PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705951

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705951

B2B Payments Transaction Market, By Payment Type, By Payment Method, By Enterprise Type, By Industry, By Geography

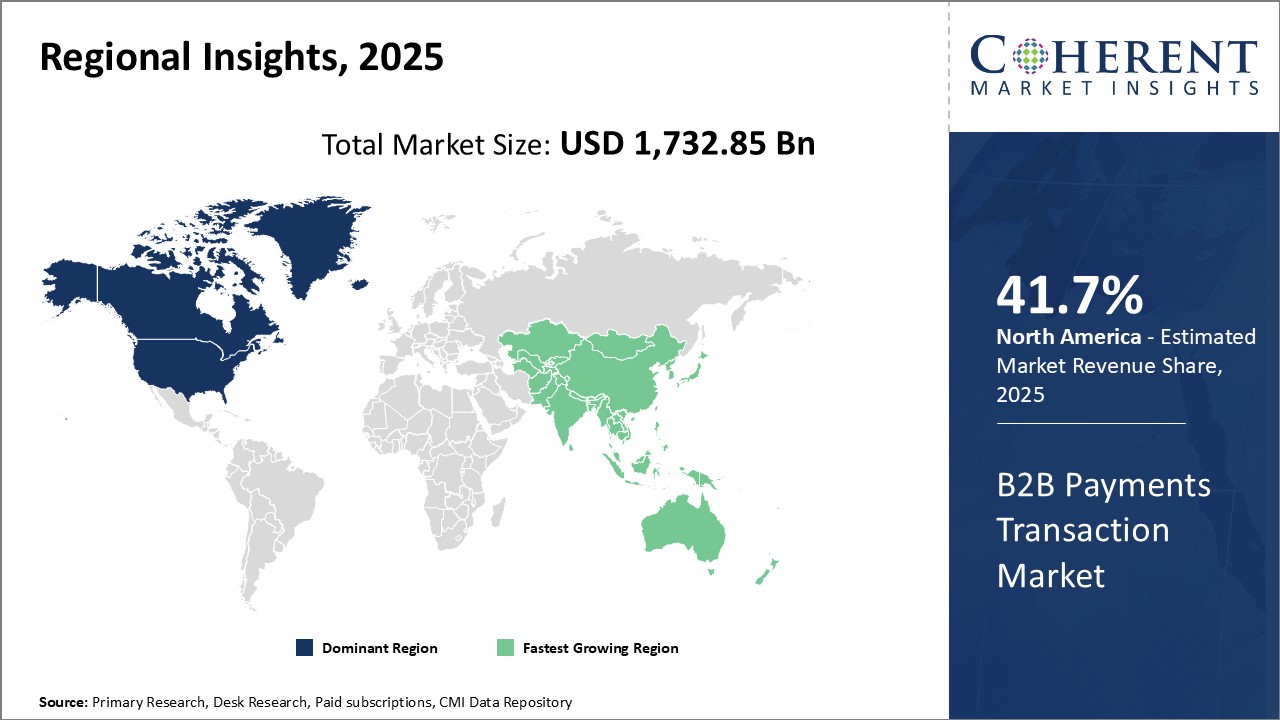

Global B2B Payments Transaction Market is estimated to be valued at USD 1,732.85 Bn in 2025 and is expected to reach USD 3,357.55 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 1,732.85 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.90% | 2032 Value Projection: | USD 3,357.55 Bn |

The B2B payments transaction market refers to financial transactions conducted between businesses, from large enterprises to small and medium-sized businesses. This includes all methods of payment for purchasing goods and services from other companies. Key aspects of B2B payments include commercial cards, direct debits, business checks, and electronic payments like wire transfers and automated clearing house (ACH) transactions. The global pandemic has accelerated the trend of digital transformation across industries and the shift towards digital and remote B2B transaction models. This has propelled growth in the market for electronic B2B payments as businesses seek convenient, secure and cost-effective payment solutions.

