PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707384

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1707384

Off Price Retail Market, By Product Category, By Price Range, By Demographics, By Distribution Channel, By Geography

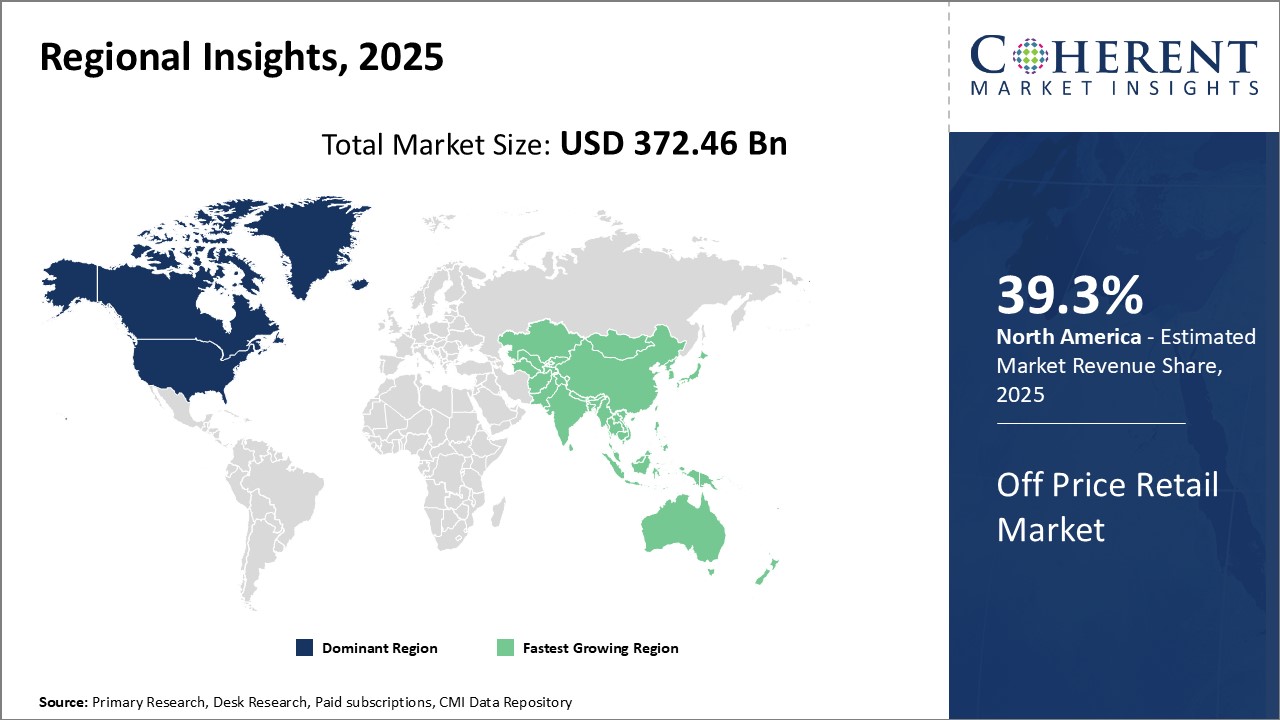

Global Off Price Retail Market is estimated to be valued at USD 372.46 Bn in 2025 and is expected to reach USD 668.30 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.7% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 372.46 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.70% | 2032 Value Projection: | USD 668.30 Bn |

The off-price retail market has experienced significant growth over the past decade. Off-price retailers offer name brand fashion merchandise at prices 20-60% lower than traditional retailers. They are able to achieve these lower prices through an inventory model that focuses on opportunistic buying - purchasing irregulars, canceled orders, and excess inventory from other retailers. This business model allows off-prices to offer constantly changing selections of top brands at discounted prices. As consumer incomes have stagnated in recent years while the variety and marketing of fashion items has increased, off-price shopping has grown in popularity as a way for customers to indulge their fashion interests affordably. Looking ahead, strategic expansion of store counts in existing and new markets combined with omnichannel capabilities is expected to drive further gains in the already sizable off-price retail sector.

