PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1706023

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1706023

Global Single Use Assemblies Market, By Product, By Application, By Solution, By End User, By Geography

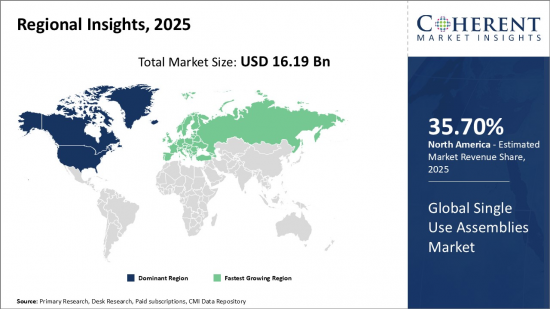

Global Single Use Assemblies Market is estimated to be valued at USD 16.19 Bn in 2025 and is expected to reach USD 51.56 Bn by 2032, growing at a compound annual growth rate (CAGR) of 18.0% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 16.19 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 18.00% | 2032 Value Projection: | USD 51.56 Bn |

Single-use assemblies, also known as single-use systems, are pre-assembled sets of fluid handling components that are designed for single use in the biopharmaceutical manufacturing process. These provide benefits like reduced risk of cross-contamination, lower costs of cleaning and sterilization as compared to traditional stainless-steel bioreactors. As the demand for biologics and cell therapies escalates, there is a heightened need for solid and scalable production capabilities. Single-use assemblies contribute to quicker production cycles and adaptable scalability. They also enable more compact manufacturing spaces and enhanced operational efficiency.

Compared to traditional stainless steel equipment, single-use assemblies provide advantages such as reduced capital investment, lower cleaning and maintenance costs, elimination of cross-contamination risks. However, their widespread adoption also raises concerns about increased solid waste generation. Overall, single-use assemblies have enabled faster process development with reduced costs and improved productivity for manufacturers.

Market Dynamics:

Global single-use assemblies market growth is driven by increasing demand for biopharmaceuticals, fast adoption of single-use technologies by biopharmaceutical companies, and advantages like flexible scalability, lower facility footprint and reduced validation costs compared to stainless steel assemblies. However, concerns about extractable and leachable from materials used in single-use assemblies and lack of standardization are some of the factors restraining the market growth. Growing demand for biosimilars and advanced therapies like gene and cell therapies present lucrative opportunities for players in this market.

The key market players are focusing on various growth strategies such as expansion, and this is expected to propel the market growth over the forecast period. For instance, in June 2021, NewAge Industries, a manufacturer of AdvantaPure high purity tubing products used in single-use systems for biopharmaceutical manufacturing, announced expansion of capacity at its headquarters facility in southeastern Pennsylvania, U.S. The initiative will expand the current facility by adding over 3000 square feet of ISO Class 7 certified cleanroom space. This space is designated for the production of AdvantaFlex weldable and sealable tubing, AdvantaSil silicone tubing, reinforced hose, and molded single-use tubing assemblies.

Key features of the study:

- This report provides in-depth analysis of the global single-use assemblies market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global single-use assemblies market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Thermo Fisher Scientific, Inc., Merck KGaA, Sartorius AG, Danaher (Pall Corporation), Avantor, Inc., Lonza, Saint-Gobain, Corning Incorporated, Entegris, KUHNER AG., Parker Hannifin Corporation, Ami Polymer, HIGH PURITY NEW ENGLAND, Liquidyne Process Technologies, Inc. and ESI Ultrapure

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- Global single-use assemblies market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global single-use assemblies market

Detailed Segmentation:

- Global Single Use Assemblies Market, By Product

- Bag Assemblies

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

- Global Single Use Assemblies Market, By Application

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish

- Others

- Global Single Use Assemblies Market, By Solution

- Customized

- Standard

- Global Single Use Assemblies Market, By End User

- Biopharmaceutical Companies

- CROs

- CMOs

- Others

- Global Single Use Assemblies Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Company Profiles

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher (Pall Corporation)

- Avantor, Inc

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG.

- Parker Hannifin Corporation

- Ami Polymer

- HIGH PURITY NEW ENGLAND

- Liquidyne Process Technologies, Inc.

- ESI Ultrapure

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Single Use Assemblies Market, By Product

- Global Single Use Assemblies Market, By Application

- Global Single Use Assemblies Market, By Solution

- Global Single Use Assemblies Market, By End User

- Global Single Use Assemblies Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Increasing Demand for Disposable Systems

- High costs associated with single-use assemblies

- Technological advances in single-use assemblies

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Service offering Portfolio

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Single Use Assemblies Market- Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Single Use Assemblies Market, By Product, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Bag Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- 2D bag assemblies

- 3D bag assemblies

- Filtration Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Bottle Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Tubing Assemblies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

6. Global Single Use Assemblies Market, By Application, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Filtration

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Cell Culture & Mixing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Storage

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Sampling

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Fill-finish

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

7. Global Single Use Assemblies Market, By Solution, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Customized

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Standard

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

8. Global Single Use Assemblies Market, By End User, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Biopharmaceutical Companies

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- CROs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- CMOs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032,(US$ Bn)

9. Global Single Use Assemblies Market, By Region, 2020 - 2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Country, 2021 -2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Solution, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2020 - 2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032,(US$ Bn)

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- North Africa

- Central Africa

- South Africa

10. Competitive Landscape

- Thermo Fisher Scientific, Inc.

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Merck KGaA

- Sartorius AG

- Danaher (Pall Corporation)

- Avantor, Inc

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG.

- Parker Hannifin Corporation

- Ami Polymer

- HIGH PURITY NEW ENGLAND

- Liquidyne Process Technologies, Inc.

- ESI Ultrapure

- Analyst Views

11. Section

- Research Methodology

- About us