PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708405

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708405

Ethernet Card Market, By Data Transfer Rate, By End-use Industry, By Geography

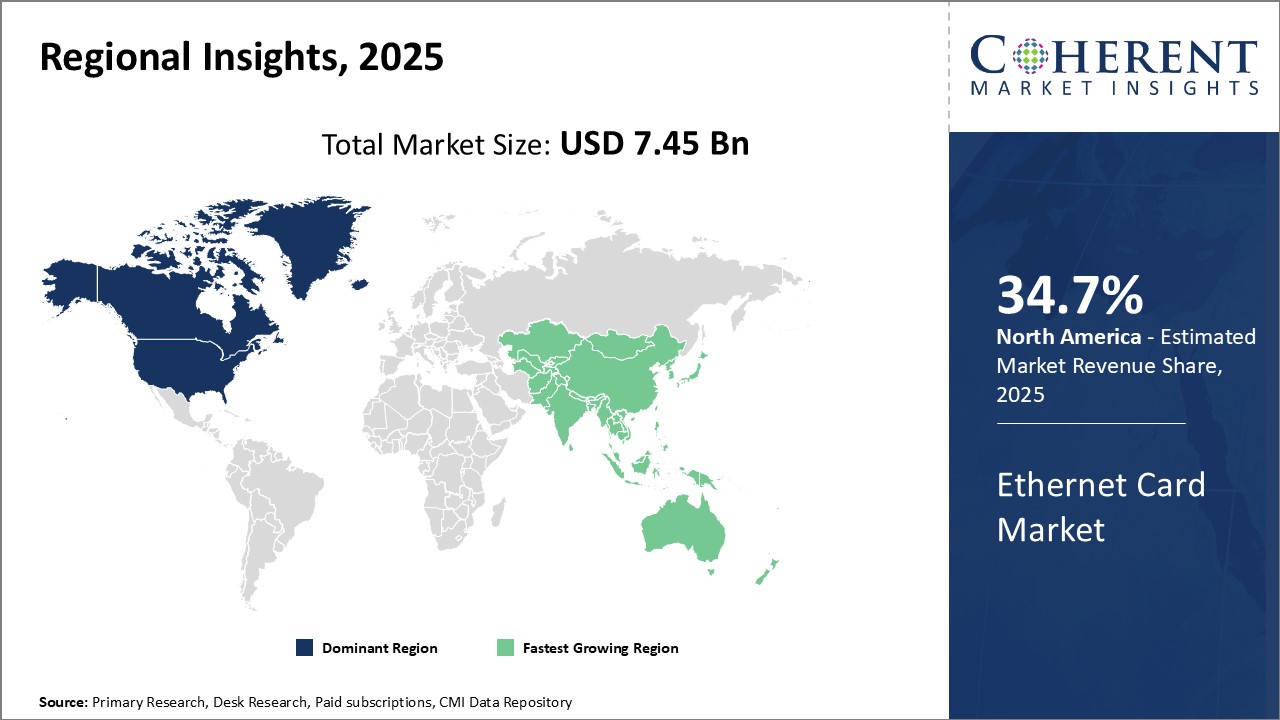

Global Ethernet Card Market is estimated to be valued at USD 7.45 Bn in 2025 and is expected to reach USD 13.90 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 7.45 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.30% | 2032 Value Projection: | USD 13.90 Bn |

The Ethernet card market has been witnessing significant growth in the recent years. An Ethernet card, commonly known as a network interface card (NIC), is a computer hardware component that connects a device such as a computer to a computer network. It allows transmission and receiving of data to and from a network respectively. Rising adoption of high-speed networking infrastructure across various industry verticals and growing demand for virtualization are some of the key factors propelling the growth of the Ethernet card market. Also, increasing consumption of bandwidth intensive content and emergence of technologies such as IoT and cloud computing are expected to drive higher adoption of Ethernet cards during the forecast period. However, factors such as high initial investment and availability of substitutes may hamper the market growth to some extent.

Market Dynamics:

The Ethernet card market growth is driven by the rising demand for high bandwidth network connectivity solutions across industries. Increasing cloud adoption and growing trend of work from home are positively impacting the market growth. However, high initial costs associated with Ethernet cards deployment poses a major challenge. Emergence of advanced networking technologies such as 5G, Wi-Fi 6, and SD-WAN present significant opportunities in the long run. Adoption of new technologies enables higher speeds and better performance without compromising security, thereby augmenting the demand for Ethernet cards. On the other hand, availability of substitute technologies like USB adapters acts as a restraining factor for this market.

Key features of the study:

This report provides in-depth analysis of the global Ethernet card market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global Ethernet card market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Arista Networks Inc., Broadcom Inc., Cisco Systems Inc., Dell Technologies Inc., Extreme Networks Inc., Fujitsu Limited, Hewlett Packard Enterprise (HPE), Huawei Technologies Co. Ltd., Intel Corporation, Juniper Networks Inc., Juniper Networks Inc., Marvell Technology Group Ltd., Mellanox Technologies, Microchip Technology Inc., and NEC Corporation are the major players.

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global Ethernet card market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global Ethernet card market

Market Segementation

- By Data Transfer Rate

- Less Than 1 Gbps

- 1-10 Gbps

- More than 10 Gbps

- By End-use Industry

- IT and Telecom

- BFSI

- Retail

- Manufacturing

- Healthcare

- Transportation and Logistics

- Energy and Utilities

- Education

- Others

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Company Profiles

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Extreme Networks Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- Marvell Technology Group Ltd.

- Mellanox Technologies

- Microchip Technology Inc.

- NEC Corporation

Table of Contents:

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Data Transfer rate

- Market Snapshot, By End-use Industry

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Ethernet Card Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Ethernet Card Market, By Data Transfer rate, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- Less Than 1 Gbps

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- 1-10 Gbps

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- More than 10 Gbps

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Ethernet Card Market, By End-use Industry, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020-2032

- Segment Trends

- IT and Telecom

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- BFSI

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Retail

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Manufacturing

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Healthcare

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Transportation and Logistics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Energy and Utilities

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Education

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Ethernet Card Market, By Region, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- North America

- Regional Trends

- Market Size and Forecast, By Data Transfer rate, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Data Transfer rate, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.K.

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Data Transfer rate, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Data Transfer rate, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Data Transfer rate, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By End-use Industry, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- South Africa

- GCC Countries

- Rest of the Middle East and Africa

8. Competitive Landscape

- Company Profiles

- Arista Networks Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Broadcom Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cisco Systems Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Dell Technologies Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Extreme Networks Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Fujitsu Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hewlett Packard Enterprise (HPE)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Huawei Technologies Co. Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Intel Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Juniper Networks Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Marvell Technology Group Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Mellanox Technologies

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Microchip Technology Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- NEC Corporation

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Arista Networks Inc.

9. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Section:

- Research Methodology

- About Us