PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674324

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674324

India Gin Market, By Type, By Price range, By Distribution Channel

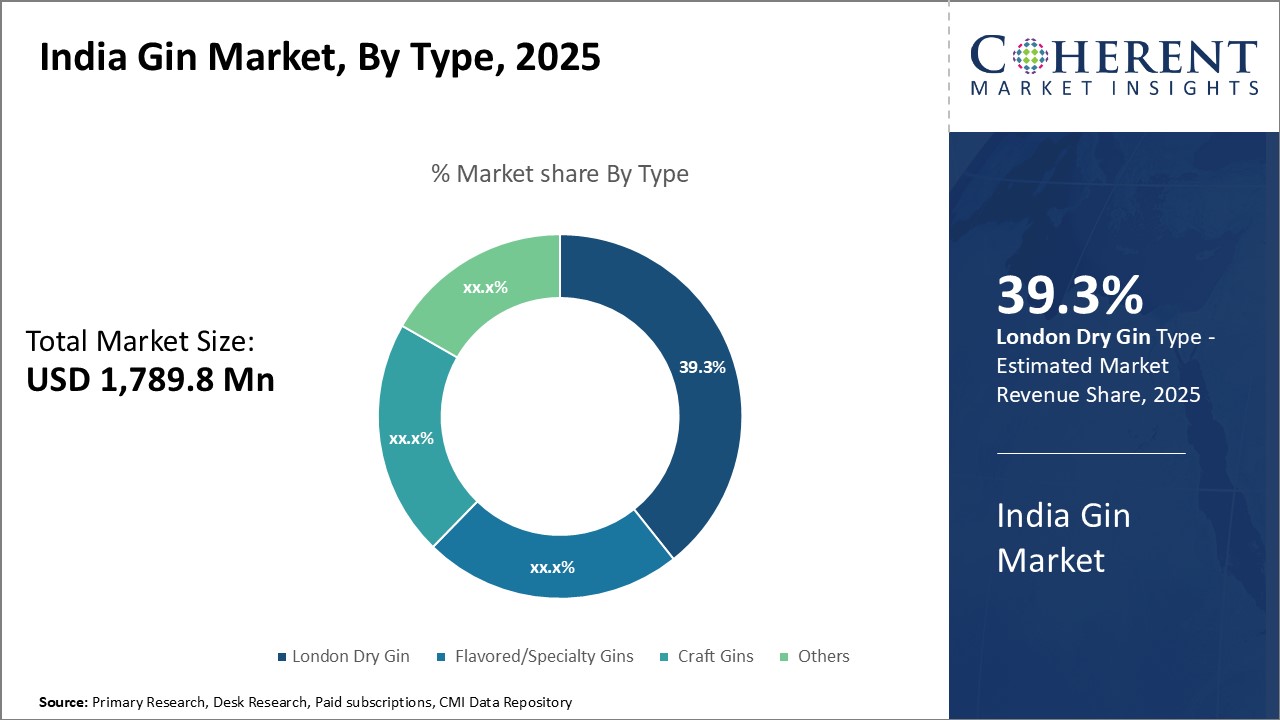

Global India Gin Market is estimated to be valued at USD 1,789.8 Mn in 2025 and is expected to reach USD 2,952.0 Mn by 2032, growing at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 1,789.8 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.40% | 2032 Value Projection: | USD 2,952.0 Mn |

The India gin market has seen steady growth over the past few years and is estimated to grow at a high rate in the coming years. Gin originated in the Netherlands in the 17th century as a medicinal liquor. Over time it gained popularity in Britain and became widely consumed. As globalization took place, British rule brought gin to India where it found some consumers but never became mainstream. In recent years, with rising disposable incomes, changing tastes towards international cocktails and liquors, and social media promoting exotic drinks, gin has entered the Indian market. Upscale bars and restaurants in metro cities started introducing craft and premium gin varieties on their menus, fueling initial growth. Meanwhile domestic gin production also began as distilleries realized an opportunity. The India gin market remains relatively small compared to whiskey but offers significant headroom for expansion as awareness and acceptance increases across target consumer segments.