Market Dynamics:

The B2B payments transaction market is driven by factors such as the growing emphasis on streamlining workflows, the need for real-time payment capabilities and flexible payment options among enterprises. The market sees restraints from legacy systems that hamper the migration to new technologies. However, opportunities lie in the modernization of B2B infrastructure to support digital transactions. The COVID-19 outbreak has created a strong impetus for contactless and digital B2B commerce, augmenting the demand for automated payment methods. Innovations in fields like AI and blockchain also promise to disrupt traditional models and forge new pathways for secured, seamless and traceable B2B transfers.

Key features of the study:

- This report provides an in-depth analysis of the global B2B Payments Transaction market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032, considering 2024 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global B2B Payments Transaction market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Mastercard Inc., FIS , Stripe, Inc. , Paystand, Inc., Flywire , Squareup Pte. Ltd, Edenred Payment Solutions , Payoneer Inc. , American Express , Visa Inc. , JPMorgan & Chase, Adyen N.V., Billtrust, Coupa Software Inc., Dwolla, Inc., Earthport PLC, FLEETCOR Technologies, Inc., Intuit Inc., Nvoicepay, Inc., Optal Limited, Paytm Mobile Solutions Private Limited, PayPal Holdings, Inc., TransferWise Ltd. (Now known as Wise), and Scoot and Ride.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global B2B Payments Transaction market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global B2B Payments Transaction market.

Market Segmentation

- By Payment Type

- Domestic Payments

- Cross Border Payments

- By Payment Method

- Bank Transfer

- Cards

- Online Payments

- By Enterprise Type

- Small & Medium Enterprises

- Large Enterprises

- By Industry

- Government

- Manufacturing

- BFSI

- Metal & Mining

- IT & Telecom

- Retail & E-commerce

- Others (Healthcare, Energy & Utilities)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players insights

- Mastercard Inc.

- FIS

- Stripe, Inc.

- Paystand, Inc.

- Flywire

- Squareup Pte. Ltd

- Edenred Payment Solutions

- Payoneer Inc.

- American Express

- Visa Inc.

- JPMorgan & Chase

- Adyen N.V.

- Billtrust

- Coupa Software Inc.

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Nvoicepay, Inc.

- Optal Limited

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- TransferWise Ltd. (Now known as Wise)

- Scoot and Ride

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Payment Type

- Market Snippet, By Payment Method

- Market Snippet, By Enterprise Type

- Market Snippet, By Industry

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launches/Approvals

- Impact of the COVID-19 Pandemic

4. Global B2B Payments Transaction Market, By Payment Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Domestic Payments

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Cross Border Payments

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

5. Global B2B Payments Transaction Market, By Payment Method, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Bank Transfer

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Cards

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Online Payments

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

6. Global B2B Payments Transaction Market, By Enterprise Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Segment Trends

- Small & Medium Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Large Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

7. Global B2B Payments Transaction Market, By Industry, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Government

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- BFSI

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Metal & Mining

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Retail & E-commerce

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Others (Healthcare, Energy & Utilities)

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

8. Global B2B Payments Transaction Market, By Region, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- North America

- Regional Trends

- Market Size and Forecast, By Payment Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Payment Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Payment Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Payment Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Payment Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Payment Method, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Industry, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- GCC Countries

- South Africa

- Rest of the Middle East & Africa

9. Competitive Landscape

- Company Profiles

- Mastercard Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- FIS

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Stripe, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Paystand, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Flywire

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Squareup Pte. Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Edenred Payment Solutions

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Payoneer Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- American Express

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Visa Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- JPMorgan & Chase

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Adyen N.V.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Billtrust

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Coupa Software Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Nvoicepay, Inc.

- Optal Limited

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- TransferWise Ltd.

- Mastercard Inc.

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Research Methodology

- References

- Research Methodology

- About us and Sales Contact