PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707497

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707497

Adhesive Tapes Market, By Resin, By Technology, By End User Industry, By Geography

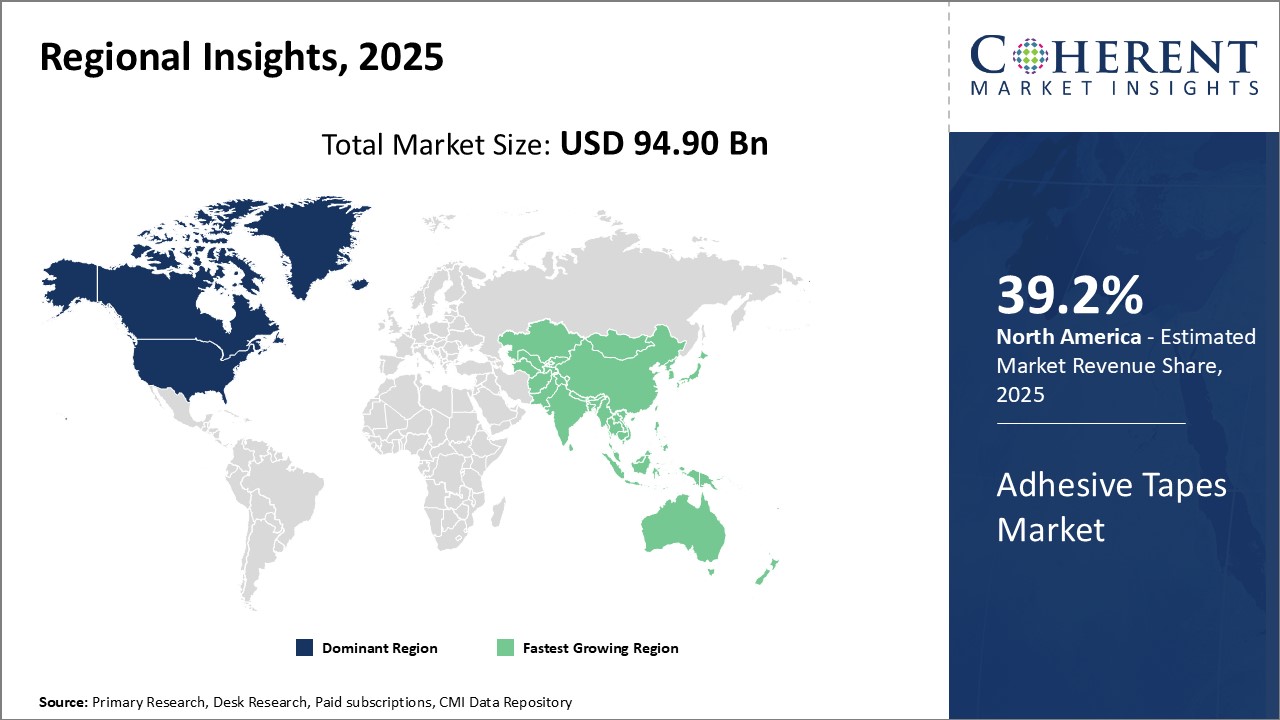

Global Adhesive Tapes Market is estimated to be valued at USD 94.90 Bn in 2025 and is expected to reach USD 141.84 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 94.90 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.90% | 2032 Value Projection: | USD 141.84 Bn |

The global adhesive tapes market has been witnessing significant growth in recent years. Adhesive tapes, also known as pressure-sensitive tapes, are versatile bonding and joining materials used across various applications due to their easy application and strong bond. Major factors driving the demand for adhesive tapes include growth of the packaging industry, increasing usage in electrical and electronics sector, and expansion of construction and automotive industries worldwide. Moreover, constant innovations in adhesive chemistry and tape backing materials along with the development of specialized tapes for newer applications have accelerated the market expansion. However, volatility in raw material prices poses a challenge.