Market Dynamics:

The India gin market is experiencing steady growth driven by several factors. Rising incomes and prosperity in big cities is increasing consumers' discretionary spending power and willingness to experiment with new premium beverages. Social media is amplifying awareness about gin-based cocktails and mixed drinks among young urban populations. Indians exposed to Western cultures during overseas travel and education are comfortable with gin and comfortable trying new variants back home. However, the market still faces restraints from traditional mindsets where gin is an unfamiliar foreign liquor. Women consumers in particular may face societal resistance. Meanwhile, establishing domestic production facilities and distribution networks for craft and artisanal gins requires heavy investment at initial stages. However, the emerging opportunity is attracting new entrants which will intensify future competition. Overall increasing exposure to globalization and evolving tastes are working in favor of The India gin market reaching its potential over the long term.

Key Features of the Study:

- This report provides an in-depth analysis of the India gin market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the India gin market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include United Spirits Limited, Tilaknagar Industries Limited, Deejay Distilleries Private Limited, SNHL India Private Limited, Jagatjit Industries Limited, Mohan Meakin Limited, Radico Khaitan Limited, Globus Spirits Limited, Allied Blenders and Distillers Pvt., SAB Millier, Khemani Group, SOM Distilleries and Breweries, Amrut Distilleries, Amber Distilleries Limited, Jaisalmer Indian Craft Gin, Terai India Dry Gin, NAO Spirits, Fullarton Distilleries, and Tanqueray.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The India gin market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the India gin market.

Detailed Segmentation-

- By Type:

- London Dry Gin

- Flavored/Specialty Gins

- Craft Gins

- Others (Old Tom Gin, Plymouth Gin, and Genever/Dutch Gin, etc.)

- By Price Range:

- Economy/Value Gin

- Mid-Range Gin

- Premium Gin

- By Distribution Channel:

- Liquor/Off-Trade Stores

- Bars, Pubs, and Restaurants

- Online/E-Commerce

- Company Profiles:

- United Spirits Limited

- Tilaknagar Industries Limited

- Deejay Distilleries Private Limited

- SNHL India Private Limited

- Jagatjit Industries Limited

- Mohan Meakin Limited

- Radico Khaitan Limited

- Globus Spirits Limited

- Allied Blenders and Distillers Pvt.

- SAB Millier

- Khemani Group

- SOM Distilleries and Breweries

- Amrut Distilleries

- Amber Distilleries Limited

- Jaisalmer Indian Craft Gin

- Terai India Dry Gin

- NAO Spirits

- Fullarton Distilleries

- Tanqueray

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By Price Range

- Market Snippet, By Distribution Channel

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

4. India Gin Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the India Gin Market

- Impact Analysis

5. India Gin Market, By Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- London Dry Gin

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Flavored/Specialty Gins

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Craft Gins

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Others (Old Tom Gin, Plymouth Gin, and Genever/Dutch Gin, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

6. India Gin Market, By Price Range, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Economy/Value Gin

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Mid-Range Gin

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Premium Gin

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

7. India Gin Market, By Distribution Channel, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Liquor/Off-Trade Stores

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Bars, Pubs, and Restaurants

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

- Online/E-Commerce

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Segment Trends

8. Competitive Landscape

- Market Share Analysis

- Company Profiles

- United Spirits Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Tilaknagar Industries Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Deejay Distilleries Private Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- SNHL India Private Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Jagatjit Industries Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Mohan Meakin Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Radico Khaitan Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Globus Spirits Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Allied Blenders and Distillers Pvt.

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- SAB Millier

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Khemani Group

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- SOM Distilleries and Breweries

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Amrut Distilleries

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Amber Distilleries Limited

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Jaisalmer Indian Craft Gin

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Terai India Dry Gin

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- NAO Spirits

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Fullarton Distilleries

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Tanqueray

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- United Spirits Limited

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Section

- References

- Research Methodology

- About Us and Sales Contact