PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709978

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709978

Global Aerodynamics Testing and Simulation Market 2025-2035

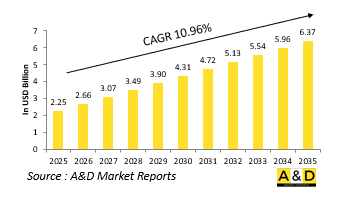

The Global Aerodynamics Testing and Simulation market is estimated at USD 2.25 billion in 2025, projected to grow to USD 6.37 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.96% over the forecast period 2025-2035.

Introduction to Aerodynamics Testing and Simulation Market:

The defense aerodynamics testing and simulation market plays a pivotal role in the design, development, and operational refinement of military aircraft, missiles, and unmanned aerial systems. As defense platforms become more advanced, their aerodynamic performance directly impacts maneuverability, survivability, fuel efficiency, and mission effectiveness. Testing and simulation allow for the safe and cost-effective evaluation of these performance parameters under controlled and extreme conditions. Wind tunnels, computational fluid dynamics tools, and virtual flight environments form the foundation of this market, offering engineers and strategists the ability to model airflow, heat distribution, and pressure dynamics across complex airframes. These capabilities are essential for validating new designs, improving legacy systems, and ensuring optimal performance under variable environmental and combat conditions. Aerodynamic simulation also supports stealth optimization, weapon integration, and high-speed flight planning-key elements in modern warfare. Furthermore, these technologies contribute to strategic planning by enabling accurate modeling of vehicle behavior in real-world scenarios. As aerial warfare becomes more dependent on agility, speed, and low observability, the significance of aerodynamic testing and simulation continues to grow. This market supports not only research and production but also the continuous adaptation required in today's evolving threat environments.

Technology Impact in Aerodynamics Testing and Simulation Market:

Emerging technologies are transforming the landscape of defense aerodynamics testing and simulation, enabling greater precision, scalability, and realism in both physical and virtual environments. High-performance computing has revolutionized computational fluid dynamics, allowing analysts to simulate highly complex flow conditions with unprecedented accuracy and speed. These digital models can now account for multi-variable scenarios, including turbulence, thermal loads, and interactions between control surfaces and embedded weapons systems. The integration of machine learning further refines simulation outputs by identifying performance patterns and optimizing design iterations based on vast datasets. In parallel, next-generation wind tunnels have evolved to simulate extreme altitude and velocity conditions, supporting the development of hypersonic platforms and maneuverable glide vehicles. Virtual reality and immersive interfaces are also beginning to influence how engineers and pilots interact with aerodynamic models, providing intuitive insights into airflow dynamics and vehicle behavior. Moreover, cloud-based simulation tools are enabling global collaboration and secure data sharing among defense contractors, research institutions, and military clients. This technological convergence is not only reducing development cycles but also enhancing system validation, contributing to more agile and adaptable defense platforms capable of operating in contested and complex aerial environments.

Key Drivers in Aerodynamics Testing and Simulation Market:

Several key factors are propelling growth in the defense aerodynamics testing and simulation market. One of the most significant is the increasing complexity of aerial combat systems, which require advanced aerodynamic profiles to meet evolving mission demands. Military aircraft and missiles must perform reliably across a broad spectrum of speeds, altitudes, and atmospheric conditions, which necessitates rigorous testing and high-fidelity simulation. As stealth becomes a baseline expectation in modern airframes, aerodynamic shaping must be optimized to support radar evasion while maintaining performance and stability. The rise of hypersonic technologies has introduced a new frontier in airflow behavior, demanding simulation tools that can handle extreme thermal and pressure conditions. Additionally, the push for reduced lifecycle costs and more efficient platform development encourages the use of virtual testing environments that minimize reliance on costly physical trials. Training and mission rehearsal systems also benefit from aerodynamic simulations, helping aircrews understand the handling characteristics of new or modified platforms. Meanwhile, growing interest in multi-role UAVs and loitering munitions requires aerodynamic refinement for endurance, payload, and maneuverability. These drivers highlight the expanding role of aerodynamic testing not just in development, but also in ensuring mission readiness and operational superiority.

Regional Trends in Aerodynamics Testing and Simulation Market:

The global defense aerodynamics testing and simulation market exhibits distinct regional profiles shaped by national priorities, industrial capabilities, and investment in advanced aerospace systems. In North America, particularly the United States, the market is supported by a robust defense R&D ecosystem and an extensive infrastructure of wind tunnels, simulation labs, and flight test ranges. These facilities play a central role in supporting next-generation aircraft programs, hypersonic weapons development, and integrated air defense platforms. Europe places strong emphasis on collaborative research initiatives and multinational defense programs, which has led to shared investment in advanced simulation capabilities and digital design hubs. Countries like France, Germany, and the United Kingdom maintain dedicated testing facilities that support both national and joint aerospace development efforts. In Asia-Pacific, rapid advancements in indigenous defense aviation programs are driving demand for domestic simulation and testing capabilities. Nations such as India, China, and South Korea are expanding their technical infrastructure to reduce dependency on foreign validation and accelerate their own aerospace timelines. In the Middle East, interest in defense industrialization is leading to partnerships with international aerospace firms to develop local capabilities in aerodynamic modeling and verification. Each region's trajectory reflects its strategic objectives and evolving role in the global defense landscape.

