PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708325

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708325

Wealth Management Platform Market, By Advisory Mode, By Deployment, By End-use Industry, By Geography

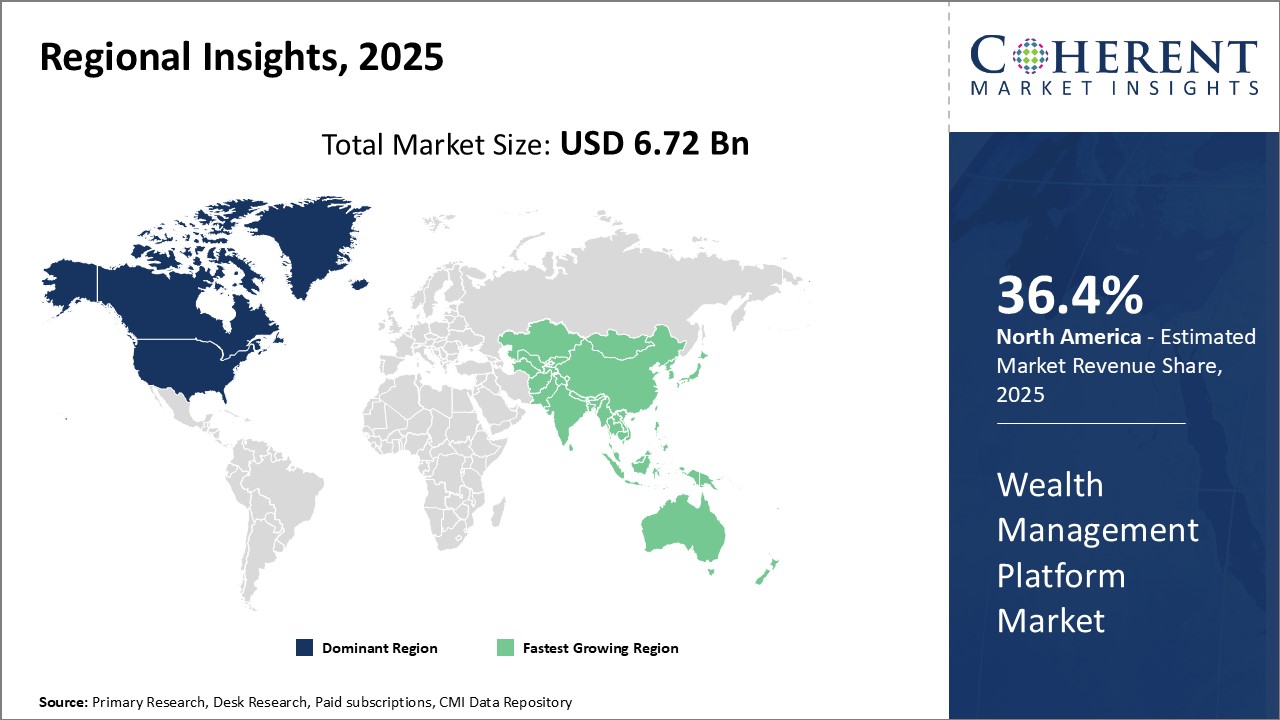

Global Wealth Management Platform Market is estimated to be valued at USD 6.72 Bn in 2025 and is expected to reach USD 17.88 Bn by 2032, growing at a compound annual growth rate (CAGR) of 15.0% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 6.72 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 15.00% | 2032 Value Projection: | USD 17.88 Bn |

The Global Wealth Management Platform Market is witnessing growth owing to rising high-net-worth individuals and growing demand for customized financial products and services. Wealth management platforms provide financial advisors and institutions with a centralized system to manage portfolios, perform financial planning, execute trades, generate reports, and conduct other operations. Major players are focusing on offering advanced digital wealth management platforms integrated with AI, predictive analytics, and robo-advisory capabilities to automate financial planning and portfolio management processes. Technological advancements in blockchain and cloud computing are further expected to transform wealth management operations and service delivery models in the coming years. While developed markets currently dominate the wealth tech space, emerging economies represent significant growth opportunities with increasing affluence and a young population seeking sophisticated wealth solutions.

Market Dynamics

The Global Wealth Management Platform Market is driven by the growing high net-worth population globally, rising demand for personalized financial services, and increasing adoption of robo-advisory and digital wealth platforms. High investment and maintenance costs associated with wealth management systems remain a key restraint. Cyber-security threats and data breaches also pose challenges. Meanwhile, opportunities lie in integrating AI, blockchain, and big data analytics into wealth platforms to automate more processes, lower costs, and improve client experiences. New entrants are launching cloud-based wealth solutions tailored for digital natives and mass affluent segments as well. Partnerships between fintechs and incumbent banks are further expanding the addressable market.

Key features of the study:

This report provides in-depth analysis of the global Wealth Management Platform Market and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

It profiles key players in the global Wealth Management Platform Market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

Key companies covered as a part of this study include Avaloq Group AG, Backbase, Broadridge Financial Solutions, Inc., Comarch SA, Dorsum Limited, FIS, Fiserv Inc., InvestCloud, InvestEdge, Inc., Profile Software, Prometeia, SEI Investments Company, SS & C Technologies, Inc., Tata Consultancy Services, and Temenos Headquarters SA

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

The global Wealth Management Platform Market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global Wealth Management Platform Market.

Detailed Segmentation:

- By Advisory Mode

- Human Advisory

- Robo Advisory

- Hybrid

- By Deployment

- Cloud-based

- On-premises

- By End-use Industry

- Banks

- Investment Management Firms

- Trading & Exchange Firms

- Brokerage Firms

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Key Players Insights

- Avaloq Group AG

- Backbase

- Broadridge Financial Solutions, Inc.

- Comarch SA

- Dorsum Limited

- FIS

- Fiserv Inc.

- InvestCloud

- InvestEdge, Inc.

- Profile Software

- Prometeia

- SEI Investments Company

- SS & C Technologies, Inc.

- Tata Consultancy Services

- Temenos Headquarters SA

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Advisory Mode

- Market Snippet, By Deployment

- Market Snippet, By End-use Industry

- Market Snippet, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Wealth Management Platform Market, By Advisory Mode, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Human Advisory

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Robo Advisory

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Hybrid

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

5. Global Wealth Management Platform Market, By Deployment, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Cloud-based

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- On-premises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

6. Global Wealth Management Platform Market, By End-use Industry, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Banks

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Investment Management Firms

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Trading & Exchange Firms

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Brokerage Firms

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Others

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

7. Global Wealth Management Platform Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Advisory Mode, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Advisory Mode, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Advisory Mode, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Advisory Mode, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Advisory Mode, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- South Africa

- Israel

- GCC Countries

- Rest of the Middle East & Africa

8. Competitive Landscape

- Company Profiles

- Avaloq Group AG

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Backbase

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Broadridge Financial Solutions, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Comarch SA

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Dorsum Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- FIS

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Fiserv Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- InvestCloud

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- InvestEdge, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Profile Software

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Prometeia

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- SEI Investments Company

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- SS & C Technologies, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Tata Consultancy Services

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Temenos Headquarters SA

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Avaloq Group AG

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Research Methodology

- References

- Research Methodology

- About us and Sales Contact