PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674197

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674197

Animal Feed Additives Market, By Product Type, By Livestock, By Geography

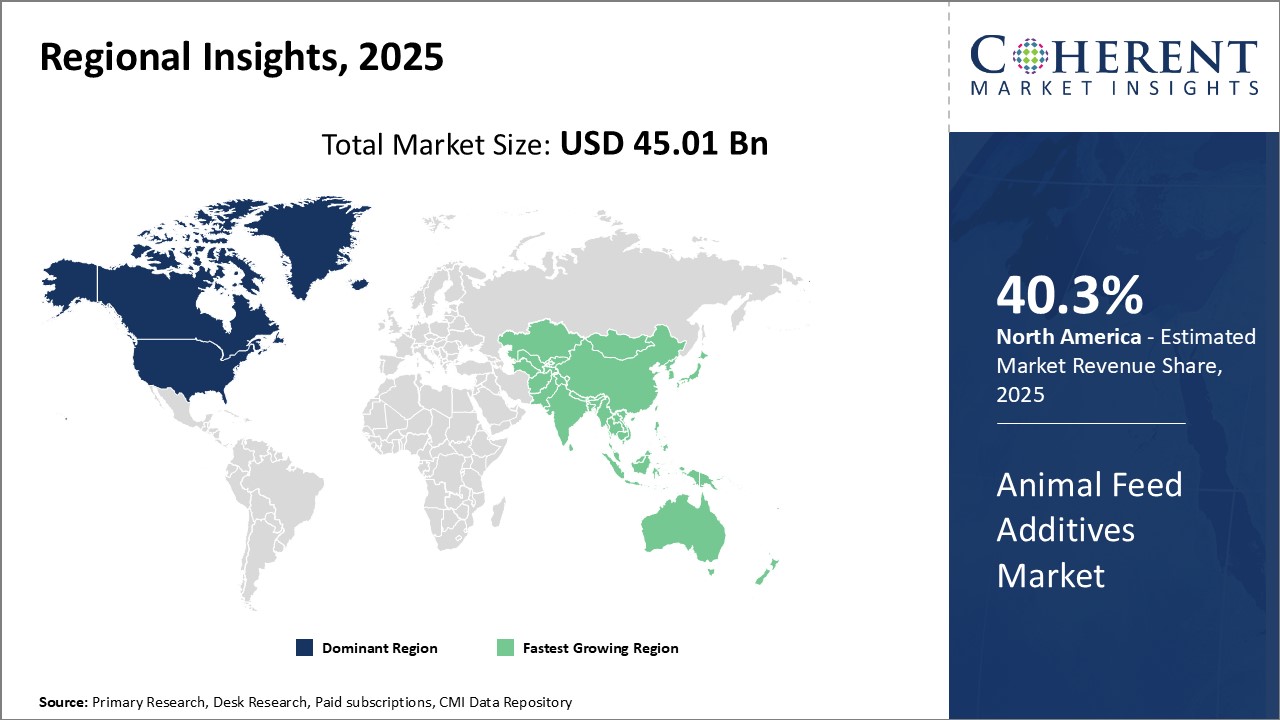

Global Animal Feed Additives Market is estimated to be valued at USD 45.01 Bn in 2025 and is expected to reach USD 57.69 Bn by 2032, growing at a compound annual growth rate (CAGR) of 3.6% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 45.01 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 3.60% | 2032 Value Projection: | USD 57.69 Bn |

The animal feed additives market has witnessed significant growth over the past few decades. Feed additives are substances, microbiological cultures, or premixes added to animal feed to improve the quality of feed and enhance the nutrient pool. They help maximize feed efficiency and support animals' growth, immune system, and general well-being. Addition of nutrients and supplements improves digestion and metabolism in livestock and poultry. They are extensively used in the nutritional fortification of aquaculture and pet foods as well. Rising demand for animal-based products and adoption of intensive farming practices have traditionally driven the adoption of feed additives. Novel technologies for the development of synergistic and species-specific additives continue to expand the scope of their applications in the poultry, cattle, swine, aquaculture, and other animal feed industries.

Market Dynamics:

Population growth worldwide has significantly boosted the demand for animal-derived food products in recent decades. This has increased pressure on farmers and feed producers to optimize feed nutrition and efficiency to meet the growing protein requirements. Feed additives help achieve higher feed conversion rates and production yields per animal. Furthermore, frequent outbreaks of epidemics and the need to comply with stringent livestock welfare standards have amplified focus on functionality additives for immunity support and gut health. However, varying regulatory directives regarding maximum residue limits of different additives pose challenges. Also, growing preference for antibiotic-free and natural feed ingredients may restrain the demand for conventional synthetic growth promoters to some extent. Meanwhile, the development of innovative delivery systems, novel sources of prebiotics and probiotics, and additives targeting specific disorders and diseases present multifarious opportunities in this dynamic space.

Key Features of the Study:

- This report provides in-depth analysis of the global animal feed additives market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (20244-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global animal feed additives market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include DSM, BIOMIN Holding GmbH, Ajinomoto Co., Inc., ADM, Alltech, Inc., ANOVA Group, BASF SE, Cargill Inc., Centafarm SRL, Chr. Hansen Holding, Evonik Industries, HONG HA NUTRITION, International Flavors & Fragrances, Inc., Kemin Industries, Inc., Novozymes, Novus International, Inc., Olmix Group, and Solvay S.A.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global animal feed additives market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Detailed Segmentation-

- By Product Type:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Others

- By Livestock:

- Pork/Swine

- Poultry

- Cattle

- Aquaculture

- Others

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles:

- DSM

- BIOMIN Holding GmbH

- Ajinomoto Co., Inc.

- ADM

- Alltech, Inc.

- ANOVA Group

- BASF SE

- Cargill Inc.

- Centafarm SRL

- Chr. Hansen Holding

- Evonik Industries

- HONG HA NUTRITION

- International Flavors & Fragrances, Inc.

- Kemin Industries, Inc.

- Novozymes

- Novus International, Inc.

- Olmix Group

- Solvay S.A.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

- Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Product Type

- Market Snippet, By Livestock

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

2. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

3. Global Animal Feed Additives Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Animal Feed Additives Market

- Impact Analysis

4. Global Animal Feed Additives Market, By Product Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Antibiotics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Vitamins

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Antioxidants

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Amino Acids

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

5. Global Animal Feed Additives Market, By Livestock, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Pork/Swine

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Poultry

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Cattle

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Aquaculture

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

6. Global Animal Feed Additives Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021-2032

- North America

- Introduction

- Market Size and Forecast, By Product Type, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Livestock, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Product Type, 2020 - 2032, (US$ Bn))

- Market Size and Forecast, By Livestock, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Product Type, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Livestock, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Product Type, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Livestock, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Product Type, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Livestock, 2020 - 2032 (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- GCC Countries

- Israel

- Rest of Middle East & Africa

7. Competitive Landscape

- Market Share Analysis

- Company Profiles

- DSM

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- BIOMIN Holding GmbH

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Ajinomoto Co., Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- ADM

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Alltech, Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- ANOVA Group

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- BASF SE

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Cargill Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Centafarm SRL

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Chr. Hansen Holding

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Evonik Industries

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- HONG HA NUTRITION

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- International Flavors & Fragrances, Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Kemin Industries, Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Novozymes

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Novus International, Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Olmix Group

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Solvay S.A.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- DSM

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. Section

- References

- Research Methodology

- About Us and Sales Contact