PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708446

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708446

India Sustainable Biopolymers Market, By Material Type, By Application

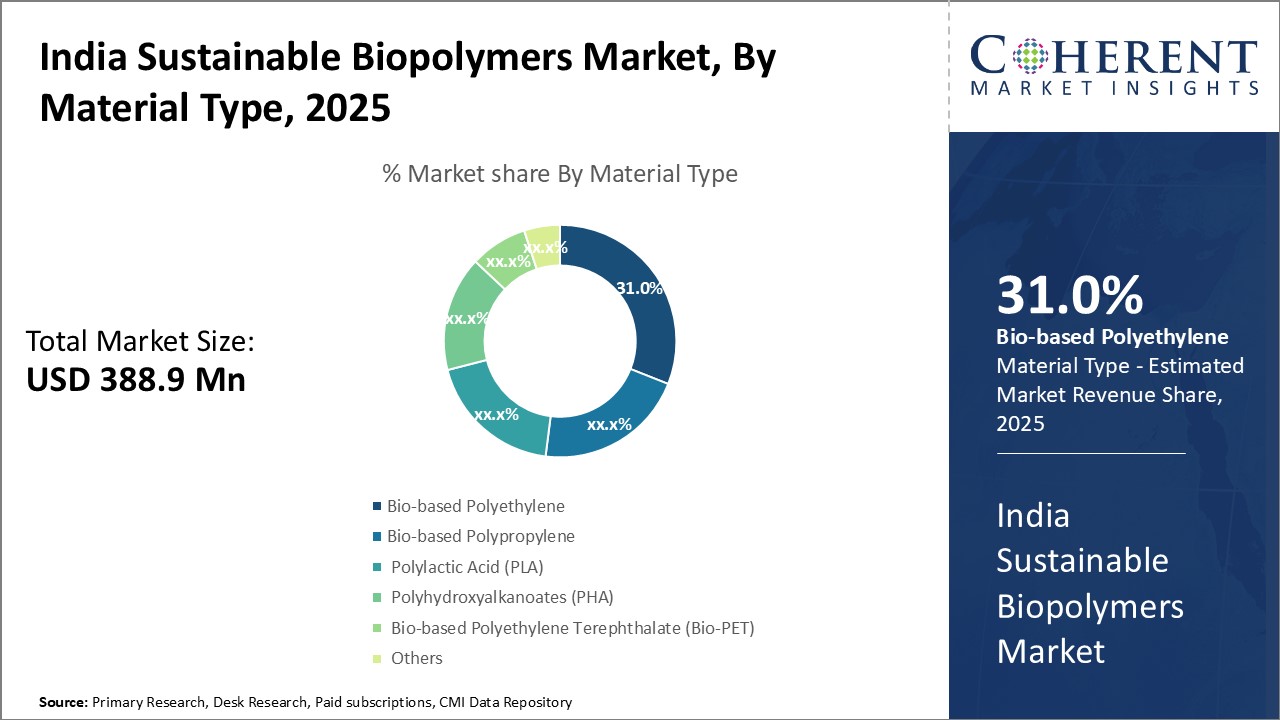

Global India Sustainable Biopolymers Market is estimated to be valued at USD 388.9 Mn in 2025 and is expected to reach USD 844.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 11.7% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 388.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 11.70% | 2032 Value Projection: | USD 844.2 Mn |

The sustainable biopolymers market in India is poised to grow significantly in the coming years. Biopolymers are derived from renewable bio-based resources and have a lower environmental impact than traditional plastics. Rising concern for environmental protection and stringent regulations around plastic waste have boosted the demand for biodegradable and sustainable alternatives. The Indian government is promoting the development and use of bioplastics through various initiatives. India has competitive advantages in the production of biopolymers owing to abundant availability of raw materials and lower costs. Key players are investing in R&D to develop innovative biopolymer products for applications in packaging, textiles, agriculture and automotive. The market is expected to witness rapid growth as sustainability gains increased importance in both public and private sectors.