Market Dynamics:

The growth of the global adhesive tapes market is driven by factors such as rising demand from the packaging sector, increasing usage in healthcare industry, and expansion of automotive production. The packaging industry has been a major consumer of adhesive tapes due to their effectiveness in sealing, holding, and bundling of packaging materials. Moreover, adhesive tapes find extensive applications in healthcare for dressings, medical devices, and other uses owing to their excellent bonding properties and hypoallergenic nature. The automotive sector is also contributing to market growth through increased utilization of adhesive tapes in vehicle interior and exterior applications. However, fluctuations in prices of raw materials such as acrylic, rubber, and silicone pose a challenge for market players. On the other hand, ongoing product innovations focusing on specialty tapes, development of bio-based adhesive tapes, and rising applications in electronics present lucrative growth opportunities for market expansion.

Key Features of the Study:

- This report provides an in-depth analysis of the global adhesive tapes market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global adhesive tapes market based on the following parameters company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include 3M, Avery Dennison Corporation, DuPont, HB Fuller Company, Henkel AG & Co, KGaA, Intertape Polymer Group, Lintec Corporation, Nitto Denko Corporation, OJI, Holding Corporation, Scapa Group Plc, Sekisui Chemical Co. Ltd, Shurtape Technologies LLC, Sika AG, TESA SE, L&L Products, Inc., Adchem Corporation, Avery Dennison Corporation, and Saint Gobain

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global adhesive tapes market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global adhesive tapes market

Detailed Segmentation-

- By Resin:

- Acrylic

- Epoxy

- Silicone

- Polyurethane

- Others

- By Technology:

- Water-based

- Solvent-based

- Hot Melt

- By End User Industry:

- Automotive

- Healthcare

- Packaging

- Electrical and Electronics

- Consumer/DIY

- Other End-user Industries

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles

- 3M

- Avery Dennison Corporation

- DuPont

- HB Fuller Company

- Henkel AG & Co

- KGaA

- Intertape Polymer Group

- Lintec Corporation

- Nitto Denko Corporation

- OJI

- Holding Corporation

- Scapa Group Plc

- Sekisui Chemical Co. Ltd

- Shurtape Technologies LLC

- Sika AG

- TESA SE

- L&L Products, Inc.

- Adchem Corporation

- Avery Dennison Corporation

- Saint Gobain

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Resin

- Market Snippet, By Technology

- Market Snippet, By End User Industry

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

4. Global Adhesive Tapes Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Adhesive Tapes Market

- Impact Analysis

5. Global Adhesive Tapes Market, By Resin, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Acrylic

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Epoxy

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Silicone

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Polyurethane

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

6. Global Adhesive Tapes Market, By Technology, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Water-based

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Solvent-based

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Hot Melt

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

7. Global Adhesive Tapes Market, By End User Industry, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Automotive

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Healthcare

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Packaging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Electrical and Electronics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Consumer/DIY

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Other End-user Industries

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

8. Global Adhesive Tapes Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021-2032

- North America

- Introduction

- Market Size and Forecast, By Resin, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Technology, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By End User Industry, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Resin, 2020 - 2032, (US$ Bn))

- Market Size and Forecast, By Technology, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By End User Industry, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Resin, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Technology, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By End User Industry, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Resin, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Technology, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By End User Industry, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Resin, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Technology, 2020 - 2032 (US$ Bn)

- Market Size and Forecast, By End User Industry, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- GCC Countries

- Israel

- Rest of Middle East & Africa

9. Competitive Landscape

- Market Share Analysis

- Company Profiles

- 3M

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Avery Dennison Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- DuPont

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- HB Fuller Company

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Henkel AG & Co

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- KGaA

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Intertape Polymer Group

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Lintec Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Nitto Denko Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- OJI

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Holding Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Scapa Group Plc

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Sekisui Chemical Co. Ltd

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Shurtape Technologies LLC

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Sika AG

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- TESA SE

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- L&L Products, Inc.

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Adchem Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Avery Dennison Corporation

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Saint Gobain

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- 3M

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section

- References

- Research Methodology

- About Us and Sales Contact