PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672839

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672839

Buy Now Pay Later Platforms Market, By Channel (Point of Sale (POS) and Online), By Enterprise Type (SMEs and Large Enterprises), By Category, By Geography (North America, Europe, Asia Pacific, Latin America, Middle East and Africa)

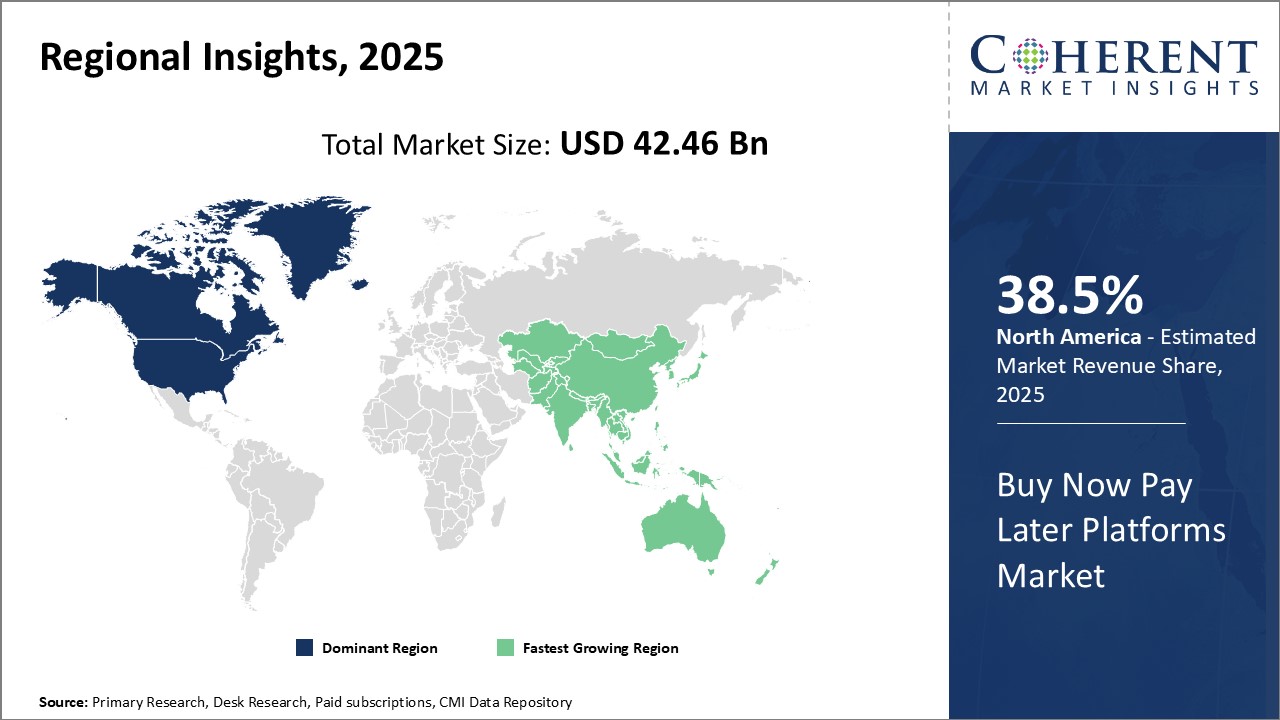

Global Buy Now Pay Later Platforms Market is estimated to be valued at USD 42.46 Bn in 2025 and is expected to reach USD 175.87 Bn by 2032, growing at a compound annual growth rate (CAGR) of 22.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 42.46 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 22.50% | 2032 Value Projection: | USD 175.87 Bn |

Report Description:

The buy now pay later platforms market has seen significant growth over the past few years. These platforms provide consumers the flexibility to purchase goods and pay for them interest-free, over a period of time. This has boosted the spending power of consumers while driving sales for merchants. buy now pay later services fill an important gap between conventional credit and payment options like cash or cards. They offer instant credit approval, with simpler terms and shorter repayment windows compared to traditional loans. Several BNPL players have emerged, providing innovative payment solutions primarily through mobile apps and web platforms. The proliferation of e-commerce and the growth of direct to customer brands have accelerated the adoption of BNPL services.

Market Dynamics:

Rising consumer preference for deferred payment options is a key driver propelling the buy now pay later platforms market. These platforms make purchases more affordable by removing lump sum costs. Growing online shopping and financial technologies have enabled new payment choices. Favorable demographics with N increasing young working population is expanding the customer base. However, concerns around overspending and debt risks act as restraints. Fraud and security issues also challenge the market growth. Opportunities lie in strategic partnerships with banks, merchants, and smartphone makers to diversify services. Entering new retail verticals and geographic regions presents scope for market expansion.

Key Features of the Study:

- This report provides an in-depth analysis of the global buy now pay later platforms market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global buy now pay later platforms market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Affirm, Inc., Afterpay Pty Ltd, Atome, Flipkart Internet Private Limited, Grab Holdings Inc., Hoolah Holdings Pte Ltd., Klarna Inc., LatitudePay Australia Pty Ltd, Laybuy Group Holdings Limited., Mastercard International Incorporated, Monzo Bank Limited, One97 Communications Limited (Paytm), Openpay Pty Ltd., Payl8r (Social Money Ltd.), PayPal Holdings, Inc., Perpay Inc., Sezzle Inc, SPLITIT USA INC., and Zip Co Limited

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global buy now pay later platform market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global buy now pay later market

Market Segmentation

- By Channel

- Point of Sale (POS)

- Online

- By Enterprise Type

- SMEs

- Large Enterprises

- By Category

- Banking, Financial Services and Insurance (BFSI)

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Retail

- Media and Entertainment

- Others (Travel and Transportation, Education, Logistics)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- Affirm, Inc.

- Afterpay Pty Ltd

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

Table of Contents:

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Channel

- Market Snapshot, By Enterprise Type

- Market Snapshot, By Category

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Buy Now Pay Later Platforms Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Buy Now Pay Later Platforms Market, By Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Point of Sale (POS)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Buy Now Pay Later Platforms Market, By Enterprise Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- SMEs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Large Enterprises

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Buy Now Pay Later Platforms Market, By Category, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Banking, Financial Services and Insurance (BFSI)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Consumer Electronics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Fashion & Garment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Healthcare

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Retail

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Media and Entertainment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others (Travel and Transportation, Education, Logistics)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

8. Global Buy Now Pay Later Platforms Market, By Region, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.K.

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country/Sub-region, 2025 and 2032 (%)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

9. Competitive Landscape

- Company Profiles

- Affirm, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Afterpay Pty Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Atome

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Flipkart Internet Private Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Grab Holdings Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hoolah Holdings Pte Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Klarna Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Affirm, Inc.

10. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section:

- Research Methodology

- About Us