PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707349

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707349

Factoring Services Market, By Application, By Enterprise Size, By Provider, By Industry Vertical, By Geography

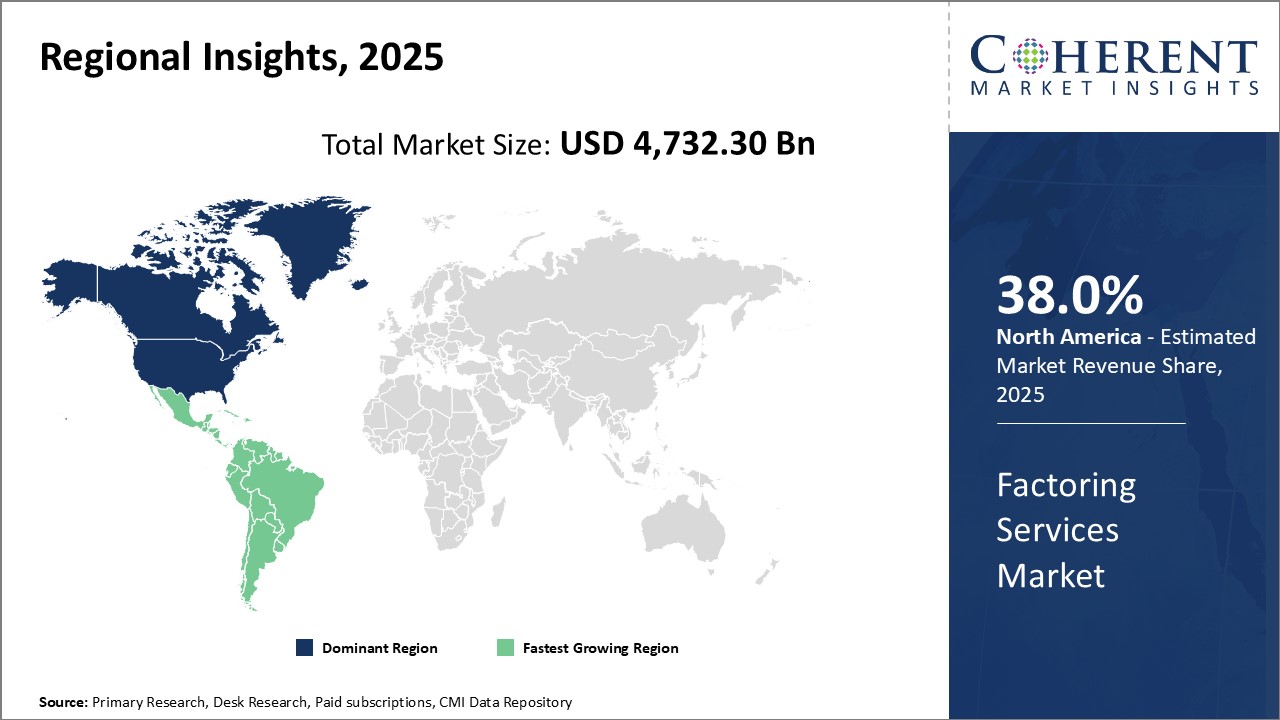

Global Factoring Services Market is estimated to be valued at USD 4,732.30 Bn in 2025 and is expected to reach USD 8,010.98 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 4,732.30 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 7.80% | 2032 Value Projection: | USD 8,010.98 Bn |

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and short-term financial needs. Through factoring, a business can obtain liquid funds without having to wait for the lengthy payment period for their customers or clients. This financial transaction allows businesses to improve their cash flow, reduce credit and risk exposure, and focus on their core operations. Factoring services provide an alternative source of working capital to many small and medium-sized enterprises.

Market Dynamics:

The global factoring services market growth is primarily driven by the working capital requirements of small and medium-sized businesses. As obtaining financing from banks can be a difficult and lengthy process for SMEs, factoring services provide them quick access to cash from their receivables. This addresses the cash flow issues faced by SMEs. Moreover, factoring allows businesses to transfer credit and debt collection risks to the factoring company. This spurs the demand for factoring especially among businesses dealing with a large number of customers with varying creditworthiness. However, factors may charge high-interest rates, commissions and penalties which can reduces the margins of businesses. Furthermore, businesses lose the chance of getting discounts if receivables are paid before the due date. Nonetheless, the growing SME sector worldwide is widening opportunities for growth of factoring services market.

Key features of the study:

- This report provides in-depth analysis of the global factoring services market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global factoring services market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include altLINE (The Southern Bank Company), Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation, Deutsche Factoring Bank, Eurobank, Factor Funding Co., Hitachi Capital (UK) PLC, HSBC Group, ICBC China, Kuke Finance, Mizuho Financial Group, Inc., RTS Financial Service, Inc., Societe Generale S.A., and TCI Business Capital

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global factoring services market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global factoring services market.

Detailed Segmentation

- By Application

- Domestic

- International

- By Enterprise Size

- Large Enterprises

- SMEs

- By Provider

- Banks

- NBFCs

- By Industry Vertical

- Construction

- Manufacturing

- Healthcare

- Transportation & Logistics

- Energy & Utilities

- IT & Telecom

- Staffing

- Others

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- altLINE (The Southern Bank Company)

- Barclays Bank PLC

- BNP Paribas

- China Construction Bank Corporation

- Deutsche Factoring Bank

- Eurobank

- Factor Funding Co.

- Hitachi Capital (UK) PLC

- HSBC Group

- ICBC China

- Kuke Finance

- Mizuho Financial Group, Inc.

- RTS Financial Service, Inc.

- Societe Generale S.A.

- TCI Business Capital

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Application

- Market Snippet, By Enterprise Size

- Market Snippet, By Provider

- Market Snippet, By Industry Vertical

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Factoring Services Market, By Application, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Domestic

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- International

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

5. Global Factoring Services Market, By Enterprise Size, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Segment Trends

- Large Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- SMEs

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

6. Global Factoring Services Market, By Provider, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Segment Trends

- Banks

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- NBFCs

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

7. Global Factoring Services Market, By Industry Vertical, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Segment Trends

- Construction

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Healthcare

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Transportation & Logistics

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Energy & Utilities

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Staffing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Others

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

8. Global Factoring Services Market, By Region, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- North America

- Regional Trends

- Market Size and Forecast, By Application, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Provider, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry Vertical, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Application, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Provider, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry Vertical, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Application, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Provider, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry Vertical, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Application, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Provider, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry Vertical, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Application, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Provider, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry Vertical, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- altLINE (The Southern Bank Company)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Barclays Bank PLC

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- BNP Paribas

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- China Construction Bank Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Deutsche Factoring Bank

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Eurobank

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Factor Funding Co.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hitachi Capital (UK) PLC

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- HSBC Group

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- ICBC China

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Kuke Finance

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Mizuho Financial Group, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- RTS Financial Service, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Societe Generale S.A.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- TCI Business Capital

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- altLINE (The Southern Bank Company)

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section

- References

- Research Methodology

- About us and Sales Contact