Market Dynamics:

India sustainable biopolymers market growth is driven by several factors such as rising concerns over plastic waste, supportive government policies, and growth in end-use industries. However, high production costs and lack of awareness pose challenges to market players. Significant opportunities exist in the development of novel biopolymer formulations, collaborative research, and expanding applications beyond packaging.

Key drivers propelling market revenue growth include growing public and regulatory pressure to reduce dependency on petroleum-based plastics due to environmental pollution concerns. The Government of India has implemented strict regulations against single-use plastics and introduced incentives to promote the adoption of biodegradable alternatives. Moreover, increasing availability of raw materials such as sugar, starch and cellulose within the country provides a competitive cost advantage for domestic producers. Key challenges restricting rapid adoption are the high costs associated with developing biopolymer formulations and setting up production facilities. In addition, lack of consumer awareness regarding the benefits of sustainable alternatives poses a barrier. However, as production volumes increase, costs are likely to reduce significantly. The key opportunities lie in the introduction of technologically advanced product grades, research collaborations to expand application sectors, and developing economies of scale. As sustainability gains increasing business importance, major end-use industries such as packaging, food services, electronics and automotive are expected to drive the uptake of bioplastics over the forecast period.

Key features of the study:

- This report provides in-depth analysis of India sustainable biopolymers market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the India sustainable biopolymers market based on the following parameters company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include India Glycols Limited, SKYi FKuR Biopolymers Pvt Ltd, Bioplastics India, Biotecnika, Green Dot Bioplastics, EcoCocoon, Ecolife Recycling, Biopac India Corporation Ltd., Sree Sakthi Paper Mills, Aum Biofuels, Bioplastics Technology, Green Plastics, Eco-Friendly Bioplastics Pvt Ltd, Parakh Agro Industries Ltd., Sukhbir Agro Energy Ltd.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global India sustainable biopolymers market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global India sustainable biopolymers market.

Detailed Segmentation-

- By Material Type Insights (Revenue, USD Mn, 2020 - 2032)

- Bio-based Polyethylene

- Bio-based Polypropylene (Bio-PP)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Bio-based Polyethylene Terephthalate (Bio-PET)

- Others

- By Application Insights (Revenue, USD Mn, 2020 - 2032)

- Packaging

- Agriculture & Horticulture

- Textiles

- Automotive

- Electronics

- Others

- Key Players Insights

- India Glycols Limited

- SKYi FKuR Biopolymers Pvt Ltd

- Bioplastics India

- Biotecnika

- Green Dot Bioplastics

- EcoCocoon

- Ecolife Recycling

- Biopac India Corporation Ltd.

- Sree Sakthi Paper Mills

- Aum Biofuels

- Bioplastics Technology

- Green Plastics

- Eco-Friendly Bioplastics Pvt Ltd

- Parakh Agro Industries Ltd.

- Sukhbir Agro Energy Ltd.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- India Sustainable Biopolymers Market, By Material Type

- India Sustainable Biopolymers Market, By Application

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. India Sustainable Biopolymers Market, By Material Type, 2025-2032, (USD Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Bio-based Polyethylene

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Bio-based Polypropylene (Bio-PP)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Polylactic Acid (PLA)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Polyhydroxyalkanoates (PHA)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Bio-based Polyethylene Terephthalate (Bio-PET)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

5. India Sustainable Biopolymers Market, By Application, 2025-2032, (USD Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Packaging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Agriculture & Horticulture

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Textiles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Automotive

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Electronics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Mn)

6. Competitive Landscape

- India Glycols Limited

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- SKYi FKuR Biopolymers Pvt Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Bioplastics India

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Biotecnika

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Green Dot Bioplastics

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- EcoCocoon

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ecolife Recycling

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Biopac India Corporation Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Sree Sakthi Paper Mills

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Aum Biofuels

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Bioplastics Technology

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Green Plastics

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Eco-Friendly Bioplastics Pvt Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Parakh Agro Industries Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Sukhbir Agro Energy Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

7. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

8. References and Research Methodology

- References

- Research Methodology

- About us