PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708946

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708946

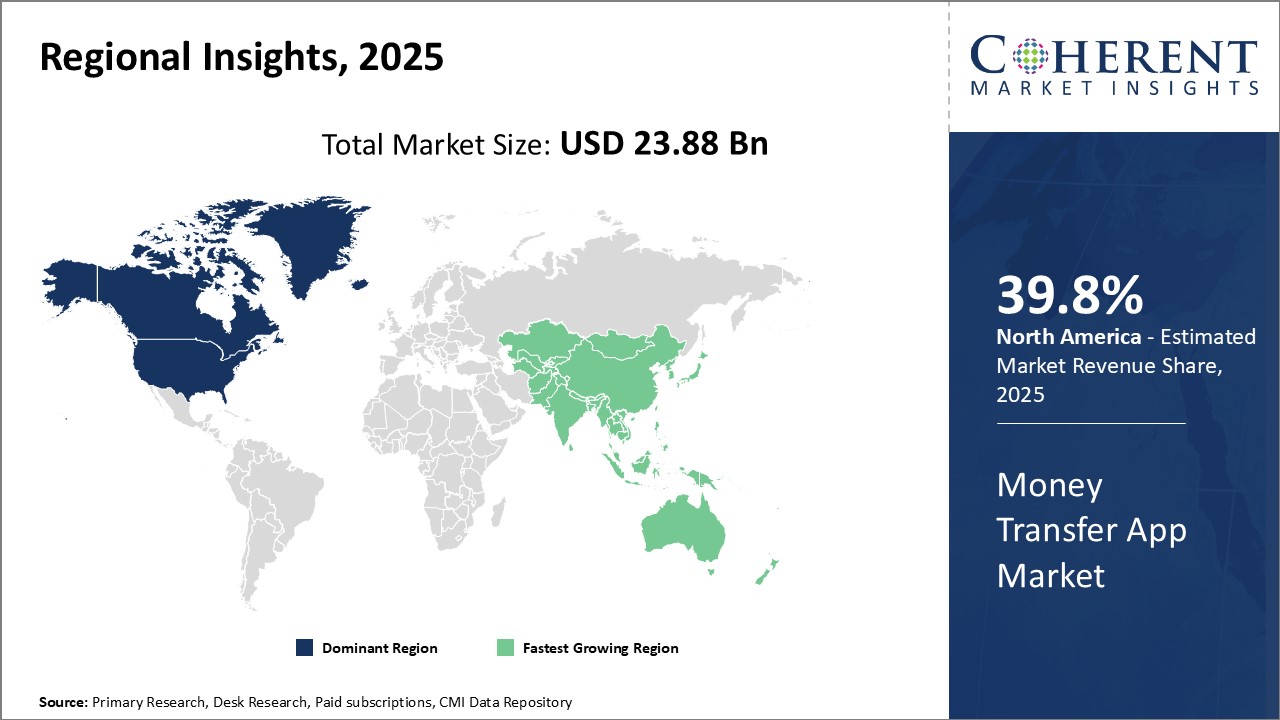

Money Transfer App Market, By Type (iOS and Android), By Applications (Enterprise and Personal), By Geography (North America, Latin America, Europe, Asia Pacific, Middle East & Africa)

Global Money Transfer App Market is estimated to be valued at USD 23.88 Bn in 2025 and is expected to reach USD 78.40 Bn by 2032, growing at a compound annual growth rate (CAGR) of 18.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 23.88 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 18.50% | 2032 Value Projection: | USD 78.40 Bn |

Global money transfer app market growth is driven by growing adoption of smartphones and high-speed internet connectivity across the globe. Mobile apps offer swift, convenient and cost-effective money transfer facilities for both personal and commercial use. These enable users to send and receive funds digitally from any location in just a few taps, thus, eliminating the need to visit money transfer agents or banks. Various international and domestic money transfer apps have also facilitated cross-border transactions, thus, boosting trade and commerce. Due to continued expansion of internet infrastructure and financial inclusion drives worldwide, the money transfer app market can witness growth in the near future.

Market Dynamics:

Global money transfer app market growth is driven by factors like rapid urbanization, rising smartphone penetration, growth of freelance economy, expanding migrant workforce and increasing digitization of financial services. However, cybersecurity threats pertaining to financial data theft and lack of trust in digital-only platforms continue can hamper the market growth. Block chain-powered remittance services and central bank digital currencies can offer significant growth opportunities. Partnerships between money transfer apps and enterprises can also offer growth opportunities.

Key features of the study:

- This report provides in-depth analysis of the global money transfer app market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global money transfer app market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Azimo, Cashq, Glint Pay, Insta-Rem, Leios, Moneygram, NetM, Noir Social Cash, NOW Money, OFX, Remitly, Remit2India, Revolut, Ria, Skrill.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- Global money transfer app market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global money transfer app market.

Detailed Segmentation:

- By Type

- iOS

- Android

- By Applications

- Enterprise

- Personal

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- Azimo

- Cashq

- Glint Pay

- Insta-Rem

- Leios

- Moneygram

- NetM

- Noir Social Cash

- NOW Money

- OFX

- Remitly

- Remit2India

- Revolut

- Ria

- Skrill

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By Applications

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Money Transfer App Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- iOS

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Android

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

5. Global Money Transfer App Market, By Applications, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Enterprise

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Personal

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

6. Global Money Transfer App Market, By Region, 2020-2032 (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- North America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Applications, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Applications, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.K.

- Germany

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Applications, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Applications, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Applications, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

7. Competitive Landscape

- Company Profiles

- Azimo

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cashq

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Glint Pay

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Insta-Rem

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Leios

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Moneygram

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NetM

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Noir Social Cash

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NOW Money

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- OFX

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Remitly

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Remit2India

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Revolut

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Ria

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Skrill

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Azimo

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. Reference and Research Methodology

- References

- Research Methodology

- About us and Sales Contact