PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705889

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1705889

Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Service Type, By Therapeutic Area, By End User, By Geography

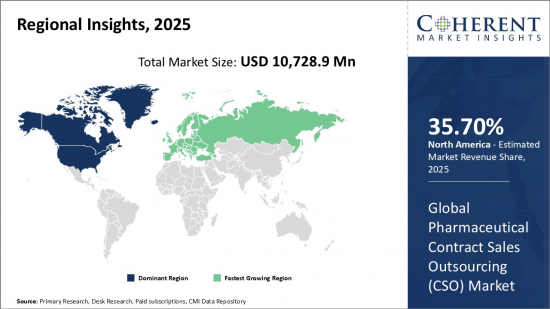

Global Pharmaceutical Contract Sales Outsourcing (CSO) Market is estimated to be valued at USD 10,728.9 Mn in 2025 and is expected to reach USD 19,362.4 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 10,728.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.80% | 2032 Value Projection: | USD 19,362.4 Mn |

The global pharmaceutical contract sales outsourcing (CSO) market has shown promising growth in recent years. Pharmaceutical manufacturers are increasingly outsourcing their sales and marketing operations to specialized CSO providers in order to focus on drug research and development. CSO firms assist drug makers in optimizing sales operations, managing representative visits, and ensuring promotional compliance with regulatory guidelines. They leverage data-driven insights and technological solutions to enhance sales representative effectiveness and expand physician reach. The outsourcing model enables pharmaceutical companies to access specialized expertise and achieve operational efficiencies without incurring high fixed costs. This cost-effective approach has thus gained traction among biopharma firms looking to streamline commercialization activities.

Market Dynamics:

The global pharmaceutical contract sales outsourcing (CSO) market is driven by factors such as the need of biopharma players to optimize sales costs and boost productivity. Growing complexity of drug promotion regulations particularly in the U.S. also prompts pharmaceutical companies to outsource sales operations to specialized CSO providers well-versed with compliance frameworks. Additionally, technological advancements in customer relationship management and data analytics are translating into increased demand for outsourced sales capabilities. However, volatility in drug pricing environments and unfavorable healthcare reforms in certain regions pose challenges to market players. Furthermore, consolidation in the CSO industry landscape impacts client relationships. Emerging opportunities lie in expansion into non-traditional therapeutic areas and offering value-added services around market access.

Increasing requirement for companies to streamline the sales process and achieve higher efficiency will further aid in the demand for sales planning/performance analytics software. For instance, on November 7, 2024, Accenture, a digital technology company, and Salesforce, Inc., a software company, announced the collaboration to build an Artificial intelligence (AI) powered cloud service for life sciences companies. Under the collaborations, Accenture added its own expertise both in the biomedical research industry and in artificial intelligence technologies to the Salesforce Life Sciences Cloud to help fulfill the new software's mission of making medtech, biotech, and pharma companies more efficient.

Key Features of the Study:

- This report provides an in-depth analysis of the global pharmaceutical contract sales outsourcing (CSO) market, and provides market size (US$ Mn) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global pharmaceutical contract sales outsourcing (CSO) market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include IQVIA Inc., Syneos Health Inc., Parexel International Corporation, PPD, ICON plc, Publicis Touchpoint Solutions, Inc., PRA Health Sciences, Inc., The Medical Affairs Company (TMAC), Ashfield Healthcare Communications Group, and GTS Solutions

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global pharmaceutical contract sales outsourcing (CSO) market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global pharmaceutical contract sales outsourcing (CSO) market

Detailed Segmentation:

- Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Service Type

- Personal Promotion

- Non-personal Promotion

- Others

- Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Therapeutic Area

- Cardiovascular Disorders

- Oncology

- Metabolic Disorders

- Neurology

- Orthopedic Diseases

- Infectious Diseases

- Others

- Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By End User

- Biopharmaceutical Companies

- Medical Device Companies

- Generic Companies

- Others

- Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles

- IQVIA Inc.

- Syneos Health Inc.

- Parexel International Corporation

- PPD

- ICON plc

- Publicis Touchpoint Solutions, Inc.

- PRA Health Sciences, Inc.

- The Medical Affairs Company (TMAC)

- Ashfield Healthcare Communications Group

- GTS Solutions

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Service Type

- Market Snippet, By Therapeutic Area

- Market Snippet, By End User

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Digital technology adoption

- Access to care disparities

- Population health initiatives

- Key Highlights

- Regulatory Scenario

- Recent Trends

- PEST Analysis

- PORTER's Analysis

- Mergers, Acquisitions, and Collaborations

4. Global Pharmaceutical Contract Sales Outsourcing (CSO) Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Service Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Personal Promotion

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Non-personal Promotion

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

6. Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Therapeutic Area, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Cardiovascular Disorders

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Oncology

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Metabolic Disorders

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Neurology

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Orthopedic Diseases

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Infectious Diseases

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

7. Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By End User, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Biopharmaceutical Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Medical Device Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Generic Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032,(US$ Mn)

8. Global Pharmaceutical Contract Sales Outsourcing (CSO) Market, By Region, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020-2032,(US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Service Type, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Therapeutic Area, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020-2032,(US$ Mn)

- Market Size and Forecast, and Y-o-Y Growth, By Country/Region, 2020-2032,(US$ Mn)

- North Africa

- Central Africa

- South Africa

9. Competitive Landscape

- Company Profile

- IQVIA Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Syneos Health Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Parexel International Corporation

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- PPD

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- ICON plc

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Publicis Touchpoint Solutions, Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Strategies

- PRA Health Sciences, Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- The Medical Affairs Company (TMAC)

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Ashfield Healthcare Communications Group

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- GTS Solutions

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

10. Section

- References

- Research Methodology

- About us