PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708881

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708881

Lng as a Bunker Fuel Market, By Vessel Type (Offshore Tugs & Service, Ferries, Oil & Chemical Tankers, Container Ships, Gas Carriers, Cargo, Others), By Geography (North America, Latin America, Europe, Asia Pacific, Middle East & Africa)

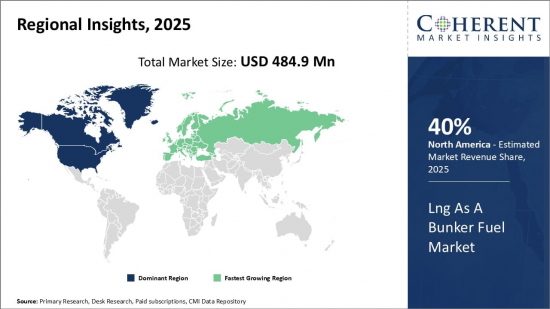

Global Lng As A Bunker Fuel Market is estimated to be valued at USD 484.9 Mn in 2025 and is expected to reach USD 1,648.5 Mn by 2032, growing at a compound annual growth rate (CAGR) of 19.1% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 484.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 19.10% | 2032 Value Projection: | USD 1,648.5 Mn |

Liquefied natural gas (LNG) as a bunker fuel refers to the use of LNG to power ships. LNG is a natural gas that has been cooled to liquid form for ease and safety in non-pressurized storage or transport. As a bunker fuel, LNG offers various benefits compared to conventional bunker fuels such as heavy fuel oil. It is a cleaner alternative as it emits less sulfur and particulate emissions, which improves local air quality in port cities. LNG produces less carbon emissions compared to heavy fuel oil and meets the stringent climate targets adopted. From an economic standpoint, the price of LNG is competitive and more stable over the long term compared to oil-linked bunker fuels. With the growing availability of infrastructure for LNG bunkering worldwide, the maritime industry is progressively adopting LNG as a fuel.

Market Dynamics:

The global LNG as a bunker fuel market is driven by the International Maritime Organization's (IMO) regulations to reduce maritime sulfur emissions and tighten restrictions on particulate matter and nitrogen oxide emissions from ships. The IMO 2020 mandate, which came into effect in January 2020, has accelerated the demand for cleaner marine fuels, including LNG. The availability of LNG bunkering infrastructure in key ports and regions also provides opportunities for wider adoption of LNG as a ship fuel. However, the high capital costs associated with retrofitting ships to use LNG and establishing networks for LNG bunkering remain a key challenge restricting large scale adoption. Geopolitical risks associated with heavy reliance on certain regions for LNG supply are another restraint. Nevertheless, the growing environmental awareness and sustainability targets of shipping companies are expected to drive future opportunities for LNG bunkering.

Key features of the study:

- This report provides an in-depth analysis of the LNG as a bunker fuel market, and provides market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2025 -2032), considering 2024 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the LNG as a bunker fuel market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include a BP P.L.C., Conocophillips Corporation, Chevron Corporation, China National Petroleum Corporation, ENI S.P.A., Equinor ASA, Exxon Mobil Corporation, PJSC GAZPROM, Petronas, Rosneft Oil Company, Royal Dutch Shell PLC, and Total S.A.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The LNG as a bunker fuel market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the LNG as a bunker fuel market

Detailed Segmentation:

- LNG as a Bunker Fuel Market, By Vessel Type

- Offshore Tugs & Service

- Ferries

- Oil & Chemical Tankers

- Container Ships

- Gas Carriers

- Cargo

- Others

- LNG as a Bunker Fuel Market, By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East

- Africa

- Company Profiles

- BP P.L.C.

- Conocophillips Corporation

- Chevron Corporation

- China National Petroleum Corporation

- ENI S.P.A.

- Equinor ASA

- Exxon Mobil Corporation

- PJSC GAZPROM

- Petronas

- Rosneft Oil Company

- Royal Dutch Shell PLC

- Total S.A.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- LNG as a Bunker Fuel Market, By Vessel Type

- LNG as a Bunker Fuel Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Driver

- Cost competitiveness of LNG compared to conventional fuels

- Restraints

- Storage challenges and safety issues of LNG

- Opportunities

- Increasing LNG production

- Key Highlights

- Regulatory Scenario

- Recent Trends

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Mergers, Acquisitions, and Collaborations

4. LNG as a Bunker Fuel Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. LNG as a Bunker Fuel Market, By Vessel Type , 2020-2032 , (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Offshore Tugs & Service

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Ferries

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Oil & Chemical Tankers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Container Ships

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Gas Carriers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Cargo

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Mn)

6. LNG as a Bunker Fuel Market, By Region, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Vessel Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- GCC Countries

- Israel

- South Africa

- Central Africa

- North Africa

- Rest of Middle East

7. Competitive Landscape

- Company Profile

- BP P.L.C.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Conocophillips Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Chevron Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- China National Petroleum Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- ENI S.P.A.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Equinor ASA

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Exxon Mobil Corporation

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- PJSC GAZPROM

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Petronas

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Rosneft Oil Company

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Royal Dutch Shell PLC

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Total S.A.

- Company Overview

- Component Portfolio

- Financial Performance

- Recent Developments/Updates

- Analyst Views

8. Section

- References

- Research Methodology

- About us