PUBLISHER: Bluefield Research | PRODUCT CODE: 1549547

PUBLISHER: Bluefield Research | PRODUCT CODE: 1549547

U.S. & Canada Digital Water Market Outlook: Key Drivers, Competitive Shifts, and Forecasts, 2024-2033

The U.S. and Canada have long been at the forefront of digital water adoption, shaped by a diverse network of assets, an expansive roster of technology vendors, and relative access to capital. As such, Bluefield Research anticipates strong demand for digital water solutions in North America, underpinning a cumulative US$169.5 billion in spending from 2024 to 2033.

This growth is fueled by several key factors: the need for increased efficiencies in asset and operations management, which is becoming ever more critical due to a growing workforce gap; shifts in policy and government funding that are incentivizing digital technology adoption; and the increasingly ubiquitous deployment of technology across all aspects of critical infrastructure. These drivers also usher in the increasingly complex challenges associated with cybersecurity.

As utility demand intensifies, from very large to very small utilities, the vendor landscape is becoming more competitive. The market is currently dominated by established water technology players, many of which are based in the U.S. and Canada. However, new market entrants are making inroads through strategic acquisitions and partnerships, while emerging startups are challenging the status quo, especially with software-based solutions.

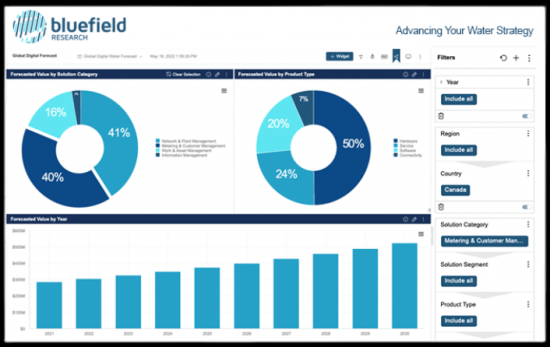

This Insight Report (and related data dashboard) offers a comprehensive analysis of the U.S. & Canada digital water market, including hardware, software, services, and connectivity. Bluefield's bottom-up approach provides a detailed view of the current landscape and future growth, along with insights into major drivers and trends, the competitive environment, and detailed company profiles of 15 major digital water incumbents.

Report+Data Option:

Data is a key component to this analysis. Our team has compiled relevant data dashboards as an add on purchase option.

Companies Profiled:

|

|

Companies Mentioned:

|

|

Table of Contents

Section 1: U.S. & Canada Digital Water Market Drivers & Trends

- Drivers and Inhibitors Impacting the Digital Water Market

- Challenges and Solutions - Digital Water Addresses Industry Pain Points

- Digital Maturity - Differing Needs and Experiences

- Landscape Fragmentation - Diverging Digital Water Priorities

- Driving Change - Policies and Government Funding Influence Investments

- Slow and Steady - IIJA Funding Presents Opportunities for Digital Water

- Silver Tsunami - Utility Workforce Trends

- Cybersecurity - Rising Concern, Limited Capacity

- Internal Challenges - Barriers to Digital Water Adoption

Section 2: U.S. & Canada Digital Water Market Forecasts

- Bluefield Digital Water Market Model Overview

- Asset Base - U.S. Utility Landscape

- Asset Base - Canada Utility Landscape

- Quantifying Spend - Digital Water Pricing by Utility Size

- The Big Picture - U.S. & Canada Digital Water Market Opportunity

- 10-Year Spend - Legacy Solutions Account for Lion's Share

- Digital Water Hot Spots - Market Size by U.S. State

- Digital Water Hot Spots - Market Size by Canadian Province

- Digital Water Solutions Come Online - Market Outlook by Product Type

- Water Utilities Spearhead Investments - Market Outlook by Water Type

- OPEX Outpaces CAPEX - Market Outlook by Spend Type

- Growth Opportunities Across the Board - Market Outlook by Utility Size

- Digital Drives Optimization - Network & Plant Mgmt. Market Outlook

- Beyond Meter to Cash - Metering & Customer Mgmt. Market Outlook

- Reactive to Proactive - Work & Asset Mgmt. Market Outlook

- Next Steps in Digital Transformation - Information Mgmt. Market Outlook

- Securing IT and OT - Cybersecurity Market Outlook

- Leveraging Data - AI/ML Enhances Digital Water Solutions

- Push to the Cloud - Digital Water Software Adoption Trends

Section 3: Competitive Landscape

- Key Competitive Trends Emerging Across Digital Water Landscape

- Vendor Growth - Riding the Technology Wave

- Portfolio Expansion - Organic and Inorganic Growth Strategies

- Acquisition Hot Spots - Digital Water M&A Trends in the U.S. & Canada

- Market Consolidation - Strategic Growth via M&A

- Capital Flows - Investments Support Early-Stage Growth

- Notable M&A and VC Investment Deals

- Vendor Landscape - Hardware and Software Companies

- Beyond Technology - The Role of Service Providers

Section 4: Key Company Profiles

- Autodesk

- Badger Meter

- Bentley Systems

- Esri

- Halma

- IDEX Corporation

- Itron

- Kamstrup

- Mueller Water Products

- Neptune Technology Group

- Rockwell Automation

- Suez

- Trimble

- Veralto

- Xylem