PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673917

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1673917

Cryptocurrency Market, By Component, By Type, By Vertical, By Geography

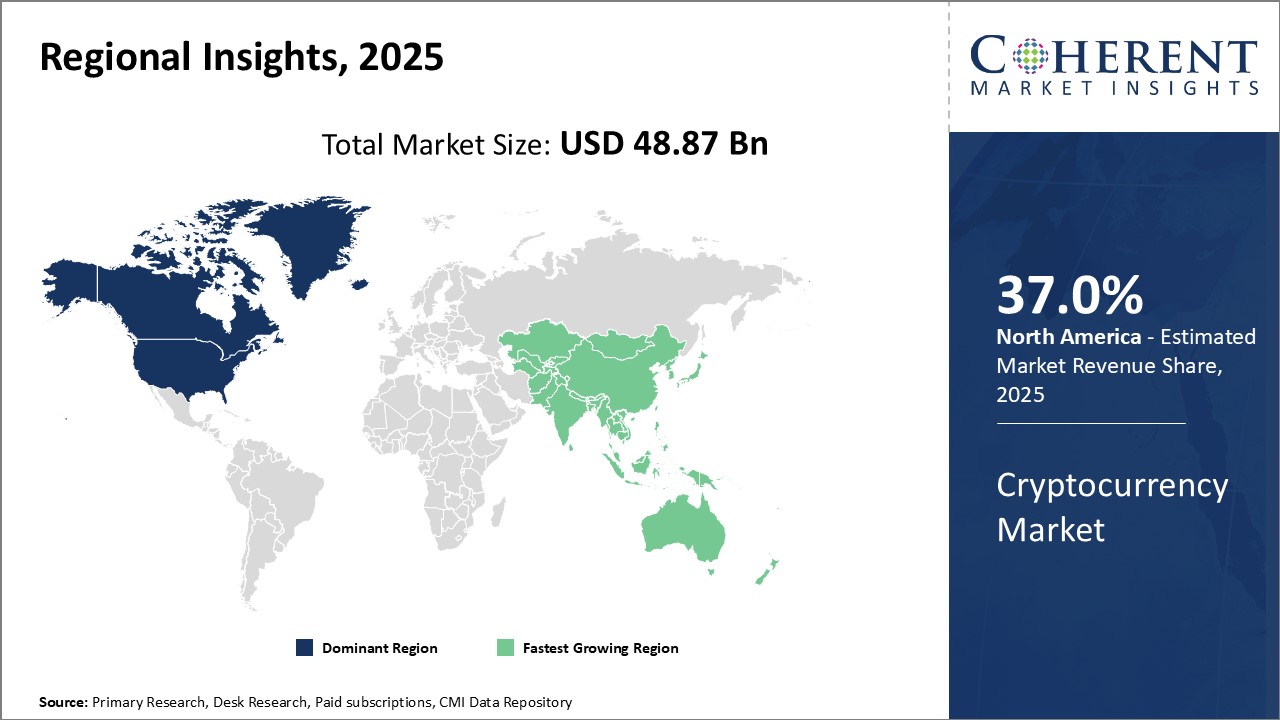

Global Cryptocurrency Market is estimated to be valued at USD 48.87 Bn in 2025 and is expected to reach USD 73.04 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 48.87 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.90% | 2032 Value Projection: | USD 73.04 Bn |

The global cryptocurrency market has witnessed substantial growth in the past few years. Cryptocurrencies are digital or virtual currencies that use cryptography for security and decentralization. The concept of cryptocurrency was introduced in 2009 with the launch of Bitcoin, which sparked the era of virtual currencies. Cryptocurrencies allow peer-to-peer transactions through a decentralized network without requiring any intermediaries like banks. Some key factors that have driven the adoption of cryptocurrencies globally include their anonymity in transactions, decentralized control, ease of access through digital wallets, and limited role of governments. However, cryptocurrencies also face challenges around regulatory concerns, price volatility, computational power requirements, and threat from hackers.

Market Dynamics:

The global cryptocurrency market is primarily driven by the rising adoption of Blockchain technology across various sectors, investments from large institutions in digital assets, growing millennial interest in digital currencies, and efforts by industry players to expand crypto utilities via platforms and protocols. However, the market faces restraints from regulatory uncertainties around cryptocurrencies in major economies, concerns regarding use of crypto in illicit activities, and environmental impacts associated with mining activities. Meanwhile, opportunities include continued innovation in the decentralized finance space, integration of cryptocurrencies in payment solutions, and growing institutional investments in the asset class. The COVID-19 pandemic has also provided an unexpected boost to digital currencies as more people explore contactless payment options.

Key Features of the Study:

- This report provides in-depth analysis of the global cryptocurrency market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global cryptocurrency market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Argo Blockchain, Bit Digital, Inc., BITMAIN Technologies Holding Company, Braiins Systems s.r.o., Canaan Inc., Core Scientific, F2Pool, Genesis Mining Ltd., HIVE Blockchain Technologies Ltd., Hut 8 Mining Corp., iMining Technologies Inc., MinerGate, Miningstore, Riot Blockchain, Inc., and ASICminer Company

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global cryptocurrency market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global cryptocurrency market

Detailed Segmentation:

- By Component

- Hardware

- Software

- By Type

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Others

- By Vertical

- Banking

- Gaming

- Government

- Healthcare

- Retail & E-commerce

- Trading

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- Argo Blockchain

- Bit Digital, Inc.

- BITMAIN Technologies Holding Company

- Braiins Systems s.r.o.

- Canaan Inc.

- Core Scientific

- F2Pool

- Genesis Mining Ltd.

- HIVE Blockchain Technologies Ltd.

- Hut 8 Mining Corp.

- iMining Technologies Inc.

- MinerGate

- Miningstore

- Riot Blockchain, Inc.

- ASICminer Company

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Component

- Market Snippet, By Type

- Market Snippet, By Vertical

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Cryptocurrency Market, By Component, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Hardware

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Software

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

5. Global Cryptocurrency Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Bitcoin

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Bitcoin Cash

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Ethereum

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Litecoin

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Ripple

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Others

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

6. Global Cryptocurrency Market, By Vertical, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Banking

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Gaming

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Government

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Healthcare

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Retail & E-commerce

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Trading

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Others

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

7. Global Cryptocurrency Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Component, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Vertical, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Component, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Vertical, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.K.

- Germany

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Component, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Vertical, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Component, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Vertical, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Component, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Vertical, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

8. Competitive Landscape

- Company Profiles

- Argo Blockchain

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Bit Digital, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- BITMAIN Technologies Holding Company

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Braiins Systems s.r.o.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Canaan Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Core Scientific

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- F2Pool

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Genesis Mining Ltd.

- HIVE Blockchain Technologies Ltd.

- Hut 8 Mining Corp.

- iMining Technologies Inc.

- MinerGate

- Miningstore

- Riot Blockchain, Inc.

- ASICminer Company

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Research Methodology

- References

- Research Methodology

- About us and Sales Contact

"