressor Corp.

- Boge Compressors

- Gardner Denver

- FS-Curtis

- Elgi Equipments

- Hitachi Industrial Equipment Systems

- Doosan Portable Power

- Chicago Pneumatic

- Fusheng

- Hannover Messe

- Graham Corporation

- Airman

- CompAir

- DENAIR

- VMAC

- Zhejiang Kaishan Compressor Co. Ltd.

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us