Market Dynamics:

The off-price retail market is driven by consumers' increasing preference for value shopping and willingness to hunt for deals. However, rising supply chain costs and labor expenses pose restraints. Opportunities lie in advancing digital and omnichannel services. Surging inflation has boosted the appeal of discount shopping in 2022. Off-price retailers excel at sourcing irregular items and canceled orders, frequently updating inventories. Still, fluctuating product availability can frustrate some shoppers. Most major players like TJX Companies and Burlington have grown through new store openings, acquisitions, and e-commerce initiatives. But smaller chains struggle against industry giants. Overall, the convenience and thrill of the treasure hunt experience will keep drawing shoppers to off-price shops, supporting steady market expansion if cost pressures can be managed.

Key Features of the Study:

- This report provides an in-depth analysis of the global off-price retail market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global off-price retail market based on the following parameters company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include TJX Companies Inc., Ross Stores Inc., Burlington Stores Inc., Nordstrom Rack, Marshalls, DSW, Macy's Backstage, Century 21 Department Store, Saks OFF 5TH, Stein Mart Inc., Sierra Trading Post, Off Broadway Shoe Warehouse, Gordmans, Bealls Outlet, and Gabriel Brothers Inc.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global off-price retail market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global off-price retail market.

Detailed Segmentation-

- By Product Category:

- Apparel and Footwear

- Home Goods

- Electronics

- Beauty and Cosmetics

- Others

- By Price Range:

- Low-end

- Mid-range

- High-end

- By Demographics:

- Men

- Women

- Children

- By Distribution Channel:

- B2B

- B2C

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles

- TJX Companies Inc.

- Ross Stores Inc.

- Burlington Stores Inc.

- Nordstrom Rack

- Marshalls

- DSW

- Macy's Backstage

- Century 21 Department Store

- Saks OFF 5TH

- Stein Mart Inc.

- Sierra Trading Post

- Off Broadway Shoe Warehouse

- Gordmans

- Bealls Outlet

- Gabriel Brothers Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Product Category

- Market Snippet, By Price Range

- Market Snippet, By Demographics

- Market Snippet, By Distribution Channel

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

4. Global Off Price Retail Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Off Price Retail Market

- Impact Analysis

5. Global Off Price Retail Market, By Product Category, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Apparel and Footwear

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Home Goods

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Electronics

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Beauty and Cosmetics

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Others

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

6. Global Off Price Retail Market, By Price Range, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Low-end

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Mid-range

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- High-end

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

7. Global Off Price Retail Market, By Demographics, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020- 2032

- Segment Trends

- Men

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Women

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Children

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

8. Global Off Price Retail Market, By Distribution Channel, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Brick-and-Mortar Stores

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Online Retail

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

9. Global Off Price Retail Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2020-2032

- North America

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Price Range, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Demographics, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, (US$ Bn))

- Market Size and Forecast, By Price Range, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Demographics, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Price Range, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Demographics, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Price Range, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Demographics, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Product Category, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Price Range, 2020 - 2032 (US$ Bn)

- Market Size and Forecast, By Demographics, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Distribution Channel, 2020 - 2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020 - 2032, (US$ Bn)

- GCC Countries

- Israel

- Rest of Middle East & Africa

10. Competitive Landscape

- Market Share Analysis

- Company Profiles

- TJX Companies Inc.

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Ross Stores Inc.

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Burlington Stores Inc.

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Nordstrom Rack

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Marshalls

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- DSW

- Company Overview

- Product Portfolio

- Recent Developments/Updates

- Macy's Backstage

- Century 21 Department Store

- Saks OFF 5TH

- Stein Mart Inc.

- Sierra Trading Post

- Off Broadway Shoe Warehouse

- Gordmans

- Bealls Outlet

- Gabriel Brothers Inc.

- TJX Companies Inc.

11. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. Section

- References

- Research Methodology

- About Us and Sales Contact