Key Aerodynamics Testing and Simulation Program:

The Future Combat Air System (FCAS) is a cornerstone of Europe's efforts to maintain sovereignty in defense and security. At the heart of FCAS lies the Next Generation Weapon System (NGWS), forming the foundation of a sophisticated "system of systems." This integrated network will feature manned New Generation Fighters operating in tandem with Unmanned Remote Carriers, all seamlessly connected through the "Combat Cloud"-a secure data network linking assets across air, land, sea, space, and cyberspace. These interconnected platforms will function as sensors, effectors, and command-and-control nodes, supporting rapid and flexible decision-making. The architecture behind FCAS is open, modular, and service-oriented, allowing for the integration of future platforms and emerging technologies. National and allied assets will complement the NGWS by contributing their distinct capabilities, enabling a truly collaborative combat environment across multiple domains through the combined strength of interoperable, networked systems.

Table of Contents

Global aerodynamics testing and simulation market- Table of Contents

Global aerodynamics testing and simulation market Report Definition

Global aerodynamics testing and simulation market Segmentation

By Test method

By Technology

By End Use

By Region

Global aerodynamics testing and simulation market Analysis for next 10 Years

The 10-year Global aerodynamics testing and simulation market analysis would give a detailed overview of Global aerodynamics testing and simulation market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global aerodynamics testing and simulation market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global aerodynamics testing and simulation market Forecast

The 10-year Global aerodynamics testing and simulation market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global aerodynamics testing and simulation market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global aerodynamics testing and simulation market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global aerodynamics testing and simulation market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global aerodynamics testing and simulation market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Test Methods, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Test Methods, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By End User, 2022-2032

List of Figures

- Figure 1: Global Aerodynamics Testing and Simulation Forecast, 2022-2032

- Figure 2: Global Aerodynamics Testing and Simulation Forecast, By Region, 2022-2032

- Figure 3: Global Aerodynamics Testing and Simulation Forecast, By Test Methods, 2022-2032

- Figure 4: Global Aerodynamics Testing and Simulation Forecast, By Technology, 2022-2032

- Figure 5: Global Aerodynamics Testing and Simulation Forecast, By End User, 2022-2032

- Figure 6: North America, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 7: Europe, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 8: Middle East, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 9: APAC, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 10: South America, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 11: United States, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 12: United States, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 13: Canada, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 14: Canada, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 15: Italy, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 16: Italy, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 17: France, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 18: France, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 19: Germany, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 20: Germany, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 21: Netherlands, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 23: Belgium, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 24: Belgium, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 25: Spain, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 26: Spain, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 27: Sweden, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 28: Sweden, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 29: Brazil, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 30: Brazil, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 31: Australia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 32: Australia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 33: India, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 34: India, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 35: China, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 36: China, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 39: South Korea, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 40: South Korea, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 41: Japan, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 42: Japan, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 43: Malaysia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 45: Singapore, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 46: Singapore, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Aerodynamics Testing and Simulation, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Aerodynamics Testing and Simulation, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Aerodynamics Testing and Simulation, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Aerodynamics Testing and Simulation, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Aerodynamics Testing and Simulation, By Test Methods (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Aerodynamics Testing and Simulation, By Test Methods (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Aerodynamics Testing and Simulation, By End User (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Aerodynamics Testing and Simulation, By End User (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Aerodynamics Testing and Simulation, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Aerodynamics Testing and Simulation, Global Market, 2022-2032

- Figure 59: Scenario 1, Aerodynamics Testing and Simulation, Total Market, 2022-2032

- Figure 60: Scenario 1, Aerodynamics Testing and Simulation, By Region, 2022-2032

- Figure 61: Scenario 1, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 62: Scenario 1, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 63: Scenario 1, Aerodynamics Testing and Simulation, By End User, 2022-2032

- Figure 64: Scenario 2, Aerodynamics Testing and Simulation, Total Market, 2022-2032

- Figure 65: Scenario 2, Aerodynamics Testing and Simulation, By Region, 2022-2032

- Figure 66: Scenario 2, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 67: Scenario 2, Aerodynamics Testing and Simulation, By Technology, 2022-2032

- Figure 68: Scenario 2, Aerodynamics Testing and Simulation, By End User, 2022-2032

- Figure 69: Company Benchmark, Aerodynamics Testing and Simulation, 2022-2032